On Dec. 23, 2022, Matthew Russell Lee from the Interior Metropolis Press printed the not too long ago unsealed responsible plea transcript of Caroline Ellison, Alameda Analysis’s former CEO. In her statements, Ellison describes that she was the co-CEO and CEO of Alameda, and underneath these roles, she reported on to the previous FTX CEO Sam Bankman-Fried (SBF). The ex-Alameda CEO’s testimony particulars that she was totally conscious from 2019 to 2022, that Alameda Analysis had entry to a particular borrowing facility that allowed the corporate to take care of an infinite line of credit score with zero collateral. The ‘borrowing facility,’ in accordance with Ellison, was FTX’s buyer funds.

Caroline Ellison Particulars FTX’s Misconduct With Alameda and the Co-Mingling of Buyer Funds Began From the Very Starting

Following the unsealing of Caroline Ellison’s plea deal, Inner City Press reporter Matthew Russell Lee printed a tweet storm that featured screenshots of Ellison’s unsealed responsible plea transcript. Russell Lee stated that the plea arraignment was “held in secret, and never docketed till at the moment, as soon as Bankman-Fried was freed on $250 [million] bond.” If Ellison’s testimony is true, the doc highlights a lot of infractions each FTX and Alameda executives partook in since 2019.

“From 2019 to 2022, I used to be conscious that Alameda was offered entry to a borrowing facility on FTX.com, the cryptocurrency alternate run by Mr. Bankman-Fried. I understood that executives had carried out particular settings on Alameda’s FTX.com account that permitted Alameda to take care of detrimental balances in fiat currencies and cryptocurrencies,” Ellison’s testimony particulars. “In sensible phrases, this association permitted Alameda entry to an infinite line of credit score with out being required to submit collateral, with out having to pay curiosity on detrimental balances, and with out being topic to margin calls or FTX.com’s liquidation protocols,” the ex-Alameda CEO added.

Ellison’s account of the scenario continued:

I understood that if Alameda had vital detrimental balances in a specific forex, it meant that Alameda was borrowing funds that prospects had deposited on the alternate.

Ellison Understood FTX Buyer Funds Have been Used to ‘Finance FTX’s Loans to Alameda,’ Ex-Alameda CEO Is ‘Actually Sorry’ for What She Did

Ellison was conscious that lots of Alameda’s investments had been illiquid, and she or he stated she totally agreed to borrow funds from FTX’s coffers. “Whereas I used to be co-CEO after which CEO, I understood that Alameda had quite a few massive illiquid investments and had lent some huge cash to Mr. Bankman-Fried and different FTX executives,” Ellison’s testimony explains. “I additionally understood that Alameda had financed the investments with short-term and open-term loans price a number of billion {dollars} from exterior lenders within the cryptocurrency trade. In or round June 2022, I agreed to borrow a number of billion {dollars} from FTX to repay these loans. I understood that FTX would wish to make use of buyer funds to finance its loans to Alameda.”

Ellison additional added:

I additionally understood that many FTX prospects invested in crypto derivatives and that almost all FTX prospects didn’t count on that FTX would lend out their digital asset holdings and fiat forex deposits to Alameda on this vogue.

Moreover, Ellison stated in or round July 2022 to October 2022, she agreed with SBF to “present materially deceptive monetary statements to Alameda’s lenders.” Ellison stated that the crew served lenders botched quarterly reviews that obfuscated “the extent of Alameda’s borrowing.” The ex-Alameda CEO additionally elaborated that she was conscious that FTX’s fairness traders had been stored in the dead of night in regards to the nature of FTX’s and Alameda’s co-mingled relationship. “I agreed with Mr. Bankman-Fried and others to not publicly disclose the true nature of the connection between Alameda and FTX, together with Alameda’s credit score association. I additionally understood that Mr. Bankman-Fried and others hid the supply and nature of these funds,” Ellison’s account of the scenario particulars.

In accordance with SBF’s alleged ex-girlfriend, Ellison stated she was very sorry for what she has performed. On the finish of her transcript, she apologizes an ideal deal for what she did. The testimony from Ellison could be very totally different than that of SBF’s tales, when he managed to do a media tour for a month earlier than he was arrested and he apologized an ideal deal. Whereas SBF apologized quite a bit, he by no means admitted to doing any wrongdoing by way of fraud or committing any monetary misconduct. SBF additional stated that he didn’t run Alameda Analysis, and harassed that he had little information of the buying and selling agency’s enterprise dealings. Talking nearly on the New York Occasions’ Dealbook Summit with Andrew Ross Sorkin, SBF insisted he “didn’t knowingly co-mingle funds.”

So far as Alameda Analysis was involved, SBF stated:

I didn’t know the scale of their place. I wasn’t working Alameda — I didn’t know precisely what was happening.

