Fast Take

- As the worldwide world faces excessive inflation, central banks attempt to rein in inflation by reducing their steadiness sheets (quantitative tightening) and growing rates of interest.

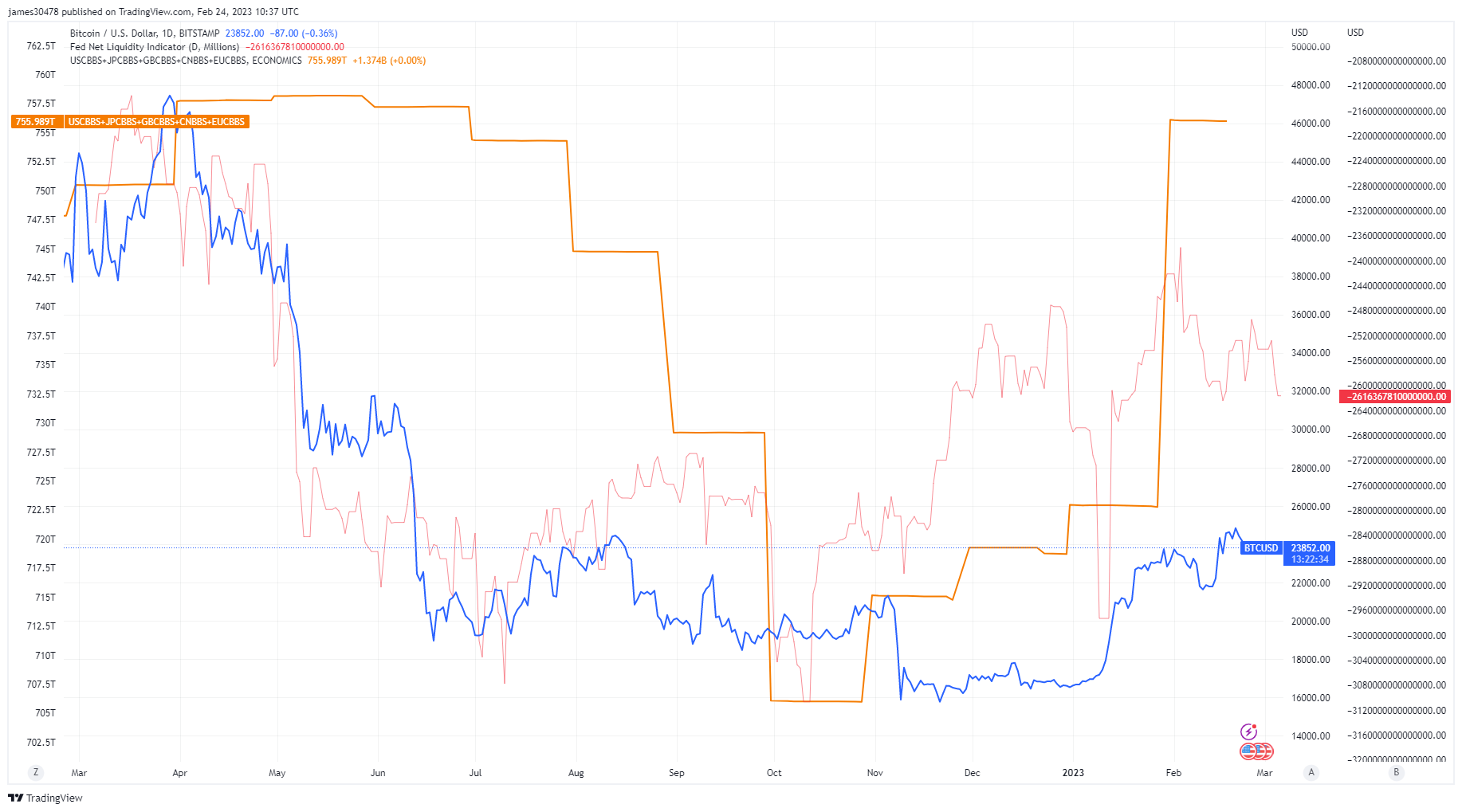

- The blue line is Bitcoin which has soared roughly 50% yr up to now.

