“What underpins a world order is all the time the monetary system.

We’re on the point of a dramatic change the place we’re about to, and I will say this boldly, abandon the standard system of cash and accounting and introduce a brand new one. And the brand new one is what we name blockchain.

It means digital. It means having an nearly excellent document of each single transaction that occurs within the financial system, which is able to give us far larger readability over what is going on on. It additionally raises large risks by way of the steadiness of energy between states and residents. In my view, we’ll want a digital structure of human rights if we’ll have digital cash.

Most individuals assume that digital cash is crypto and personal, however what I see are superpowers introducing digital forex. The Chinese language had been the primary. The US is on the point of shifting in the identical route. The Europeans have dedicated to that as effectively.”

This revolutionary speech a couple of new monetary system, was delivered on the World Authorities Summit in March 2022 in Dubai, by Philippa “Pippa” Malmgren, a member of the Council on International Relations (CFR) and Chatham Home; her father, Harald Malmgren served as a senior advisor to US Presidents Kennedy, Nixon, Ford and others. She’s a expertise entrepreneur and economist, who served as Particular Assistant to President George W. Bush, for Financial Coverage on the Nationwide Financial Council and is a former member of the President’s Working Group on Monetary Markets and Company Governance.

Her phrases in regards to the transition to a brand new world order that requires a brand new monetary construction correspond effectively with the phrases of French President Emmanuel Macron in June 2023 on the World Finance Summit in Paris: “The world wants a public monetary shock to struggle world warming, and the present system will not be appropriate for coping with the world’s challenges.” The president of Brazil, Lula da Silva, additionally called for “a clear slate” and stated the Bretton Woods organizations (World Financial institution, Worldwide Financial Fund) don’t serve their targets nor reply to society’s wants.

“The New Bretton Woods Second”

“A brand new worldwide financial system is taking form, some name it the brand new Bretton Woods second that must be seized to create a brand new world monetary governance,” says the investigative journalist Whitney Webb in a current sitdown interview, the place she point out that in line with Mark Carney, former governor of the Financial institution of England & Financial institution of Canada and the UN Particular Envoy for Local weather Motion and Finance, the three pillars of the brand new multi-polar world are Digital IDs, CBDCs and ESG, by a worldwide carbon market. All world governments are pushing this agenda, that to ensure that it to succeed, all financial techniques and supporting techniques should turn out to be digital and depend on digital information.

A very good instance of this was revealed at an occasion of the Central Financial institution of Israel with the Financial institution for Worldwide Settlements (BIS) – which I attended – in September 2023 in Tel Aviv, the place the “Genesis Project” was introduced. As a part of this venture, “inexperienced” bonds are issued, primarily based on carbon quotas within the CBDC infrastructure. That is how the local weather agenda is linked to monetary markets.

“Debt Serfdom”

“Stablecoins may very well be the best way during which the US is additional globalizing the greenback, spreading its adoption on to the world’s normal public as a way to proceed growing its debt and encourage uptake and utilization of the greenback”, says Mark Goodwin, Editor in Chief of Bitcoin Journal, on this interview with Whitney Webb. He means that the politician’s outcry of de-dollarization and the weakening of the greenback are a distraction from perpetuating the greenback because the world’s reserve forex.

“Whereas CBDCs are what persons are changing into fearful and conscious of, it could simply be the pink herring, and the true technique of the US greenback’s survival is extremely regulated stablecoins (corresponding to Tether), which might simply be programmable, much more than CBDCs, in addition to seized, regulated and managed not directly by governments. 100 billion {dollars} in treasuries had been already bought by Tether, its subsidiaries and homeowners. Tether is positioned alongside the highest 20 nation states shopping for debt from the US, with round one tenth of China or Japan which have a trillion {dollars} debt to the US”.

This idea, along with the phrases of Mark Carney, Pippa Malmgren, Emmanuel Macron & Lula Da Silva, be a part of the calls of world leaders and heads of states, pointing to the substitute of the financial and monetary world order, to introduce a brand new financial system. Many specialists say that we’re reaching the tip of the present fiat financial system experiment, which is destined to break down. Since world leaders are conscious of this, they like to engineer a managed demolition, to keep up management and steer the course, and enter the brand new period with energy firmly inside their grasp.