Ellison’s unsealed testimony utterly contradicts SBF’s place throughout his media tour, and never solely does she apologize, she explains a lot of misdeeds she personally dedicated. “I’m really sorry for what I did,” Ellison concluded. “I knew that it was unsuitable. I need to apologize for my actions to the affected prospects of FTX, lenders to Alameda, and traders in FTX. Since FTX and Alameda collapsed in November 2022, I’ve labored laborious to help with the restoration of property for the advantage of prospects and to cooperate with the federal government’s investigation. I’m right here at the moment to just accept my duty for my actions by pleading responsible.” When the decide requested Ellison if she knew what she did was unlawful, she replied “sure.”

Billionaire Invoice Ackman’s Current FTX Twitter Thread Slammed

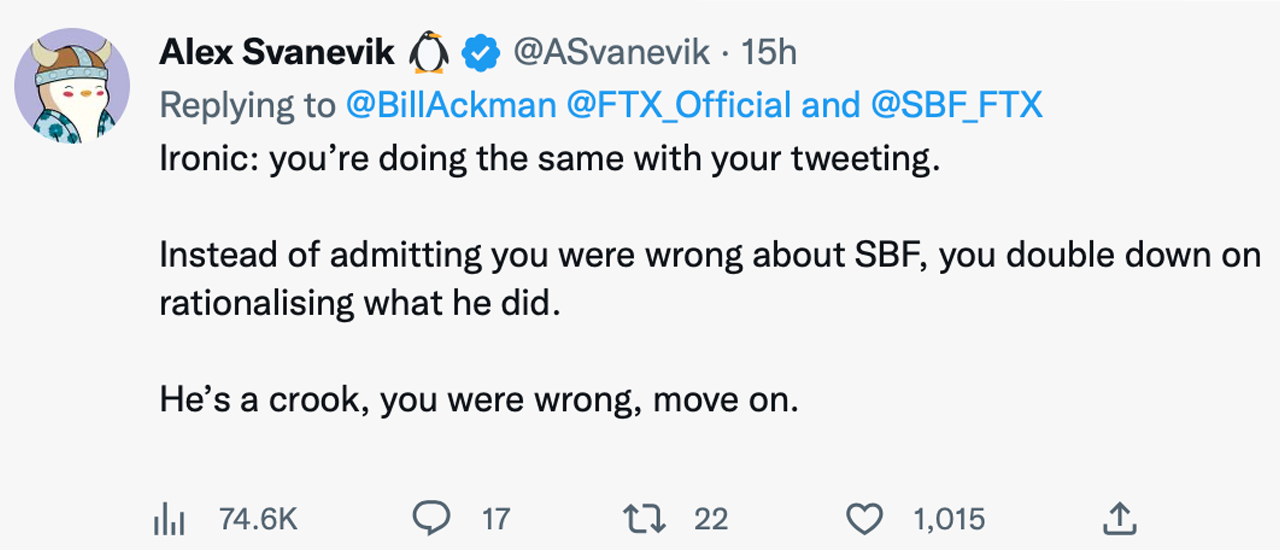

Apparently, billionaire Invoice Ackman tweeted about SBF and cohorts the day prior on Dec. 22, and determined to explain the case as a enterprise “failure.” “One that’s “so horrifying that they will’t acknowledge it, and so they do silly sh-t to keep away from the embarrassment and the come down,” Ackman wrote. Ackman’s most up-to-date FTX Twitter thread wasn’t acquired nicely by an ideal majority of commenters who instructed Ackman that SBF and FTX are being convicted of beginning the fraud from the very starting. Ellison’s testimony even notes that her particular Alameda remedy and the co-mingling of buyer funds started in 2019.

Bitcoin proponent Nic Carter, for example, replied to Ackman and said: “They had been partaking in fraud from day 1.” Coinshares government Meltem Demirors additionally responded to Ackman’s tweets and remarked: “They had been depositing FTX buyer funds immediately into Alameda’s checking account from day 1.” Ackman was reminded on a number of events within the thread that possibly he ought to learn the SEC charges, earlier than claiming that FTX was a “reputable worthwhile alternate began by an MIT grad with backing from high VCs at an enormous valuation.”

What do you consider Caroline Ellison’s testimony and her facet of the story? Tell us what you consider this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a suggestion to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, immediately or not directly, for any injury or loss induced or alleged to be attributable to or in reference to using or reliance on any content material, items or providers talked about on this article.

More NFT News

Mango Markets Exploiter Avraham Eisenberg Convicted In $110M Crypto Fraud

Bitcoin Nears Two Necessary On-Chain Ranges: What Occurred Final Time

The U.S. Wants To Lead in Bitcoin, Says Congressman Patrick McHenry