One of the heated debates surrounding Ethereum’s transition to a Proof-of-Stake network centered on the issuance of ETH. The main narrative behind the Merge was that it was imagined to make ETH a deflationary forex.

For the reason that Merge was completed on September 15, ETH issuance has been drastically diminished. The estimated annual issuance within the PoS community is round 600,000 ETH. The precise annual issuance will differ all through the years, because it’s decided primarily based on the variety of validators taking part within the consensus mechanism.

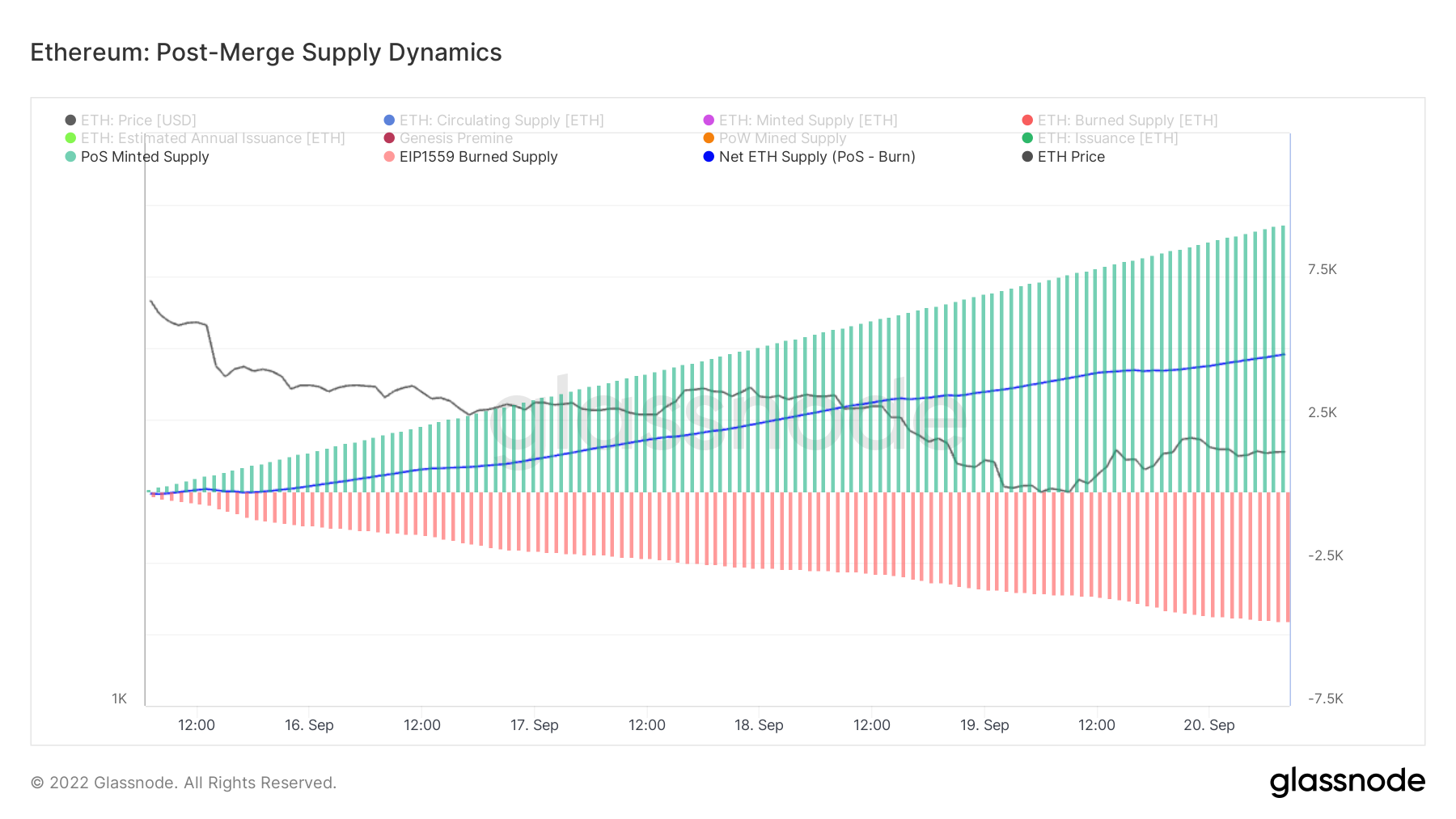

Nevertheless, whereas the issuance was diminished in idea, the precise provide of ETH has elevated because the community deserted Proof-of-Work. The provision progress is at present constructive and has grown by over 4,000 ETH because the Merge. On the present tempo, the availability is ready to extend by 0.21% per yr.

The Merge has to date didn’t ship on making Ethereum a deflationary forex. The minted provide from the PoS community has outpaced the burn charge carried out with EIP-1559.

In response to knowledge from Glassnode, since Proof-of-Work issuance ceased completely, Ethereum’s provide has been rising on an hourly foundation. The chart beneath exhibits that the availability mined by PoS is outpacing the availability burned by EIP-1559. This precipitated the web provide of ETH to extend following the Merge.

