That is an opinion editorial by Bitcoin Graffiti, a software program developer and graffiti artist.

In 1714, the British Parliament launched the Longitude Act, a legislation rewarding a £20,000 bounty (greater than $1 million in in the present day’s cash) to anybody who may precisely decide longitude at sea. Captains had been battling poor navigation because the onset of world commerce. Although sailors may simply measure latitude by gauging the solar’s peak, longitude was very onerous to find out and inapt methods veered vessels in fact. With out visible bearings, people have been crusing blind on the open seas. The elevated journey time led to scurvy, delays and ships smashing on the rocks — shedding crew and cargo endlessly to the deep.

Luckily, a genius Brit got here up with the answer — the chronometer, a clock that would hold its beat on the risky seas. John Harrison was this genius and his invention outperformed crude astronomical methods that relied on clear skies, quantity tables and hours of calculation. There was no second finest.

However his innovation wasn’t adopted!

In response to “Longitude” by Dava Sobel, it took till 1828 for the Board of Longitude to be disbanded and the chronometer to succeed in mass adoption.

Why on Earth did it take so lengthy?

Going Past The S Curve

“…the diffusion of improvements is a social course of, much more than a technical one.”

–Everett M. Rogers, “Diffusion Of Innovations”

One other timekeeping system was invented in 2008 by Satoshi Nakamoto. Bitcoin is a decentralized clock in our on-line world enabling correct financial calculation and monetary navigation within the unsure waters of life. Although its properties are superior within the eyes of its customers, the speed of adoption isn’t as spectacular.

Many declare it’s on the brink of crossing the chasm: “That is the web of 1995!” However in our bullishness, we anticipated an iPhone-like adoption. Actually, concepts unfold sooner than ever earlier than, however to think about this development as the only real variable governing adoption price is oversimplifying it. The longitude story exhibits us that, even when an innovation is a whole no-brainer, it could take longer than you assume to catch on.

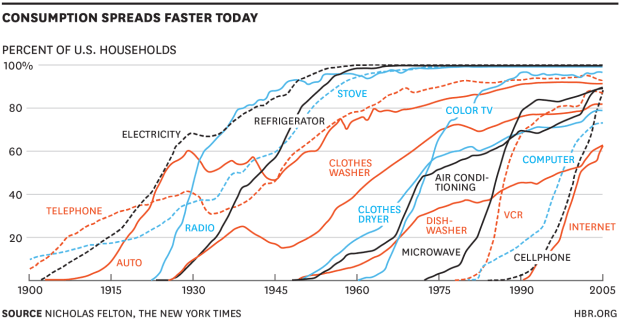

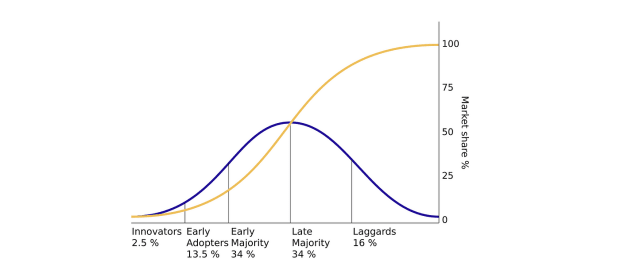

Everett Rogers was the social scientist who popularized the observation of how innovations diffuse across the social medium by a normal distribution. By aggregating adopters over time, the uptake seems like an S curve that hockey-sticks upward after a important mass of customers has been reached. This mannequin gained recognition early this century because it defined the exponential progress of cell phones and the web.

However Rogers’ analysis encompasses extra than simply this memorable mannequin. In his ebook, “Diffusion Of Innovations,” he discerned 5 parameters that govern a know-how’s adoption price.

The 5 Perceived Attributes Of Bitcoin

One: Relative Benefit

“Diffusion is a selected sort of communication through which the message content material that’s exchanged is worried with a brand new concept.”

–Rogers, “Diffusion Of Innovations”

Bitcoin’s perceived worth is decided by two issues: wants and worth.

