A information to the multi-chain future, sidechains, and layer-2 options

Around the Block from Coinbase Ventures sheds gentle on key developments in crypto. Written by Justin Mart & Connor Dempsey.

As of late 2021, Ethereum has grown to assist hundreds of purposes from decentralized finance, NFTs, gaming and extra. All the community settles trillions of {dollars} in transactions yearly, with over $170 billion locked on the platform.

However because the saying goes, more cash, extra issues. Ethereum’s decentralized design finally ends up limiting the quantity of transactions it will probably course of to only 15 per second. Since Ethereum’s recognition far exceeds 15 transactions per second, the result’s lengthy waits and charges as excessive as $200 per transaction. In the end, this costs out many customers and limits the kinds of purposes Ethereum can deal with right this moment.

If smart-contract based mostly blockchains are to ever develop to assist finance and Net three purposes for billions of customers, scaling options are wanted. Fortunately, the cavalry is starting to reach, with many proposed options coming on-line lately.

On this version of Round The Block, we discover the crypto world’s collective quest to scale.*

To compete or to enrich?

The objective is to extend the variety of transactions that brazenly accessible sensible contract platforms can deal with, whereas retaining adequate decentralization. Keep in mind, it might be trivial to scale sensible contract platforms by means of a centralized resolution managed by a single entity (Visa can deal with 45,000 transactions per second), however then we’d be proper again to the place we began: a world owned by a handful of highly effective centralized actors.

The approaches being taken to repair this downside come twofold: (1) construct model new networks aggressive to Ethereum that may deal with extra exercise, or (2) construct complementary networks that may deal with Ethereum’s extra capability.

Broadly, they escape throughout a number of classes:

- Layer 1 blockchains (aggressive to Ethereum)

- Sidechains (considerably complementary to Ethereum)

- Layer 2 networks (complementary to Ethereum)

Whereas every differs in structure and method, the objective is similar: let customers really use the networks (eg, work together with DeFi, NFTs, and so forth) with out paying exorbitant charges or experiencing lengthy wait instances.

Layer 1s

Ethereum is taken into account a layer 1 blockchain — an impartial community that secures consumer funds and executes transactions multi function place. Wish to swap 100 USDC for DAI utilizing a DeFi utility like Uniswap? Ethereum is the place all of it occurs.

Competing layer 1s do every little thing Ethereum does, however in a model new community, soup to nuts. They’re differentiated by new system designs that allow greater throughput, resulting in decrease transaction charges, however often at the price of elevated centralization.