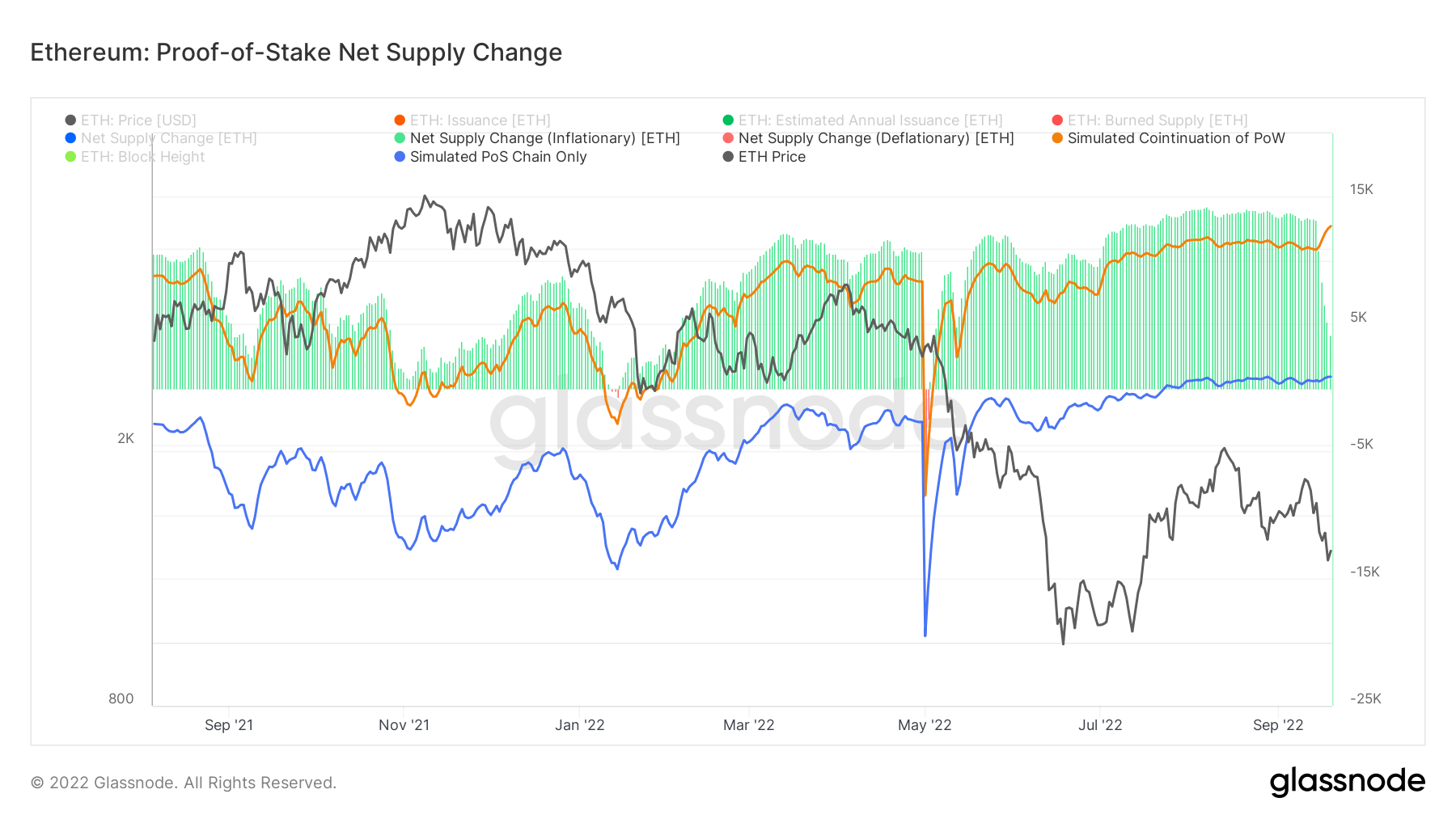

Analyzing Ethereum’s provide and issuance earlier than the Merge exhibits the community has been below inflationary strain for nearly two years.

The PoS issuance of ETH started lengthy earlier than the Merge — proper after the beacon chain genesis occasion on December 1, 2020. The PoW issuance, nonetheless, wasn’t halted till September 15, 2022. EIP-1559, the transaction pricing mechanism that carried out a set transaction charge burned with each block, was implement on August 5, 2021.

This discrepancy in implementation instances has additional exacerbated the strain on the community.

Since EIP-1559 was carried out, ETH has been deflationary for less than very brief durations — in January and Might 2022. The graph beneath exhibits the disparity between inflationary and deflationary durations — the previous are marked inexperienced, whereas the latter are marked crimson.

Nonetheless, PoS managed to scale back the availability of ETH drastically. Within the graph above, the orange line represents the simulated provide if Ethereum continued to exist as a PoW system. The blue line represents the simulated provide if Ethereum existed as a PoS system for the previous yr. The information clearly exhibits {that a} PoS system drastically reduces the availability of ETH.

The graph additionally illustrates that the inflationary strain on Ethereum has been steadily dropping because the Merge. Nevertheless, we’re but to see whether or not the diminished strain ultimately results in a deflationary provide.

More NFT News

Binance Slapped With $4.Four Million Advantageous By Canadian Authorities

Singapore Revisits Terraform Labs' Collapse, Clarifies Licensing Irregularities

Stake Chickens, Earn BAWK – Play to Earn