In 2021, African fintech startups accounted for 61% of the $2.7 billion in enterprise capital funding that was deployed on the continent, a brand new research has discovered. Whereas its share of worldwide fintech funding is simply over one %, the continent’s fintech sector nonetheless recorded one of many highest year-on-year development charges globally.

‘File-Excessive Variety of Offers Closed’

In keeping with the findings of a brand new Mastercard study, African fintech startups — whose quantity grew from 311 in 2019 to 564 in 2021 — accounted for “61% of the USD 2.7 billion deployed throughout Africa in 2021.” The findings additionally present that fintechs’ share “of the record-high variety of offers closed” in that 12 months was 27%.

When put next with the $131.5 billion that was raised globally, African fintech’s share of the overall stays very low — simply over 1% of the 2021 whole. Nevertheless, by way of the funding development price, the research famous that the continent — the Sub-Saharan Africa area specifically — had one of many highest year-on-year development charges globally. The research report defined:

Within the Sub-Saharan Africa (SSA) area, fintech startups recorded 894% year-on-year development in funding in 2021 – the second highest within the Center East, Africa, and Pakistan area through the interval, and the very best yearly development price over the previous 5 years. SSA acquired USD 1.56 billion in funding, the very best within the area by a large margin.

In regards to the funds raised by fintech startups per nation, the research findings present that Nigeria, which is residence to among the continent’s fintech unicorns, had in reality emerged as a number one fintech hub not simply in Africa however throughout the Center East and Pakistan. In keeping with the research’s findings, the West African nation’s fintechs alone “accounted for a 3rd of all funding deployed into fintech in 2021.” Inside the nation, fintechs’ share of all enterprise capital raised throughout the identical interval topped 71%.

Fintechs and the Monetary Exclusion Hole

Concerning why the fintech sector continues to get a disproportionate share of the funding, the research, titled the “Way forward for Fintech in Africa,” factors to the continent’s longstanding monetary exclusion hole and the way fintechs are “constructing inclusion from the bottom up.”

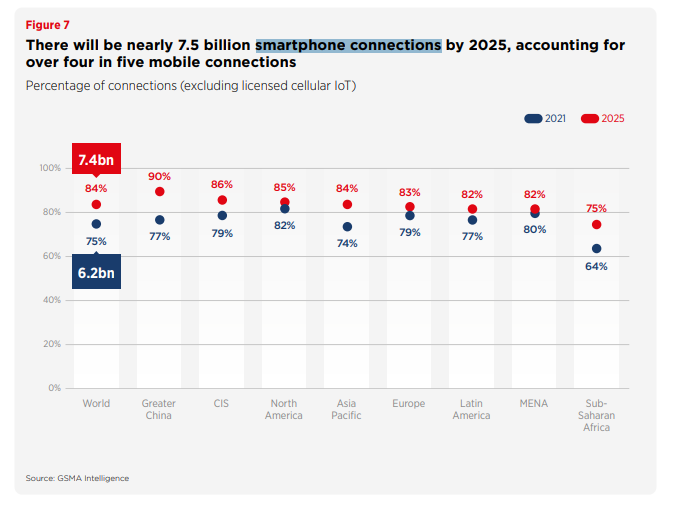

A lot of the sector’s previous and projected success sooner or later can also be tied to improved smartphone penetration. As proven within the 2022 GSMA report, there’s an expectation that the variety of smartphone connections will develop from the 6.2 billion seen in 2021 to 7.5 billion by 2025.

In the meantime, the report steered that Nigeria, together with South Africa and Kenya, will proceed to drive the sector development. Nevertheless, the research steered that the fintech sector development price will depend upon regulators’ and policymakers’ continued prioritization of “reasonably priced web and cellular penetration.”

Register your e mail right here to get a weekly replace on African information despatched to your inbox:

What are your ideas on this story? Tell us what you suppose within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, instantly or not directly, for any injury or loss prompted or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

More NFT News

Telos to Work With R&D Agency Ponos on {Hardware}-Accelerated Ethereum ZkEVM

Can Slothana Expertise a Bullish Rally Much like SLERF’s at Launch?

Mango Markets Exploiter Avraham Eisenberg Convicted In $110M Crypto Fraud