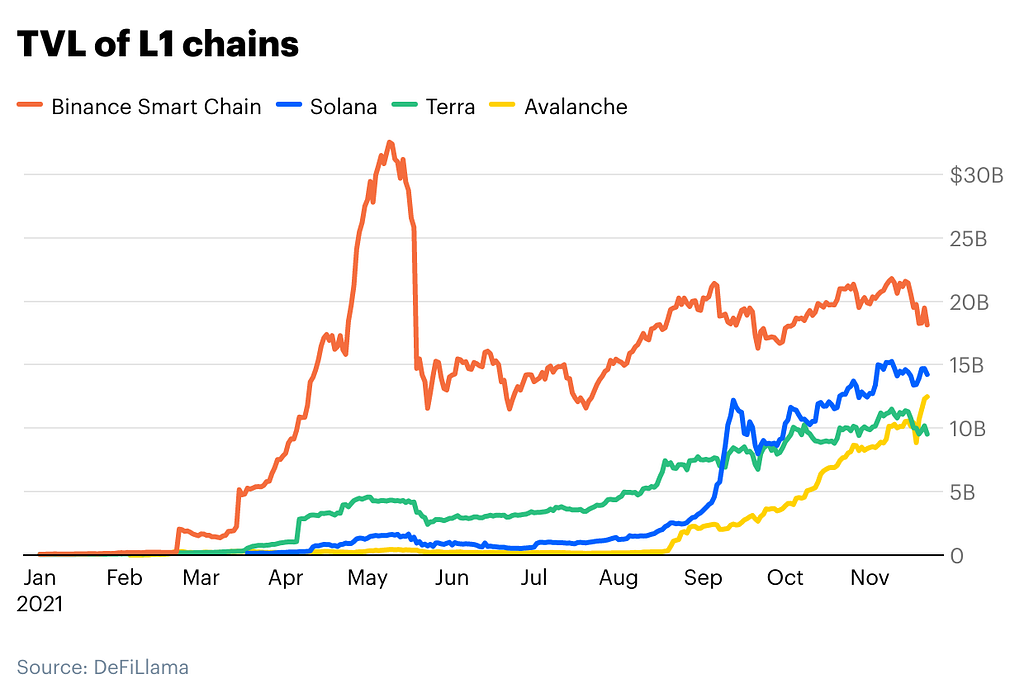

New layer 1s have come on-line in droves over the past 10 months, with the combination worth on these networks rocketing from $Zero to ~$75B over the identical time interval. This area is presently led by Solana, Avalanche, Terra, and Binance Good Chain, every with rising ecosystems which have reached over $10 billion in worth.

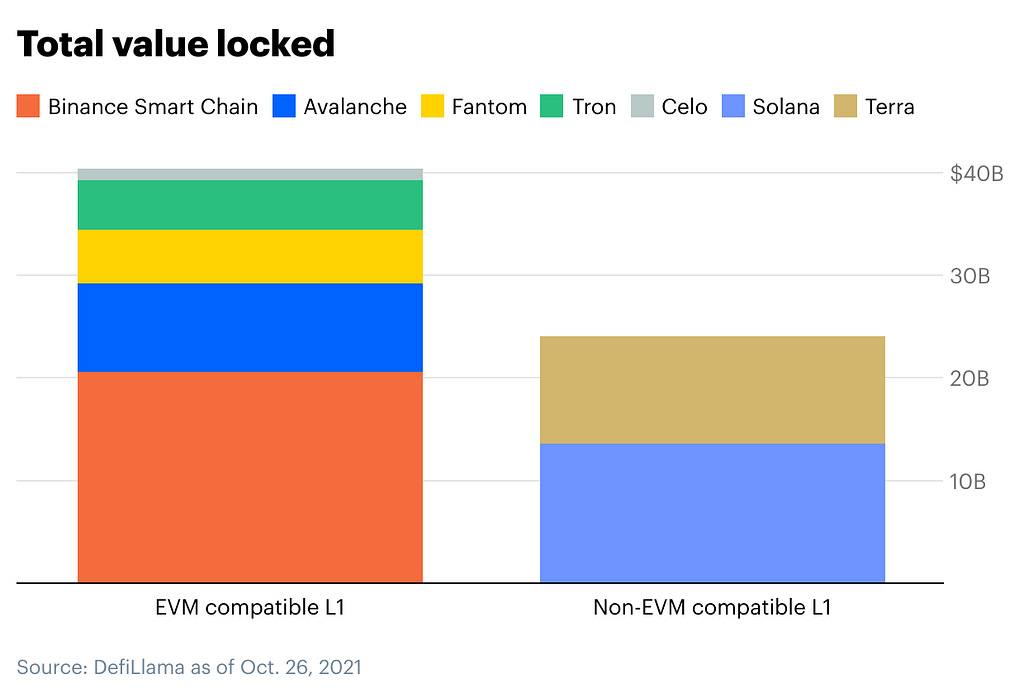

All layer 1s are in competitors to draw each builders and customers. Doing so with none of Ethereum’s tooling and infrastructure that make it simple to construct and use purposes, is tough. To bridge this hole, many layer 1s make use of a tactic referred to as EVM compatibility.

EVM stands for the Ethereum Digital Machine, and it’s basically the mind that performs computation to make transactions occur. By making their networks suitable with the EVM, Ethereum builders can simply deploy their current Ethereum purposes to a brand new layer 1 by basically copying and pasting their code. Customers may simply entry EVM suitable layer 1s with their current wallets, making it easy for them to migrate.

Take Binance Good Chain (BSC) for instance. By launching an EVM suitable community and tweaking the consensus design to allow greater throughput and cheaper transactions, BSC noticed utilization explode final summer time throughout dozens of DeFi purposes all resembling in style Ethereum apps like Uniswap and Curve. Avalanche, Fantom, Tron, and Celo have additionally taken the identical method.

Conversely, Terra and Solana don’t presently assist EVM compatibility.

