Let’s face it: Non-fungible tokens — or NFTs — are remodeling each aspect of recent society, from finance to artwork. And we have now each cause to suspect it received’t cease there.

For the reason that twenty-teens, NFTs have grow to be some of the significant and resilient modern improvements in tech, finance, fashion, sports, memes, and the arts. However whereas NFTs have been linked to hype, confusion, and drama (yes, drama!) — these reactions are additionally signs of a paradigm shift.

So prepare.

What’s an NFT?

Like several new technology, understanding NFTs and everything that’s happening in the space may be difficult. However no worries: we’re right here to elucidate what NFTs are, how they’re made, the varied advantages and downsides, and how one can decide whether or not NFTs are best for you.

To start, a non-fungible token (NFT) is a singular unit of information on a blockchain that may be linked to digital and bodily objects to offer an immutable proof of possession. The info an NFT comprises may be tied to digital photographs, songs, movies, avatars, and extra. Nonetheless, they can be used to offer an NFT proprietor access to exclusive merchandise, tickets to live or digital events, or be linked to bodily belongings like cars, yachts, and much more.

On this respect, NFTs enable people to create, purchase, and promote objects in an simply verifiable method using blockchain technology. However keep in mind that, until in any other case said, you’re not shopping for the copyright, mental property rights, or business rights to any underlying belongings whenever you purchase an NFT. Nonetheless, all of the authorized particulars can get fairly difficult, so we’ll dive into this extra in subsequent sections.

In relation to creating and promoting NFTs, the method is admittedly relatively easy. It really works like this:

- A person (or firm) selects a singular asset to promote as an NFT.

- They add the article to a blockchain that helps NFTs by way of a course of known as “minting,” which creates the NFT.

- The NFT now represents that merchandise on the blockchain, verifying proof of possession in an immutable document.

- The NFT may be stored as a part of a personal assortment, or it may be purchased, offered, and traded utilizing NFT marketplaces and auctions.

As you may think, the technical definition is a little more convoluted. Should you’re fascinated with that type of breakdown, our NFT dictionary offers you a complete overview of all of the expertise and infrastructure within the NFT ecosystem.

How are NFTs totally different from cryptocurrency?

Similar to the cash in your checking account, cryptocurrency is what you utilize for any and all transactions on the blockchain. Cryptocurrency may be bought or transformed into fiat currencies ({dollars}, euros, yen, and so on.) via crypto exchanges. Against this, an NFT is a singular and irreplaceable asset that’s bought utilizing cryptocurrency. It might acquire or lose worth unbiased of the foreign money used to purchase it, similar to a preferred buying and selling card or a singular piece of artwork.

On this respect, NFTs are non-fungible and cryptocurrencies are fungible.

To raised perceive this, it is smart to think about conventional fiat currencies. If we requested you to allow us to borrow a greenback, you wouldn’t open your pockets and say, “Which greenback invoice would you like?” Doing so could be foolish, as every $1 invoice represents the identical factor and may be exchanged for another $1 invoice. That’s as a result of the U.S. greenback is fungible. Cryptocurrencies are additionally fungible. They’re not distinctive and may simply be traded and changed.

NFTs, alternatively, are non-fungible within the sense that no two are the identical. Every NFT is a singular unit of information that can not be changed by an equivalent model as a result of there may be no equivalent model.

In relation to NFTs, uniqueness and shortage enhance their enchantment and desirability. And as is true of all uncommon objects, this shortage permits people to promote their NFTs for premium costs.

Why personal NFTs?

The demand for NFT artwork has exploded lately. Nonetheless, there may be nonetheless a number of skepticism. In any case, NFTs are usually tied to digital information. How is proudly owning such an NFT totally different from a screenshot of a photograph? Does “proof of possession” imply something? That will help you resolve, listed here are among the most important the explanation why individuals personal NFTs.

1) It empowers artists

Publishers, producers, and public sale homes usually strong-arm creators into contracts that don’t serve their pursuits. With NFTs, artists can mint and promote their work independently, permitting them to retain the IP and inventive management. Artists also can earn royalties from all secondary gross sales of their work.

On this respect, NFTs have the potential to create fairer fashions by bypassing the gatekeepers that at the moment management inventive industries, and lots of people purchase NFTs as a result of it’s a method of empowering and financially supporting the creators that they love.

2) Collectibility

Regardless of costing lower than 5 cents to make, a 1952 Mickey Mantle rookie card offered for $5.2 million. This occurred due to the historical past, rarity, and cultural relevance of the cardboard. NFTs are, in some ways, the digital model of this. For people who need to construct a set of digital belongings, NFTs provide a singular alternative that hasn’t existed exterior of conventional collectibles and artwork markets ever earlier than.

3) Funding

Some NFT homeowners merely need an asset that may enhance in worth. On this respect, some collectors deal with NFTs as an funding — very like conventional artwork. Need proof? Mike Winkelmann, a distinguished American digital artist recognized professionally as Beeple, offered his Everydays: The First 5000 Days composite at Christie’s for $69 million in March of 2021.

This will appear unusual to some, as everybody can see and work together with the picture. Nonetheless, as famous, there can solely be one NFT proprietor. For some, that is sufficient. But, market volatility makes NFT funding a excessive threat, with the potential for main losses.