Central Financial institution Digital Foreign money System (CBDC)

Central Financial institution Digital Currencies (CBDC), tie the monetary freedom of residents to the federal government and the banking institution. The central financial institution points its centralized digital currencies, and primarily creates a brand new financial system, “fiat on steroids”, a system that takes all the things that’s unhealthy within the fiat system, and provides extra of it; surveillance, management, censorship, and enforcement capabilities. A contemporary jail? Certainly, the CBDC is the final word prototype of a jail with out bodily chains. By connecting CBDCs to digital identification playing cards, and to authorities techniques corresponding to common primary revenue, social credit and extra, we get the final word management equipment. This equipment will dictate to residents what they’re allowed to buy, what the permitted quotas are whereas limiting consumption in line with guidelines and use circumstances, at programmed occasions, locations and cadences. The system is ready to decide the usage of a geographic radius (geo-fencing), and to find out expiration dates on the cash. Every distant managed digital pockets will also be switched on and off by its operators. Greater than 130 nations are within the preliminary levels of piloting CBDC techniques, of which 36 nations are in superior pilots, and three nations have already launched techniques (Nigeria, Jamaica and the Bahamas).

Will Ripple (XRP) Be The Chosen Platform for CBDC?

Ripple, a digital fee community and transaction protocol that owns the cryptocurrency XRP, is taken into account one of the crucial in style cryptocurrencies, and is strategically positioning itself on the coronary heart of presidency monetary innovation, aiming to be the cornerstone of future CBDCs.

The corporate is in talks with about twenty governments world wide to develop their CBDCs utilizing Ripple’s expertise. In Could 2023, Ripple launched a devoted CBDC platform to help central banks, governments and monetary establishments world wide in issuing CBDCs and stablecoins. Thus far, Ripple has partnered with six governments for CBDC pilot tasks: Georgia, Colombia, Montenegro, Hong Kong, Bhutan and the Republic of Palau.

The Nationwide Financial institution of Georgia, for instance, has chosen Ripple as its expertise accomplice for its CBDC pilot final yr, citing Ripple’s technical experience and group capabilities. Its curiosity in CBDCs is in leveraging fashionable applied sciences, such because the programmability side of CBDCs, aiming to create a platform with sensible contract and programmable token capabilities to stimulate innovation within the monetary sector.

Within the case of Bhutan, Ripple’s expertise was chosen in 2021 for the nation’s CBDC venture to allow superior cross-border funds, and help in “monetary inclusion” – in keeping with Bhutan’s mission to extend monetary inclusion in Bhutan to 85% by 2023.

In 2022, Ripple reached the ultimate stage of the G20 Techsprint CBDC Hackathon, hosted by Indonesia and the Financial institution of Worldwide Settlements (BIS), and in August 2023, the Republic of Palau launched a USD-backed digital forex, developed by Ripple.

Selling its platform as an infrastructure for a CBDC, Ripple advocates for presidency regulation of cryptocurrencies, and tries to place itself as the popular answer for CBDC tasks. Its declare to fame of being the best CBDC accomplice for governments is the mix of pace, effectivity, a sustainable and “inexperienced” blockchain community that makes use of little power (in comparison with the Bitcoin community), and interoperability – the power to speak and work with CBDC options in different nations on the Ripple infrastructure. The corporate warns that there’s a threat for CBDC adoption by the general public, triggered primarily by an absence of market schooling, and it encourages the programming and expiration dates capabilities, that are perceived by many of the public as significantly Orwellian options of CBDCs.

Ripple encourages the abolition of money (and a transfer to a cashless society), and unsurprisingly, it promotes the local weather agenda; The corporate’s web site presents its dedication to a clear, affluent and safe low-carbon future, with a plan to succeed in carbon net-zero by 2030.

Apparently, in keeping with Ripple’s enlargement technique vis-a-vis governments, the corporate makes certain to recruit workers who got here from central and industrial banks. One of many firm’s prime executives is Andrew Whitworth, coverage director at Ripple, who beforehand labored on the Financial institution of England. Similtaneously his function in Ripple, Whitworth additionally serves as a Director of the “Digital Pound Basis”, a corporation that has declared itself the authority on the Digital Pound; it advises and influences the federal government’s selections relating to CBDC tasks and deployments. Clearly an inside connection corresponding to this would possibly give Ripple a bonus in shaping digital forex insurance policies to suit their platform and options. Does this trace a battle of pursuits, or at the least an unfair play?