Interoperable Chains

In a barely completely different layer 1 bucket are blockchain ecosystems like Cosmos and Polkadot. Relatively than construct new stand-alone blockchains, these tasks constructed requirements that permit builders create utility particular blockchains able to speaking to one another. This could permit, for instance, tokens from a gaming blockchain for use inside purposes constructed on a separate blockchain for social networking.

There may be presently over $100B+ sitting on chains constructed utilizing Cosmos’ normal that may finally interoperate. In the meantime, Polkadot lately reached a milestone that can equally unite its ecosystem of blockchains.

In brief, there’s now a various panorama of direct Ethereum rivals, with extra on the approach.

Sidechains

The excellence between sidechains and new layer 1s is admittedly a fuzzy one. Sidechains are similar to EVM-compatible layer 1s, besides that they’ve been goal constructed to deal with Ethereum’s extra capability, relatively than compete with Ethereum as an entire. These ecosystems are carefully aligned with the Ethereum group and host Ethereum apps in a complementary trend.

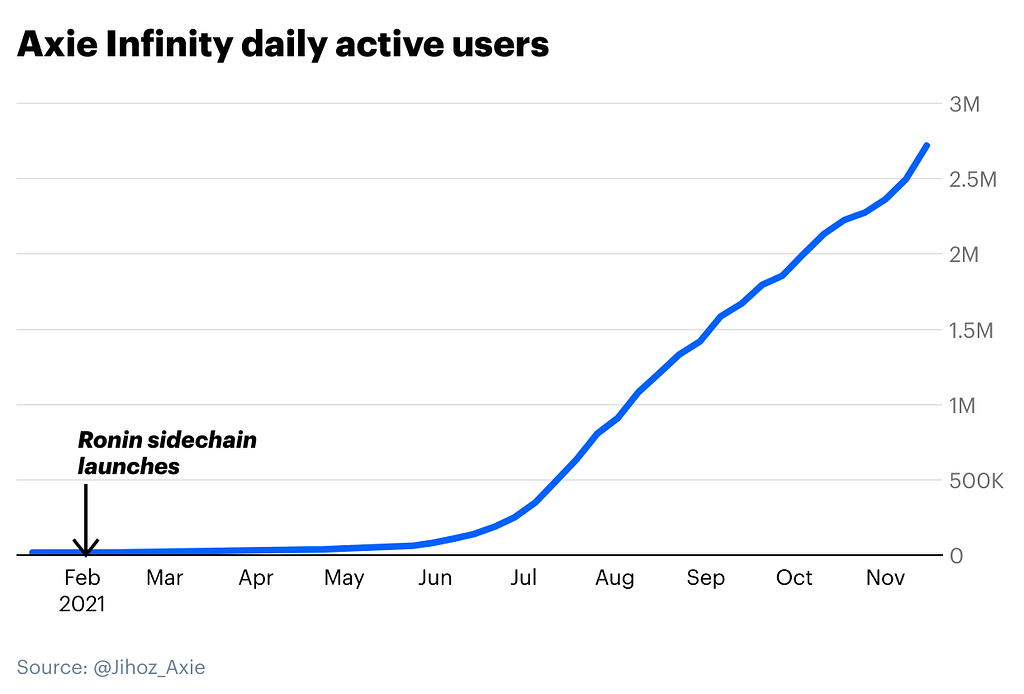

Axie Infinity’s Ronin sidechain is a chief instance. Axie Infinity is an NFT sport initially constructed on Ethereum. Since Ethereum charges made taking part in the sport prohibitively costly, the Ronin sidechain was constructed to permit customers to maneuver their NFTs and tokens from Ethereum to a low payment setting. This made the sport inexpensive to extra customers, and preceded an explosion within the sport’s recognition.

As of this writing, customers have moved over $7.5B from Ethereum to Ronin to play Axie Infinity.

Polygon POS

The place sidechains like Ronin are utility particular, others are suited to extra common goal purposes. Proper now, Polygon’s proof-of-stake (POS) sidechain is the business chief with nearly $5B in value deployed over 100 DeFi and gaming purposes together with acquainted names like Aave and Sushiswap, in addition to a Uniswap clone referred to as Quickswap.

Once more, Polygon POS actually doesn’t look that completely different from an EVM suitable layer-1. Nonetheless, it’s been constructed as a part of a framework to scale Ethereum relatively than compete with it. The Polygon crew sees a future the place Ethereum stays the dominant blockchain for prime worth transactions and worth storage, whereas on a regular basis transactions transfer to Polygon’s lower-cost blockchains. (Polygon POS additionally maintains a particular relationship with Ethereum by means of a course of often known as checkpointing).

