Fantom (FTM), a Layer-1 (L1) protocol, and its native token, FTM, have skilled important good points and notable achievements within the first quarter (Q1) of 2024.

In line with a complete efficiency analysis performed by Messari, amid the rising crypto bull market, Fantom has emerged as one of many main beneficiaries, exhibiting important progress in key metrics and market capitalization.

FTM Market Cap Soars 101% QoQ

By the numbers, FTM’s circulating market capitalization noticed a considerable 101% quarter-over-quarter (QoQ) improve, leaping from $1.three billion to $2.6 billion, vaulting it up ten spots to 48th amongst all tokens (presently 58th). The token’s rally prolonged for 2 consecutive quarters, leading to a fourfold improve for the reason that finish of Q3 2023.

Though Fantom skilled a lower of 53% QoQ in income measured in FTM, amounting to 1.Eight million FTM, income denominated in USD exhibited a 4% QoQ improve, reaching $1.2 million.

In line with Messari, the income decline was primarily because of lowered inscription exercise throughout all good contract platforms in Q1.

Regardless of this, Fantom maintained an upward trend in common day by day transactions, excluding inscription-related exercise, surpassing the Q3 common and reaching 247,000 day by day transactions. Day by day lively addresses additionally rebounded, rising by 24% QoQ to 40,500.

In Q1, the staking requirement for Fantom validators was considerably lowered from 500,000 FTM to 50,000 FTM, aiming to extend accessibility. Nevertheless, the variety of lively validators remained unchanged at 55.

Notably, the entire quantity of FTM staked elevated by 17% QoQ, from 1.1 billion to 1.three billion FTM, leading to a 135% QoQ surge within the complete greenback worth of staked FTM, reaching $1.2 billion. Amongst proof-of-stake (PoS) networks, Fantom ranked 22nd within the greenback worth of funds staked by the top of Q1.

Memecoin Mania Boosts Fantom On-Chain Exercise

Throughout the 12 months’s first quarter, Whole Worth Locked (TVL) denominated in USD skilled a considerable 59% QoQ improve, rising from $810.Eight million in This autumn to $1.28 billion.

Conversely, TVL-denominated in FTM decreased by 21% QoQ, indicating that the surge in USD-denominated TVL was partly attributed to FTM’s value appreciation.

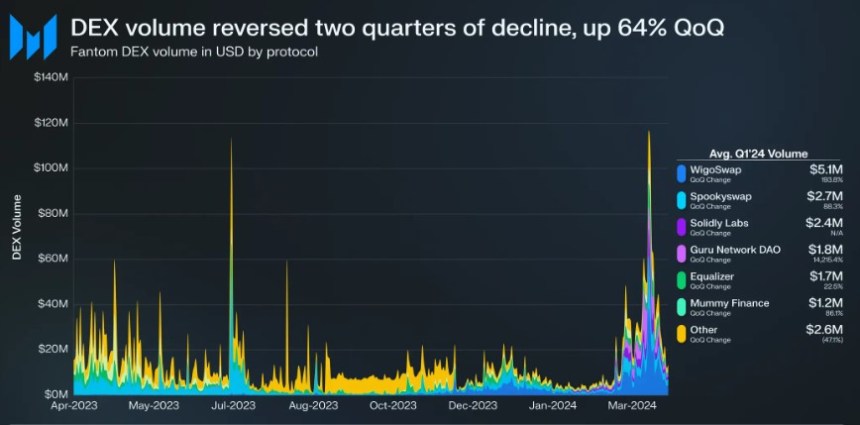

Fantom’s common day by day decentralized exchange (DEX) quantity surged by 64% QoQ, from $10.2 million to just about $176.Eight million. In Q1, the “Memecoin Mania” development contributed to elevated on-chain exercise throughout varied networks, together with Fantom.

Fantom’s month-to-month DEX quantity surpassed $1 billion in March, marking the primary time since March 2023. The variety of DEXs on Fantom elevated to 31 by the top of Q1, with no single DEX dominating greater than 30% of the market share.

Lastly, following an exploit within the Multichain: Fantom Bridge, which affected stablecoins on Fantom in Q3 2023, the Fantom Basis took steps to extend the liquidity of stablecoins.

As of Q1 2024, two impartial third-party bridging options, Axelar (axlUSDC and axlUSDT) and LayerZero (lzUSDC and lzUSDT), have emerged. USDC stays the predominant stablecoin on Fantom, accounting for 98% of the stablecoin market cap. USDT additionally skilled appreciable progress, with an 86% QoQ improve.

The FTM token is presently buying and selling at $0.7037, reflecting an 8.7% improve in value over the previous seven days. Nevertheless, it has skilled a decline of practically 20% within the month-to-month time-frame.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site totally at your personal threat.

More NFT News

Immutable X Worth Prediction for In the present day, Could 18 – IMX Technical Evaluation

Bitcoin Breakout From Main Resistance Ranges Indicators Bullish Momentum

ADA Value Surge May Push Ratio Of Holders In Loss Under 55%