One other avenue by which institutional affect and implicit management over Ripple may manifest is through a legal battle with the SEC (U.S. Securities and Change Fee) regarding the XRP cryptocurrency. Participating in such authorized disputes inevitably positions Ripple in a situation the place sustaining a optimistic relationship with establishments turns into essential. Consequently, it is no shock that Ripple prioritizes governments, central banks, and monetary establishments as its major target market in its market technique.

Fascinating Developments in CBDC

China spent a few years rolling out comparatively failed CBDC tasks with out widespread adoption, whereas injecting 30 million yuan as free cash to encourage consumer adoption. Transactions utilizing the digital yuan hit 1.eight trillion yuan (US$249 billion) in June 2023.

Not too long ago, important progress has been made: the 2 essential fee companies and functions in China – WeChat and Alipay – which have a visitors of about 3-Four trillion {dollars} per yr, built-in the Chinese language CBDC service into their functions. The central financial institution regulator made it clear that digital yuan isn’t meant to compete with the 2 funds giants. Reasonably, it’s purported to play a complementary function.

Elon Musk, who owns, amongst different issues, the Twitter/X platform, has acknowledged that he desires to make the platform an “all the things app” just like the Chinese language WeChat, together with fee administration. Will X additionally comply with the Chinese language route and combine the CBDC answer into it, or will it attempt to turn out to be a CBDC infrastructure itself with the assistance of Musk’s favourite cryptocurrency, the Dogecoin?

The CBDC pilot in Nigeria did not precisely take off both, after the residents took to the streets to protest the abolition of money within the nation, and resented the introduction of an unneeded digital answer, whereas demanding the return of money. After an extended and painful protest, the money was returned alongside the brand new digital forex, which was not canceled and have become a part of actuality. Moreover, a brand new stablecoin is in preparation in Sandbox mode in Nigeria. The cNGN is a Naira stablecoin which some declare has extra potential than the e-Naira to be broadly adopted. “The stablecoin might be extra broadly interoperable than the CBDC, which is just obtainable within the central financial institution’s pockets. At launch, the central financial institution’s pockets usability was weak, though it’s now fairly good”, stated Bolu Abiodun, a reporter at Techpoint Africa.

The UK noticed a powerful public backlash to Prime Minister Rishi Sunak final yr, with greater than 50,000 responses despatched to the Financial institution of England following a public listening to on the Digital Pound, aka the UK’s nationwide CBDC.

Germany – Consciousness of “Extreme Surveillance”

In Germany, the technical tips document for a digital forex of a central financial institution was printed in January 2024. Under are a number of quotes from the doc, reflecting the tyrannical nature of the brand new forex, and the attention of the central financial institution for belief points it will possibly create:

- Programmability is the establishment’s authority to dedicate your cash for sure makes use of, and to ban the usage of your pockets when it’s “outdoors the permitted scope”.

- “The central financial institution can revoke CBDC notes, e. g. as an instrument of financial management. Revocation of CBDC notes is carried out by a licensed entity, the revocation authority, managed and operated by the central financial institution.” This seems like a method to confiscate and apply a shelf life to cash.

- “Funds permitted underneath sure restrictions.. if the central financial institution sees match to impose them” – the doc lists restrictions that may be utilized to wallets, relying on the quantity of non-public data that might be offered. For instance, the sum of money within the pockets, the variety of funds per day, the sum of money per transaction or per day.

- The excellent news: The German central financial institution is conscious of the potential for public opposition to a surveillance system: “Many of those design selections are normal selections on the trade-off between extreme surveillance and legit monitoring capabilities for AML and KYC functions together with measures for mitigating fraud and misconduct. These selections are extraordinarily delicate in nature and may strongly affect the extent of belief that customers place into the CBDC”.

Israel – The Digital Shekel Will Be Distributed By means of Business Banks

Israel takes an intensive and lively half in numerous CBDC pilots, such because the Sela venture, Eden, Icebreaker and extra, which I’ve reported on extensively prior to now. The Deputy Governor of the Financial institution of Israel introduced that in December 2024 a technical design doc for the Digital Shekel might be printed, and its implementation will then start in partnership with the non-public sector.