With transaction charges of less than a penny, Polygon’s imaginative and prescient of the longer term appears believable. And with the assistance of incentive applications, customers have flocked to Polygon POS with every day transactions surpassing Ethereum (although spam transactions inflate this quantity).

Layer 2s (Rollups)

Layer 1s and sidechains each have a definite problem: securing their blockchains. To take action, they have to pay a brand new cohort of miners or proof of stake validators to confirm and safe transactions, often within the type of inflation from a base token (e.g. Polygon’s $MATIC, Avalanche’s $AVAX).

Nonetheless, this brings notable downsides:

- Having a base token naturally makes your ecosystem extra aggressive relatively than complementary to Ethereum

- Validating and securing transactions is a fancy and difficult job that your community is liable for indefinitely

Wouldn’t it’s good if we may create scalable ecosystems that borrowed from Ethereum’s safety? Enter layer 2 networks, and “rollups” specifically. In a nutshell, layer 2s are impartial ecosystems that sit on prime of Ethereum in such a approach that depends on Ethereum for safety.

Critically, which means that layer 2s don’t have to have a local token — so not solely are they extra complementary to Ethereum, they’re basically a part of Ethereum. The Ethereum roadmap even pays homage to this concept by signaling that Ethereum 2.Zero will likely be “rollup centric.”

How rollups work

Layer 2s are generally referred to as rollups as a result of they “rollup” or bundle transactions collectively and execute them in a brand new setting, earlier than sending the up to date transaction knowledge again to Ethereum. Relatively than have the Ethereum community course of 1,000 Uniswap transactions individually (costly!), the computation is offloaded on a layer 2 rollup earlier than submitting the outcomes again to Ethereum (low-cost!).

Nonetheless, when outcomes are posted again to Ethereum, how does Ethereum know that the info is appropriate and legitimate? And the way can Ethereum forestall anybody from posting incorrect info? These are essential questions that differentiate the 2 kinds of rollups: Optimistic rollups, and Zero Data rollups (ZK rollups).

Optimistic Rollups

When submitting outcomes again to Ethereum, optimistic rollups “optimistically” assume that they’re legitimate. In different phrases, they let the operators of the rollup publish any knowledge they need (together with doubtlessly incorrect / fraudulent knowledge), and simply assume it’s appropriate — an optimistic outlook little doubt! However there are methods to combat fraud. As a verify and stability, there’s a window of time after any withdrawal the place anybody watching can name out fraud (bear in mind blockchains are clear, anybody can watch what’s taking place). Within the occasion that one among these watchers can mathematically show that fraud occurred (by submitting a fraud proof), the rollup reverts any fraudulent transactions and penalizes the dangerous actor and rewards the watcher (a intelligent incentive system!).

The downside is a quick delay while you transfer funds between the rollup and Ethereum, ready to see if any watchers catch any fraud. In some instances this may be as much as per week, however we count on these delays to come back down over time.

