Whereas undoubtedly advanced and crucial for the world of crypto and NFTs, the concepts that underpin and connect with blockchain technology are comparatively easy to grasp. Certainly one of its most essential ideas is the so-called “51 % assault:” an virtually unmatched risk to decentralized expertise (and the crypto business it helps). To grasp what that’s and its potential wide-reaching implications for Web3, we have to take a look at the basics of the blockchain itself.

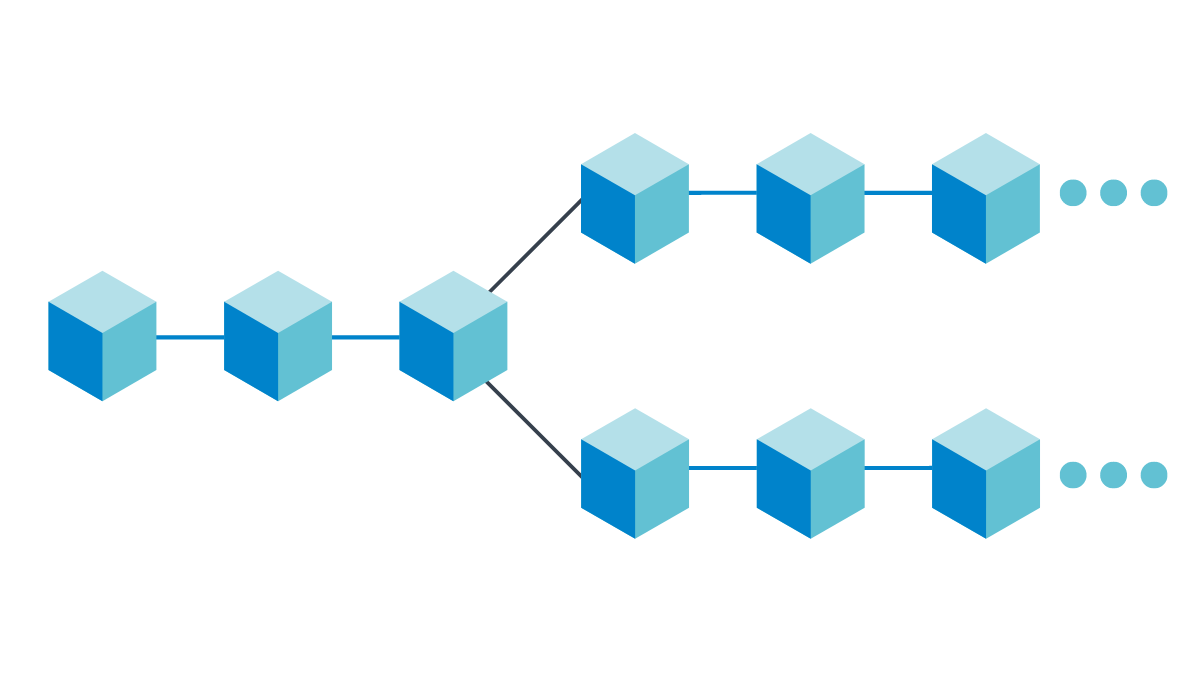

The blockchain is a distributed digital database that strikes and tracks knowledge in blocks that hyperlink collectively to type a chain-like report of data stream. The essential factor to know right here is that blockchain methods are managed by a community of customers and computer systems referred to as nodes, which collectively validate transactions instead of a 3rd get together like a financial institution or a centralized knowledge server managed by a Huge Tech firm.

However what’s a 51 % assault?

In principle, the variety of validating nodes in a blockchain system corresponds to the safety of that community. To efficiently hack the system, a gaggle or a person would wish to take management of the vast majority of nodes within the system — 51 % of them — to change the blockchain report and forge transactions involving crypto and NFTs, doubtlessly ensuing within the lack of countless millions value of digital belongings. In essence, then, a 51 % assault permits unhealthy actors to hijack the blockchain community, giving them the power to control transactions within the community with disastrous monetary results.

This might happen by means of the collusion of teams and people that management the nodes or by means of hackers taking management of them. The larger the variety of nodes, the tougher that is to do. The Ethereum blockchain reportedly has hundreds of thousands of validators in its community, for instance, whereas different chains have far fewer.