The Financial institution of Israel’s newest document from final week covers the proposed structure of the Digital Shekel. Listed below are some attention-grabbing factors from the doc:

- The distribution of the Digital Shekel might be two-tiered: as a substitute of direct contact between shoppers and the central financial institution for funding and defunding, an oblique methodology just like the distribution of money immediately might be used. The banks will buy digital shekels from the central financial institution in giant portions and switch them to prospects upon pockets charging.

- The system will be capable to apply and implement limits, for instance limits on the steadiness that customers are allowed to carry within the Digital Shekel.

- The system will assist the potential for making use of curiosity on the Digital Shekel.

- Customers will be capable to entry the Digital Shekel by a number of fee suppliers, together with bank cards, Google/Apple Pay, wearables, fee apps and extra.

- Not like most retail CBDC options, Israel’s mannequin permits customers to open a pockets with a fee service supplier (PSP) and hook up with a number of third-party banks to fund and defund balances.

One other attention-grabbing growth in Israel is the announcement of a plan to launch a brand new stablecoin pegged to the shekel, referred to as BILS, by the alternate platform, Bits Of Gold. Crypto Jungle web site stories that the Israeli Capital Market Authority accredited the pilot, in line with the draft rules printed by the Central Financial institution of Israel. Fascinating to notice that the corporate offering the infrastructure for the issuance and custody of the forex is the Israeli expertise big “FireBlocks”, which took half within the “Eden” pilot venture of the Tel Aviv Inventory Change for the issuance of digital bonds, constructed to adapt sooner or later to a possible CBDC infrastructure.

No Web? Do not Fear, Governments Will Take Care Of Connectivity Anyway

Plenty of CBDC pilots, like in India, the European Union and extra, give attention to the adoption of the system by everybody, even amongst folks with out web entry. The washed-up identify “monetary inclusion” implies that the system won’t skip anybody, not even residents with out Web connectivity in distant areas, or with out reception. In India for instance, there are 683 million folks residing with out an web connection and largely outdoors the management of the state. The Reserve Financial institution of India (RBI) plans to carry these distant areas into a brand new surveillance community by numerous technological means. A profitable launch of CBDC in India additionally corresponds with the federal government’s overarching objective of decreasing money utilization and enhancing monetary monitoring.

Thailand – Free Cash for the Plenty

In September 2023, the Thai authorities introduced that any Thai citizen over the age of 16 who chooses to take part within the CBDC pilot, will obtain free CBDC price $280 (10,000 baht) – fairly some huge cash in Thai phrases. This digital cash might be loaded into the digital pockets software and might be obtainable to be used inside 6 months, and inside a radius of Four km from the residence of the registered residents. The pilot targets low-income residents as a primary stage, and later expands to entrepreneurs and small enterprise operators – offered they’re registered within the tax system. In Thailand many voters usually are not registered within the authorities techniques and never everybody has a checking account. Evidently air-dropping “free cash” is one other tactic to lure residents into authorities techniques, with the bait of “free” managed authorities cash. However is there such a factor as “free lunch”?

The European Union – a Constructive Advertising Marketing campaign in Excessive Gear

The European Union launched a advertising marketing campaign to advertise the digital euro about six months in the past, to begin educating the European public a couple of actuality the place that they are going to be obliged to make use of a supervised digital euro, led by Christine Lagarde, who was beforehand convicted of crimes and was promoted to function the governor of the European Central Financial institution, the ECB.

The Digital Euro new advertising marketing campaign. Supply: Christine Lagarde’s Twitter account

On the identical time, a charade is happening within the European Union Parliament the place the hazards of CBDCs are being mentioned, solely because of the general public consciousness and discourse, whereas Lagarde rushes ahead and kicks off the advertising marketing campaign to instill within the public the next messages: the digital euro is straightforward, protected, quick and dependable. Not a phrase about its Orwellian capabilities to trace, program, restrict and situation exercise by expiration dates, geo-fencing, and distant on and off switching.