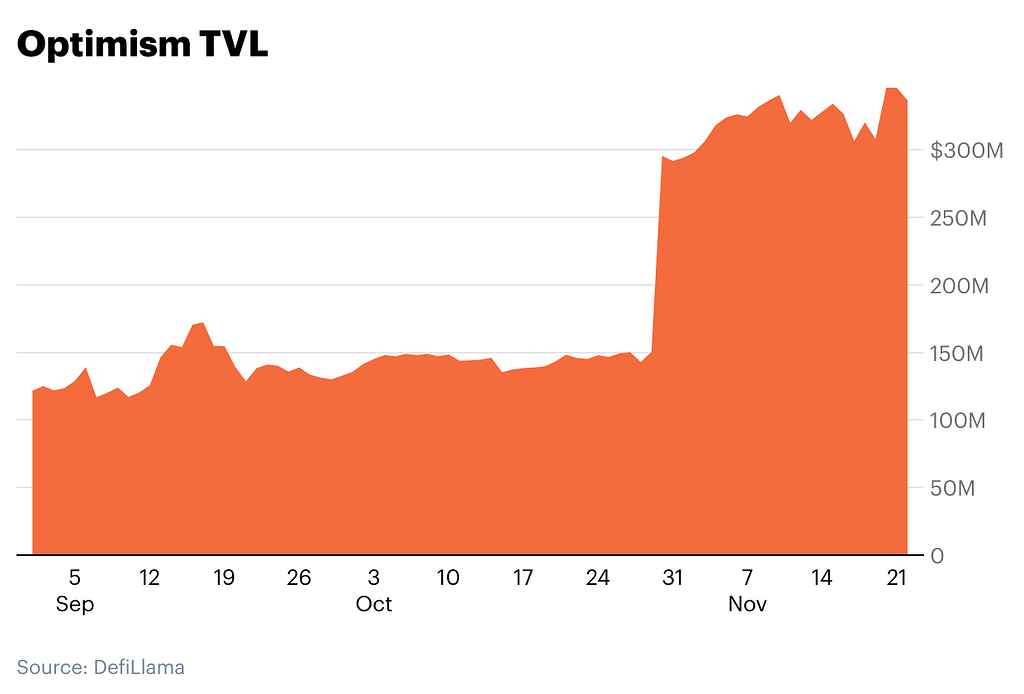

The important thing level is that optimistic rollups are intrinsically tied to Ethereum and able to assist Ethereum scale right this moment. Accordingly, we’ve seen robust nascent development with many main DeFi tasks shifting to the main optimistic rollups — Arbitrum and Optimistic Ethereum.

Arbitrum & Optimistic Ethereum

Arbitrum (by Off-chain Labs) and Optimistic Ethereum (by Optimism) are the 2 important tasks implementing optimistic rollups right this moment. Notably, each are nonetheless of their early levels, with each corporations sustaining ranges of centralized management however with plans to decentralize over time.

It’s estimated that when mature, optimistic roll ups can provide wherever from a 10–100x enchancment in scalability. Even of their early days, DeFi purposes on Arbitrum and Optimism have already accrued billions in community worth.

Optimism is earlier in its adoption curve with over $300M in TVL deployed throughout 7 DeFi applications, most notably Uniswap, Synthetix, and 1inch.

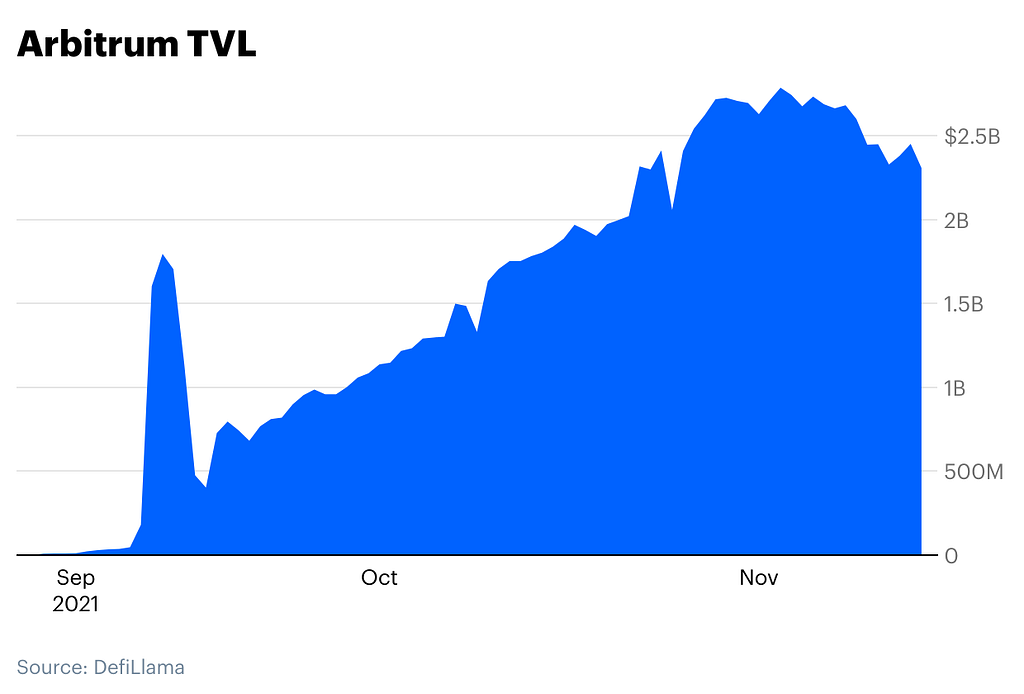

Arbitrum is additional alongside, with round $2.5B in TVL throughout 60+ applications together with acquainted DeFi protocols like Curve, Sushiswap, and Balancer.