Examples of 51 % assaults

In March 2022, hackers with ties to the North Korean authorities efficiently gained management of 5 of 9 of the Ethereum-linked sidechain Ronin’s validating nodes on the favored play-to-earn sport blockchain-based sport Axie Infinity. The hackers cast withdrawals from the community that amounted to roughly $625 million, making it the most important hack in that community’s historical past. When the Ronin workforce realized what had occurred, they took a centralized step and paused the blockchain community totally for months earlier than restarting transactions in late June.

One other 51 percent attack occurred in 2020 when hackers took management of Bitcoin Gold, a small crypto token that split from the Bitcoin blockchain in 2017. The hackers had been capable of double-spend over $72,000 value of the cryptocurrency. Double spending is when a cryptocurrency is used twice or extra, permitting the person who initiated the transaction to reclaim their spent tokens.

Simply how probably is a 51 % assault?

Vulnerability to this sort of assault straight correlates to the community measurement: the larger the blockchain, the safer it’s. For methods operating on energy-intensive proof-of-work (PoW) consensus mechanisms (like Bitcoin), the computing energy required to drag off a 51 % assault is huge and reduces their chance; it’s merely not definitely worth the hackers’ money and time to even try to take action.

If they will pull it off, nonetheless, there is no such thing as a technique to revoke the bodily {hardware} enabling them to assault the system, that means they might proceed to do that till community directors provoke a “laborious fork.” A tough fork is a big change to a blockchain’s protocol (its primary algorithm) that branches it into two now incompatible variations of itself. Such occasions are sometimes the purpose of origin for brand spanking new cryptocurrencies, as was the case with Bitcoin Gold.

However there are methods to disincentivize 51 % assaults. Proof-of-stake (PoS) consensus mechanisms, just like the one the Ethereum blockchain runs on, are exponentially much less energy-intense than PoW-operated networks. These depend on validators placing up (staking) an quantity of cryptocurrency to be accepted as a validating node. Within the case of Ethereum, that’s a hefty 32 ETH. In principle, if sufficient validators in a PoS system colluded, they might take management of the community. Nonetheless, even when this occurred, Ethereum directors might “slash” this staked ETH, that means the violating nodes would concurrently lose their funding and their capacity to assault once more.

Ethereum Co-Founder Vitalik Buterin has addressed this situation several times through the years, claiming that, whereas undesirable, a 51 % assault wouldn’t be deadly to its blockchain.

The decentralization debate

Within the days earlier than Ethereum’s merge to the rather more energy-efficient PoS consensus system it now runs on, Buterin posted a Twitter poll wherein he requested how lengthy individuals would need to wait earlier than they supported “extra-protocol” intervention. The thought was easy: would the group assist a centralized authority stepping in and making a judgment name for your entire blockchain within the occasion of maximum circumstances?

The query isn’t rhetorical, both. Bitcoin isn’t the one blockchain that was compelled to laborious fork within the occasion of an assault. In 2016, Ethereum instituted a tough fork after attackers exploited flaws in an software operating on the blockchain, inflicting the system’s directors to roll again the transactions associated to the exploit to return customers’ funds to them.

Such centralized actions are the antithesis of the very idea of blockchain expertise: Whereas the most important single group of respondents to Buterin’s ballot supported the thought of centralized intervention, the considered such motion sits uneasily with a good portion of the Web3 group, as evidenced by the feedback under the identical ballot. Nonetheless, in the interim, they continue to be an unlucky necessity to make sure the steadiness of those methods in occasions of maximum want. Regardless, they continue to be a controversial middle of dialogue in NFT and crypto circles. Very similar to the dialogue surrounding decentralized Web3 marketplaces, it might be that decentralization by centralized means is the very best, albeit paradoxical, path ahead.

More NFT News

DTX, Shiba Inu, and Cardano Poised for a Market Takeover

How NASA Repaired Voyager 1 From 15 Billion Miles Away

BAYC Asks Why Members ‘Stick Round’ on Third Anniversary