With a view to have a necessity, one has to expertise an issue. The problems with fiat cash have lengthy been acknowledged throughout the cypherpunk and sound cash communities, they usually have been the primary to undertake. However outdoors of those social cliques, the attention of greenback debasement is low. A scarcity of economic training and fiat immersion leads folks to not search options. With no proper diagnosis, no one wants a treatment.

Bitcoin’s worth is slowing adoption and unit bias makes the coin look costly. Individuals don’t know it is subdividable. The value can be risky, obfuscating its store-of-value perform. You’ll be able to distinction this with different adoption instances. For instance, cell phone customers understand worth immediately — calling anybody, anytime, anyplace. However with Bitcoin, 80% drawdowns and “quantity go down” for years aren’t unusual. It takes a excessive degree of abstraction to see Bitcoin’s worth and excessive conviction to not be shaken out of the market.

Two: Compatibility

“Potential adopters might not acknowledge that they’ve a necessity for an innovation till they change into conscious of the brand new concept or its penalties.”

–Rogers, “Diffusion Of Innovations”

The primary model of a brand new know-how is never an ideal match for the complete market, catering solely to a distinct segment group of innovators. In response to Rogers, an innovation must be reinvented to seek out product-market match.

Bitcoin is at the moment appropriate with the financially educated. However past this group, Bitcoin isn’t perceived to be consistent with folks’s worth and perception methods. It’s nonetheless a distinct segment product within the innovator stage.

For Bitcoin to succeed in extra early adopters, it must be reinvented for various world markets. At the moment, two distinct paths are rising: its narrative and medium-of-exchange (MoE) utilization. Listed below are three examples:

- “Banking the unbanked”: Bitcoin may help folks in growing international locations to leapfrog the legacy banking system. Starlink and smartphones allow adoption the place an MoE, system for remittances and a checking account in your pocket have excessive worth. Leaders in international locations like El Salvador, Mexico and Indonesia use such narratives to elucidate Nakamoto’s invention.

- “Cyber warfare”: In his ebook, “Softwar,” Jason Lowery makes use of navy language to reinvent bitcoin as a geopolitical asset to be fought over by states in our on-line world, creating a brand new area of struggle. By the navy lens, he recoins Bitcoin as “Bitpower,” making a imaginative and prescient through which ASICs convert vitality to boost a cryptographic wall, growing the price of assault on monetary information. Lowery is a change agent, somebody who interprets Bitcoin to make it appropriate with the U.S. military.

- “Grid balancing”: That is the language for the vitality sector clique. Proof-of-work mining can be utilized to make vitality grids extra resilient, steadiness provide and demand and switch a revenue out of stranded vitality sources.

These narratives are designed to make Bitcoin extra appropriate with particular social teams that talk totally different languages. With elevated understanding, these teams will drive the creation of recent makes use of and functions.

Three: Complexity

The chronometer was far forward of its time and it took years earlier than artful entrepreneurs copied and manufactured the system. Equally, Nakamoto needed to introduce his invention to its first adopters on the Bitcoin Talk forum. Since then, entrepreneurs have needed to be part of and construct companies on high of the protocol, together with chilly storage options, mnemonic seed phrases and exchanges. These upgrades improved the person expertise, however in comparison with the cell phone, Bitcoin’s nonetheless comparatively difficult.

This additionally holds true at Bitcoin’s growth degree. New software program builders expertise a steep barrier of entry implementing Bitcoin in functions — the ecosystem isn’t as nicely developed as common net growth. And whereas it’s true that Bitcoin isn’t what it was again in 2008, and upgrades proceed to make it extra accessible — with teams like Spiral and Breeze having lately launched software program growth kits to make integration simpler, for example — the place is the Steve Jobs “increase” second?

We’re nonetheless ready for the out-of-the-box killer app.

4: Trialability

“One should be taught by doing the factor, for although you assume you understand it, you don’t have any certainty till you attempt.