Arbitrum has additionally been chosen as Reddit’s scaling solution of choice for his or her lengthy awaited efforts to tokenize group factors for the social media platform’s 500 million month-to-month lively customers.

ZK Rollups

The place optimistic rollups assume the transactions are legitimate and go away room for others to show fraud, ZK rollups do the work of truly proving to the Ethereum community that transactions are legitimate.

Together with the outcomes of the bundled transactions, they submit what’s referred to as a validity proof to an Ethereum sensible contract. Because the identify suggests, validity proofs let the Ethereum community confirm that the transactions are legitimate, making it inconceivable for the relayer to cheat the system. This eliminates the necessity for a fraud proof window, so shifting funds between Ethereum and ZK-rollups is successfully instantaneous.

Whereas instantaneous settlement and no withdrawal instances sound nice, ZK rollups are usually not with out tradeoffs. First, producing validity proofs is computationally intensive, so that you want excessive powered machines to make them work. Second, the complexity surrounding validity proofs makes it harder to assist EVM compatibility, limiting the kinds of sensible contracts that may be deployed to ZK-rollups. As such, optimistic rollups have been first to market and are extra able to addressing Ethereum’s scaling woes right this moment, however ZK-rollups might develop into a greater technical resolution within the lengthy run.

ZK Rollup Adoption

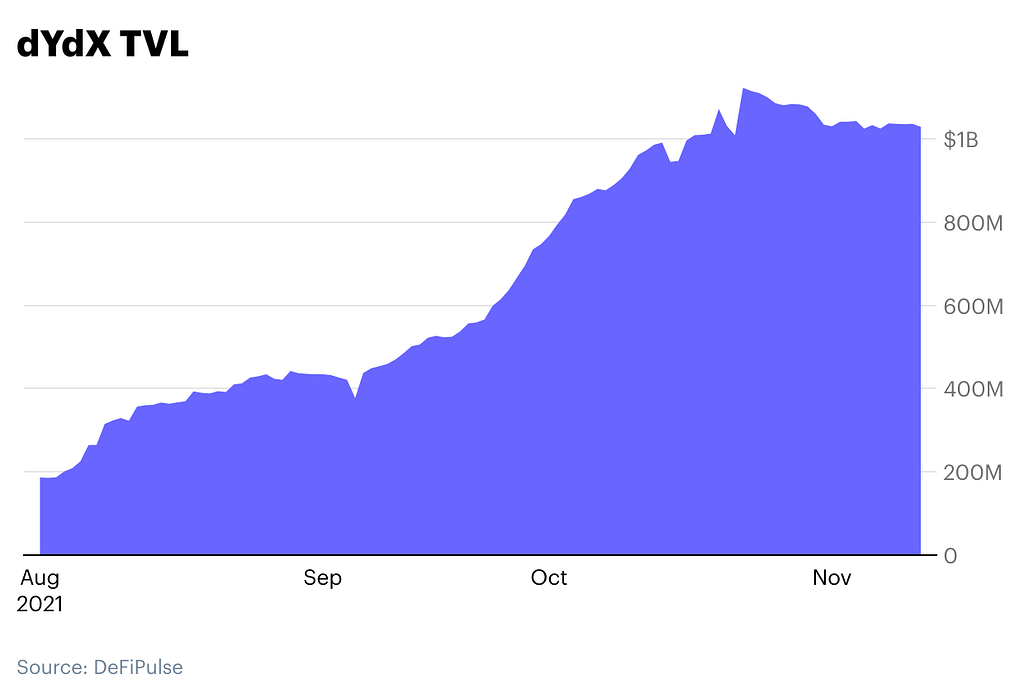

The ZK rollup panorama runs deep, with a number of groups and implementations within the works and in manufacturing. Some outstanding gamers embrace Starkware, Matter Labs, Hermez, and Aztec. At this time, ZK-rollups primarily assist comparatively easy purposes comparable to funds or exchanges (owing to limitations on what kinds of purposes ZK-rollups can assist right this moment). For instance, derivatives trade dYdX employs a ZK rollup resolution from Starkware (StarkEx) to assist almost 5 million weekly transactions and $1B+ in TVL.