- The orange line aggregates central financial institution steadiness sheets, together with the US, EU, UK, Japan, and China.

- The pink line is the fed internet liquidity indicator; the components is as follows; internet liquidity = (fed steadiness sheet – (Treasury Normal Account + Reverse Repo)) / models.

- All three metrics have elevated from their respective bottoms in October 2022 — whereas the steadiness sheet of the main central banks has elevated to 756 trillion from roughly 706 trillion

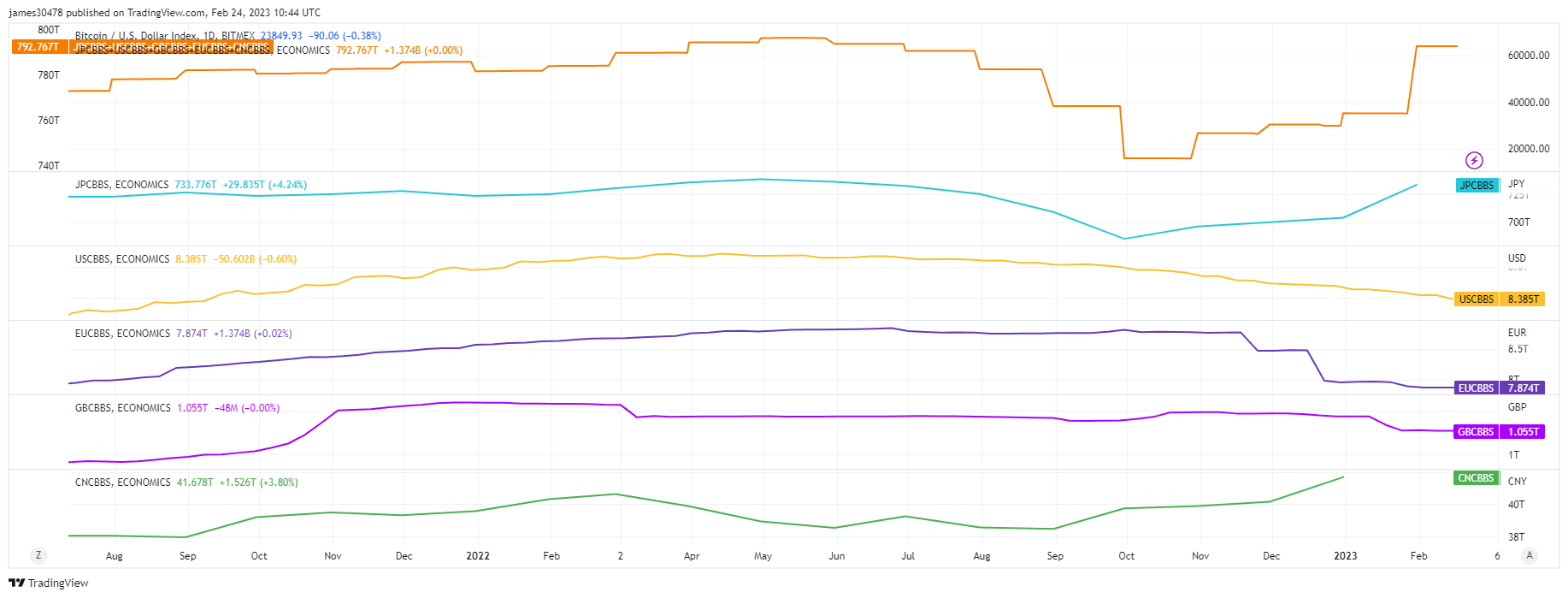

- Japan and China have continued to extend their steadiness sheet — regardless of excessive inflation and undoing the work the US, EU, and UK try to realize.

The submit Bitcoin continues to follow the liquidity plus the aggregation of central bank balance sheets appeared first on CryptoSlate.

More NFT News

Is Bitcoin Getting Prepared For An Explosive Breakout?

Strike's Growth into Europe Accelerates Bitcoin Adoption

Nigeria denies freezing over 300 P2P accounts on extra crypto exchanges amid foreign exchange issues