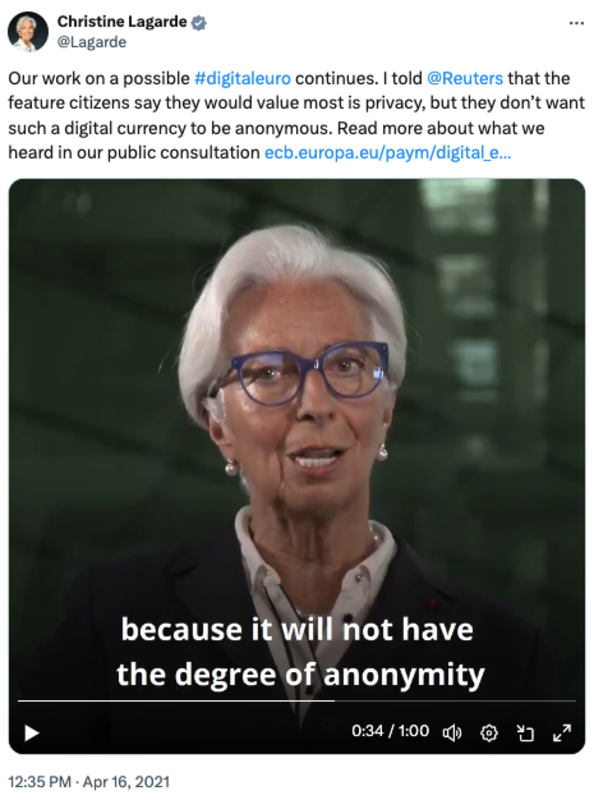

The Digital Euro Will Not Be Nameless

In a dialogue on the European Union Council in 2023, Lagarde emphasizes some extent: the digital euro won’t be nameless. Privateness will exist within the system, however not anonymity. Let’s break this up otherwise: for the banks, the important thing to surveillance and management is identification. The financial institution should know who the citizen is and confirm their identification, as a way to train regulation enforcement or rules, by technological restrictions. Lagarde’s declare that the expertise will enable privateness however not anonymity is unfounded: apparently the central financial institution considers itself and the monetary service suppliers some type of God, since in entrance of them the citizen might be recognized, and subsequently it’s not clear what sort of privateness can exist, with out anonymity.

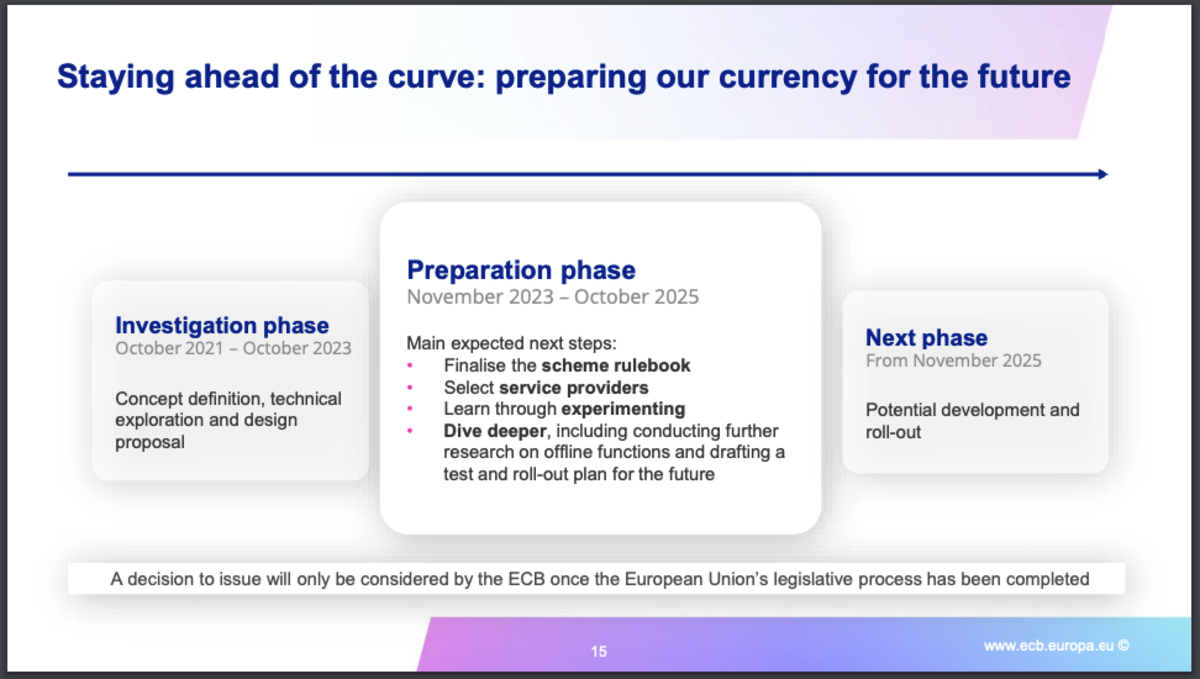

In a presentation from March 2024, the ECB presents a timetable for the Digital Euro. In November 2025, the event and implementation section will start, with the completion of the “democratic” legislative course of.