The actual prize nevertheless, is ZK rollup options which can be totally EVM suitable and thus able to supporting in style common purposes (like the complete suite of DeFi apps) with out the withdrawal delays of optimistic rollups. The principle gamers on this realm are MatterLab’s zkSync 2.0, Starkware’s Starknet, Polygon Hermez’s zkEVM, and Polygon Miden, that are all presently working in the direction of mainnet launch. (Aztec, in the meantime, is targeted on making use of zk proofs to privateness).

Many within the business (Vitalik included) are taking a look at ZK rollups along with Ethereum 2.Zero as the long run resolution to scaling Ethereum, primarily stemming from their capability to essentially deal with a whole bunch of hundreds of transactions per second with out compromising on safety or decentralization.The upcoming rollouts of totally EVM suitable ZK rollups will likely be one of many key issues to observe as the search to scale Ethereum progresses.

A fragmenting world

In the long term, these scaling options are needed if sensible contract platforms are to scale to billions of customers. Within the close to time period, these options, nevertheless, might current important challenges for customers and crypto operators alike. Navigating from Ethereum to those networks requires utilizing cross-chain bridges, which is complicated for customers and carries latent danger. For instance, a number of cross-chain bridges have already been the goal of $100+ million dollar exploits.

Extra importantly, the multi-chain world fragments composability and liquidity. Take into account that Sushiswap is presently carried out on Ethereum, Binance Good Chain, Avalanche, Polygon, and Arbitrum. The place Sushiswap’s liquidity was as soon as targeting one community (Ethereum), it’s now unfold throughout 5 completely different networks.

Ethereum purposes have lengthy benefited from composability — i.e. Sushiswap on Ethereum is plug-and-play with different Ethereum apps like Aave or Compound. As purposes unfold out to new networks, an utility carried out on one layer 1/sidechain/layer 2 is now not composable with apps carried out on one other, limiting usability and creating challenges for customers and builders.

An unsure future

Will new layer 1s like Avalanche or Solana proceed to develop to compete with Ethereum? Will blockchain ecosystems like Cosmos or Polkadot proliferate? Will sidechains proceed to run in concord with Ethereum, taking over its extra capability? Or will rollups along with Ethereum 2.Zero win out? Nobody can say for positive.

Whereas the longer term is unsure, everybody can take solace within the data that there are such a lot of sensible groups devoted to tackling essentially the most difficult issues that open, permissionless networks face. Simply as broadband in the end helped the web assist a number of revolutionary purposes like YouTube and Uber, we consider that we’ll finally have a look at the successful scaling options in the identical gentle.

- This publish focuses on scaling smart-contract based mostly blockchains. Bitcoin scaling is greatest saved for a future publish.

This web site doesn’t disclose materials nonpublic info pertaining to Coinbase or Coinbase Enterprise’s portfolio corporations.

Disclaimer: The opinions expressed on this web site are these of the authors who could also be related individuals of Coinbase, Inc., or its associates (“Coinbase”) and who don’t symbolize the views, opinions and positions of Coinbase. Data is offered for common academic functions solely and isn’t meant to represent funding or different recommendation on monetary merchandise. Coinbase makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any info on this web site and won’t be responsible for any errors, omissions, or delays on this info or any losses, accidents, or damages arising from its show or use. Except in any other case famous, all photos offered herein are the property of Coinbase. This web site incorporates hyperlinks to third-party web sites or different content material for info functions solely. Third-party web sites are usually not underneath the management of Coinbase, and Coinbase will not be liable for their contents. The inclusion of any hyperlink doesn’t indicate endorsement, approval or advice by Coinbase of the positioning or any affiliation with its operators.

Scaling Ethereum & crypto for a billion users was initially revealed in The Coinbase Blog on Medium, the place individuals are persevering with the dialog by highlighting and responding to this story.

More NFT News

EEA Releases DeFi Threat Evaluation Pointers v1 – Enterprise Ethereum Alliance

EEA Releases DLT Interoperability Case Research – Enterprise Ethereum Alliance

Enterprise Ethereum Alliance Proclaims New Management and Imaginative and prescient – Enterprise Ethereum Alliance