Eight days in the past, Paxos introduced that the corporate would not mint the stablecoin BUSD. Since then, the coin’s market capitalization has been sliding decrease as redemptions have change into extra distinguished. In the meantime, an information researcher from Nansen has found that Binance, the most important cryptocurrency trade by commerce quantity, has elevated its usd coin holdings by $1.5 billion during the last seven days.

Nansen Researcher Discovers Binance Stacking Circle’s Stablecoin

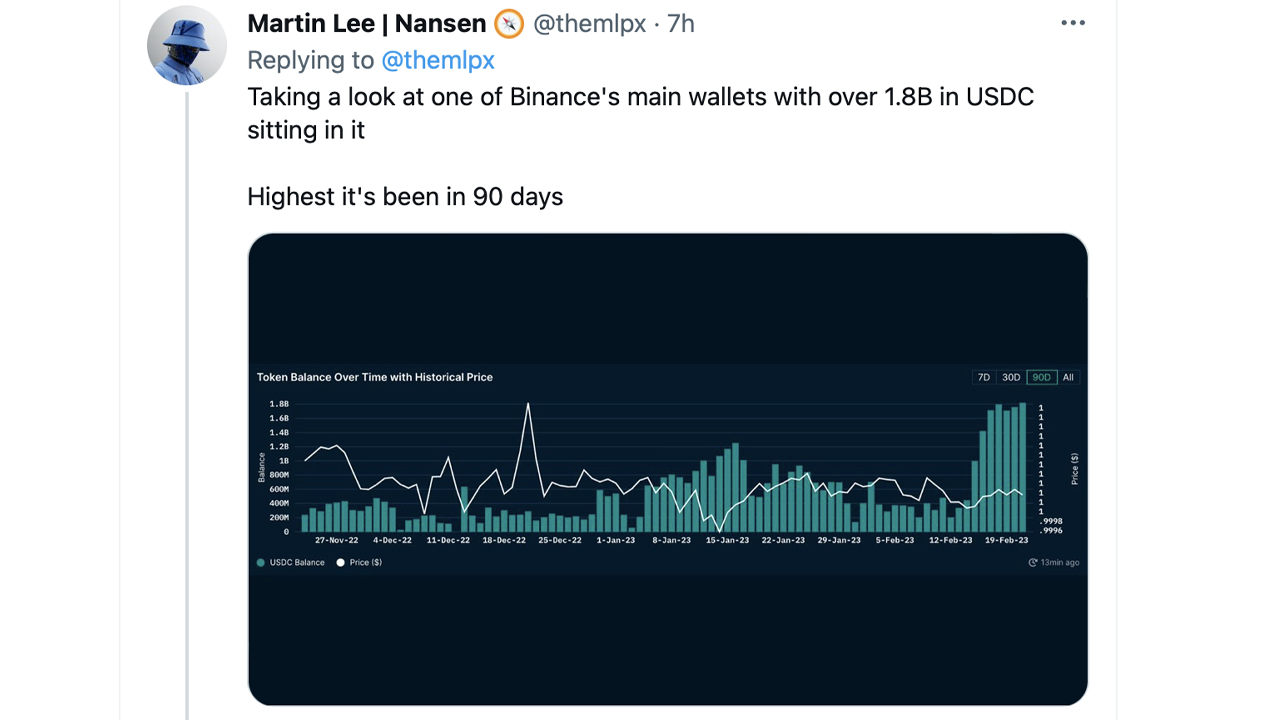

In accordance with Nansen’s information journalist Martin Lee, the quantity of usd coin (USDC) held on Binance has been steadily climbing this week. “Fascinating to see the quantity of USDC on Binance enhance a lot for the reason that BUSD information,” Lee tweeted on Tuesday. Lee additional detailed that Binance noticed a $1.5 billion enhance in USDC within the final seven days.

He additionally famous that he would have anticipated the provision of tether (USDT) to extend on Binance greater than USDC, “given that you may’t commerce utilizing USDC” on Binance. On Sept. 5, 2022, Binance dropped usd coin (USDC) buying and selling pairs and auto-converted buyer balances to BUSD. Two weeks later, Wazirx adopted Binance’s transfer, delisting usd coin (USDC) and a few different stablecoins to auto-convert balances to BUSD.

On Feb. 19, Bitcoin.com Information reported that shut to three billion BUSD had been faraway from the market, and right now, that quantity is as much as 3.55 billion since Paxos revealed it will not mint BUSD. The Paxos-managed stablecoin continues to be the third-largest stablecoin by market capitalization till it drops under DAI’s market valuation of $5 billion. BUSD, which was as soon as a distinguished top-ten crypto asset by market capitalization, is getting awfully near being knocked out of the highest ten standings.

The Nansen researcher additionally noted that there’s $1.eight billion USDC in Binance’s essential pockets right now, and it’s the very best it has been in 90 days. On the time of writing, 2:00 p.m. (ET) on Feb. 21, 2023, there’s $1.821 billion USDC held in Binance’s pockets. It’s price noting that Nansen’s portfolio viewer solely appears to be like at ERC20-based balances, and Binance has simply over 100 million Tether (USDT) in the identical pockets. The Binance pockets additionally holds 79.24 million trueusd (TUSD) and 5.34 million DAI.

What do you concentrate on Binance stacking usd coin following regulators cracking down on BUSD? Share your ideas within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss induced or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

More NFT News

Can Slothana Expertise a Bullish Rally Much like SLERF’s at Launch?

Mango Markets Exploiter Avraham Eisenberg Convicted In $110M Crypto Fraud

Bitcoin Nears Two Necessary On-Chain Ranges: What Occurred Final Time