Abstract:

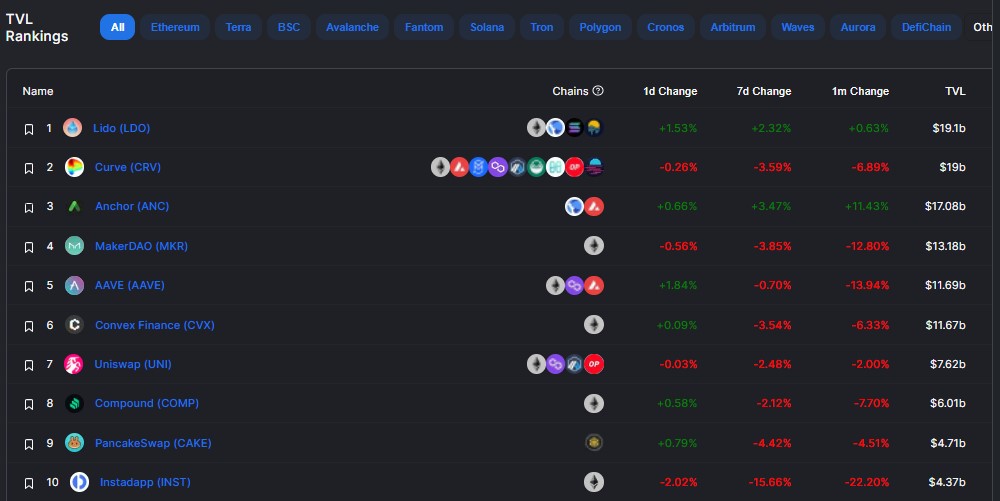

- Lido Finance has surpassed Curve finance to turn into the biggest DeFi protocol by way of whole worth locked

- Roughly $19.1 billion is locked on Lido Finance in comparison with Curve’s $19 billion

- Lido Finance is obtainable on the blockchain networks of Ethereum, Solana, Terra, Kusama, and Polygon.

Earlier as we speak, Lido Finance turned the biggest DeFi protocol by way of whole worth locked, edging out Curve Finance from the highest spot within the course of. On the time of writing, the full worth locked on Lido Finance stands at $19.1 billion in comparison with Curve’s $19 billion. Anchor is available in third with $17.08 billion, MakerDao fourth with $13.18 billion, and AAVE fifth with $11.69 billion in whole worth locked.

Lido Finance’s Rise in DeFi

Launched in December 2020, Lido Finance has grown to facilitate staking on the 5 networks of Ethereum, Terra, Solana, Kusama and Polygon. Moreover, $11 billion value of property is staked on Ethereum 2.0; $7.142 billion on Terra; $288.722 million on Solana; $2.525 million on Kusama; and $16.175 million on Polygon.

Lido’s imaginative and prescient is ‘to construct a staking resolution that’s absolutely permissionless and risk-free for the blockchain itself.’ The present roadmap of the venture consists of adopting Distributed Validator know-how and creating further checks and balances on Lido’s governance. The latter consists of immediately empowering stETH holders to veto any selections that will probably be made on the protocol.

stETH is a liquidity token that customers get once they stake their Ethereum into the ETH 2.0 contract by way of Lido in a 1-to-1 ratio. stETH additionally permits its customers to take part in the complete Ethereum DeFi ecosystem (Yearn, Curve, Maker, Aave) whereas nonetheless accruing ETH2.Zero rewards earned from staking throughout Section 0.

The workforce at Lido additional explains stETH as follows:

stETH accrues staking rewards no matter the place it’s acquired. Because of this no matter whether or not you purchase stETH immediately from staking by way of stake.lido.fi, buy stETH from 1inch or obtain it from a buddy, it would rebase day by day to replicate Ethereum staking rewards.

This nullifies the downsides from staking into the Eth2 contract immediately: illiquidity, immovability, inaccessibility. As a substitute of locking up your staked ETH, Lido permits you to put it to make use of so that you don’t want to decide on between Ethereum staking and DeFi participation.

More NFT News

Enterprise Ethereum Alliance Proclaims New Management and Imaginative and prescient – Enterprise Ethereum Alliance

DRAMA WG releases Defi Danger Pointers Evaluate Draft – Enterprise Ethereum Alliance

Evaluation and Suggestions tips – Enterprise Ethereum Alliance