Coinbase, a number one cryptocurrency trade, finds itself embroiled in a multi-front authorized warfare. From disgruntled traders to the watchful eye of the SEC, the corporate faces challenges that threaten its operations and solid a shadow over the way forward for crypto regulation.

Coinbase Accused Of Promoting Unregistered Securities

A new class-action lawsuit filed in California alleges Coinbase knowingly violated state securities legal guidelines by promoting unregistered securities. The plaintiffs, a gaggle of traders, goal particular tokens like Solana and Uniswap, arguing they need to be categorised as investments and never mere digital property.

They level to a doable contradiction throughout the trade’s personal person settlement, which can outline the corporate as a “Securities Dealer.” This lawsuit echoes the same one already underway, suggesting a rising development of investor discontent with Coinbase’s crypto choices.

A screenshot of the category motion lawsuit filed in opposition to Coinbase. Supply: US District Court Northern District of California.

Coinbase Vs. SEC: A Battle For Regulatory Readability

Probably the most distinguished authorized combat includes the US Securities and Alternate Fee (SEC). The SEC accuses Coinbase of appearing as an unregistered securities trade and dealer by providing unregistered tokens. The corporate vehemently denies these costs and has filed an attraction in opposition to the preliminary ruling.

This conflict highlights the core difficulty: the shortage of clear rules governing cryptocurrency. Coinbase, together with many within the business, views this lawsuit as an overreach by the SEC, pushing for a extra outlined regulatory framework that fosters innovation with out stifling progress.

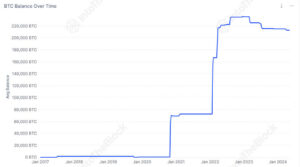

Bitcoin is now buying and selling at $64.493. Chart: TradingView

John Deaton Joins The Fray

Including one other layer of intrigue is the involvement of John Deaton, a distinguished crypto lawyer identified for his advocacy in opposition to regulatory overreach. Deaton has filed an amicus temporary in assist of Coinbase within the SEC battle.

This transfer signifies the business’s unified entrance in opposition to what they understand as stifling rules. Deaton’s professional bono work highlights the excessive stakes concerned, not only for the crypto trade, however for all the crypto ecosystem.

Past The SEC: GYEN And Staking Packages Face Scrutiny

Coinbase’s authorized woes lengthen past the SEC lawsuit. A separate case accuses the trade of mishandling the GYEN stablecoin, a cryptocurrency pegged to the Japanese Yen. Plaintiffs allege that the agency promoted and traded GYEN regardless of understanding of its volatility, resulting in vital investor losses.

Moreover, the corporate’s staking program, which permits customers to earn rewards by holding crypto, has drawn the eye of regulators. The SEC views staking as an unregistered safety, whereas a number of US states have joined the case, additional complicating the authorized panorama for Coinbase.

Featured picture from Salt&Gentle, chart from TradingView

More NFT News

Bitcoin Breakout From Main Resistance Ranges Indicators Bullish Momentum

ADA Value Surge May Push Ratio Of Holders In Loss Under 55%

Blockstream's Rusty Russell Desires To Revamp Bitcoin Script