–Sophocles, “The Trachiniae”

The chronometer had an extended trial interval. By the point captains may replace their friends on improved navigation, months of trial and journey had handed. The system was deemed good provided that it was correct alongside the total crusing journey. On high of that, a ship was underway for months, retarding the phrase of mouth.

The Bitcoin journey takes time, too. Since worth is risky, it’s not unusual to be “beneath water” for a while. This may affect the benefits perceived by the person, however may additionally deter friends from adopting. The trial interval could also be so long as the reward halving, and true advocates are solely minted after sufficient time available in the market.

Although trialability of Bitcoin is simple — one can simply purchase somewhat — the general web profit is simply nice with a bigger buy, proving the purpose that the total trial interval could be so long as one halving.

5: Observability

Bitcoin is digital and thus poorly seen. It’s not like a Ford Model T racing over the roads with its benefits on show. Most individuals solely study Bitcoin in information reviews when it has damaged by its all-time highs, which may final just for a relatively-short length.

Adoption hastens with extra seen functions. Maybe within the not too distant future, Bitcoin miners could also be integral elements of energy vegetation and houses. Individuals would possibly ship Bitcoin with their telephones to mates on the road. Or they see the Lightning buttons on a Nostr client and uncover it’s attainable to zap satoshis to their favourite influencers.

Additionally, elevated wealth by bitcoin is difficult to identify. Except Bitcoiners begin sporting Gucci and driving orange Lambos, wealthy HODLers are onerous to look at. However sporting a giga-chad t-shirt may not be in useless and will probably velocity up the unfold.

Reward

Harrison slaved away at his timekeeper alone for 20 years. His invention bought blocked and retarded by paperwork, however he lastly bought his £20,000 bounty. Sensible entrepreneurs have been capable of scale his ingenious design to mass manufacturing, bringing chronometers aboard ships the place they saved time, cargo and lives. It took a very long time, however the chronometer ultimately floated to the highest.

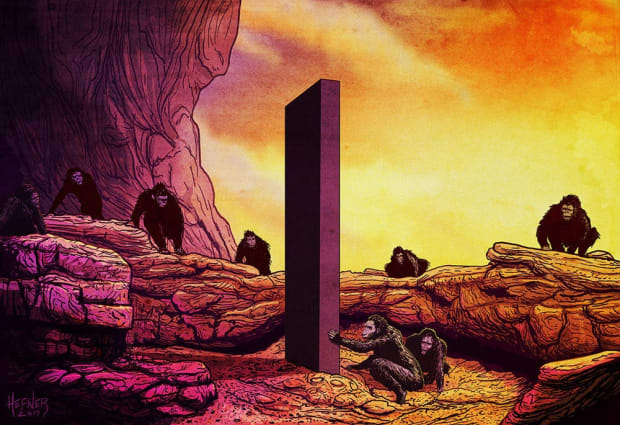

Right this moment, the folks of Earth are financially adrift. Like ships unaware of longitude, they sail blindly by the treacherous waters of life, unable to financially calculate. We’re barbarians residing within the pre-science Stone Age of cash. Future generations will have a look at us in dismay.

However that is about human psychology and the way folks embrace new concepts. In hindsight, world-changing applied sciences all seem self-evident. You’re proper in the midst of a paradigm shift, the ignition of scientific revolution, and it’s onerous to see the place issues are going.

Bitcoin received’t diffuse quickly like Fb, the web or the iPhone. A lot must be constructed, reinvented and translated earlier than the plenty get onboard. Like with electrical energy, base layers are onerous to grok with out the precise home equipment.

We are going to get there.

However it would take longer than you assume.

It is a visitor publish by Bitcoin Graffiti. Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

More NFT News

Aethir, Filecoin Basis Type Alliance for Enterprise-Grade Decentralized GPU Compute

High Cryptocurrencies to Spend money on Now September 19 – Sei, Algorand, Hedera

Shiba Inu Whale Who Made $145 Million In 2021 Loses $13.5 Million, Right here’s How