The timing of the launch of the Digital Euro corresponds effectively with the European Union’s initiative to subject digital identification playing cards to all EU residents between now and 2030, to allow the required authorities identification and monitoring of its residents. An identical initiatives are enacted and promoted in lots of different nations world wide on the identical time. The place I reside, in Israel, ID playing cards and passports have been obligatory and digital for a few years, and likewise biometric since 2013 – subsequently there isn’t a want to begin the advertising marketing campaign for the Digital Shekel but, because the digital infrastructure exists therefore step one of digitalization is already accomplished.

This section of the venture is the “preparation section”, the ECB reveals, during which they’re making ready for the launch section of the Digital Euro. In fact, we’re reassured that no remaining determination has but been made relating to the launch of the CBDC, and this may solely occur with the approval of the “Authorities Council” after the completion of the democratic legislative strategy of the European Union. Due to this fact, in parallel with the democratic debate for or towards the Digital Euro, the event of the expertise will proceed, as a way to be ready for the launch.

Central financial institution governors corresponding to Lagarde and Financial institution of Israel Governor Amir Yaron insist that the CBDC is digital money, and likewise insist that bodily money won’t be abolished. It’s doable that these central bankers really feel the necessity to make a U-turn from the incriminating speech of the pinnacle of the Financial institution for Worldwide Settlements (BIS), Augustin Carstens, who triggered a public outcry when he acknowledged in 2020 that the CBDC expertise, not like money, will enable monitoring of economic transactions and might be a way of enforcement by the institution:

“The important thing distinction with the CBDC is the central financial institution could have absolute management of the foundations and rules that can decide the usage of that

expression (cash) of central financial institution legal responsibility, and likewise we could have the expertise to implement that.”

Agustín Carstens – BIS Common Supervisor

The Future: Centralized and Managed, or Free, Decentralized and Safe?

Ayn Rand, creator and thinker, stated that “We will ignore actuality, however we can not ignore the results of ignoring actuality.” Are we taking big steps in the direction of a brand new financial actuality, the place the fiat currencies we all know turn out to be fiat on steroids, aka CBDCs? Or into the truth of “secure” and carefully regulated cryptocurrencies, tethered to fiat? Both means, the sensation is that the institution is doing all the things to protect the debt financial system, and its inherent fashionable slavery. The one approach to break these fiat-matrix boundaries is to decide out and enter into a brand new system, which appears to run in a parallel actuality, the Bitcoin system. On the Bitcoin commonplace, underneath self-custody, no third social gathering has the power to confiscate, program or take over non-public property. Not even the federal government or the state. Bitcoin makes use of numerous power for its mining, however this proof-of-work mechanism makes the blockchain community extraordinarily safe and the Bitcoin forex very worthwhile. Bitcoin is “protected cash”, which is out of attain for the institution. Not like most different cryptocurrencies, Bitcoin is a digital forex with out intermediaries or third events (peer-to-peer) in a decentralized and safe community, which permits everybody to be their very own financial institution, as a substitute of counting on banks and exterior events. With a hard and fast and recognized provide, it represents probably the most highly effective digital asset in the marketplace as a retailer of worth and as a unit of account, and sooner or later may also be used as a medium of alternate.

In my current interview with the media and finance professional, and one of the crucial well-known Bitcoiners, Max Keiser, he in contrast the CBDC to a parasitic and centralized most cancers: “For those who had been to have a look at the quantity of power that Bitcoin makes use of and the speed at which it is growing, you’d say good is triumphing over evil. So this offers me numerous hope. And I do not assume centralization in something works in any respect, besides most cancers. Most cancers is the one factor that appears to work to be overly centralized and parasitic. That is the most cancers mannequin, however I believe we’re gonna win towards the most cancers of CBDCs.”

Observe Efrat’s work here.

It is a visitor submit by Efrat Fenigson. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

More NFT News

Grayscale Withdraws Ethereum Spot ETF Proposal Amid Regulatory Obstacles

8% Worth Surge And Sturdy Double-Digit Progress In Key Metrics

Dylan LeClair Joins "MicroStrategy of Asia" as Director of Bitcoin Technique