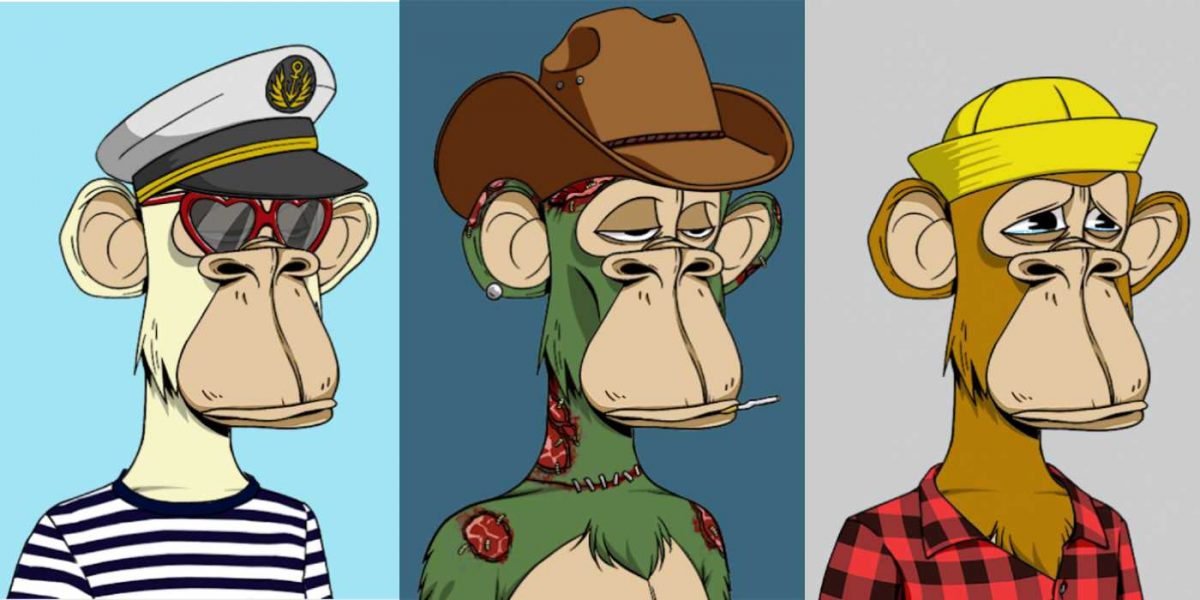

NFT Possession also comes with social benefits, as many creators have turned their NFT initiatives into vibrant communities. The Bored Ape Yacht Membership is, maybe, the perfect instance of neighborhood constructing in relation to an NFT undertaking. Collectors get entry to a members-only discord, unique merchandise, a vote in the way forward for the undertaking, tickets to digital meetups, and extra. As such, for a lot of collectors, proudly owning an NFT how they socialize with mates and a matter of identification.

Creating, shopping for, and promoting NFTs

Sadly, wading into the NFT market isn’t so simple as it’d sound. In any case, you possibly can’t precisely purchase an NFT with a greenback after which carry it dwelling with you. You’ll want cryptocurrency to fund your NFT transactions and a crypto pockets to securely retailer the information whenever you buy (or mint) your personal NFTs. And that’s just the start. On this part, we’ll speak about how NFTs are created, traded, saved, and managed.

So, in case you’re questioning how one can get began with NFTs, that is the part for you.

Step 1 – Get a crypto pockets

Briefly, a crypto pockets is a bodily machine or laptop program that lets you retailer and switch digital belongings. There are two primary sorts of crypto wallets: software program and {hardware} wallets. In relation to minting and shorter-term trades, a sizzling pockets is the way in which to go. However for security causes, it is best to use a {hardware} pockets to retailer your most precious belongings.

A software program pockets (often known as a “sizzling pockets”): That is an utility that may be downloaded and put in in your machine. Software program wallets are extra handy and may be accessed extra simply than {hardware} wallets, as they’re all the time linked to the web. Nonetheless, these wallets are extra open to assaults and simpler to hack. Because of this, they’re sometimes seen as being much less safe.

A {hardware} pockets (often known as a “chilly pockets”): It is a bodily machine that’s usually fairly just like a USB stick that you just may use to retailer information out of your laptop. Besides that, on this case, you’re storing your crypto and NFTs. As a result of these wallets may be fully remoted from the community, belongings saved in {hardware} wallets are sometimes thought-about to be far safer than software program wallets.

FURTHER READING: Everything You Need to Know About Crypto and NFT Wallets

Step 2 – Purchase crypto

Some NFT marketplaces, like Nifty Gateway and MakersPlace, allow you to commerce NFTs utilizing conventional fee strategies. Others, like SuperRare and OpenSea, solely let individuals use cryptocurrency. In relation to which crypto it is best to get, Ether (ETH) is the main one used for NFT transactions. It’s the native foreign money of the Ethereum blockchain, and it may be bought in just a few other ways, together with by way of main buying and selling platforms like Coinbase and Gemini, which permit customers to purchase ETH with a checking account or bank card.

Nonetheless, contemplating the excessive transaction prices and environmental affect related to ETH, some need to use cryptos from different blockchains to commerce NFTs. Alternate options like Solana (SOL), Tezos (XTZ), Circulate (FLOW), and Binance Good Chain (BSC) additionally help NFT transactions. However in case you’re a newbie, it could be greatest to stay to ETH and the Ethereum blockchain, because it has much more marketplaces and customers.

FURTHER READING: How to Buy and Sell Cryptocurrency in 5 Simple Steps

Step 3 – Discover a market

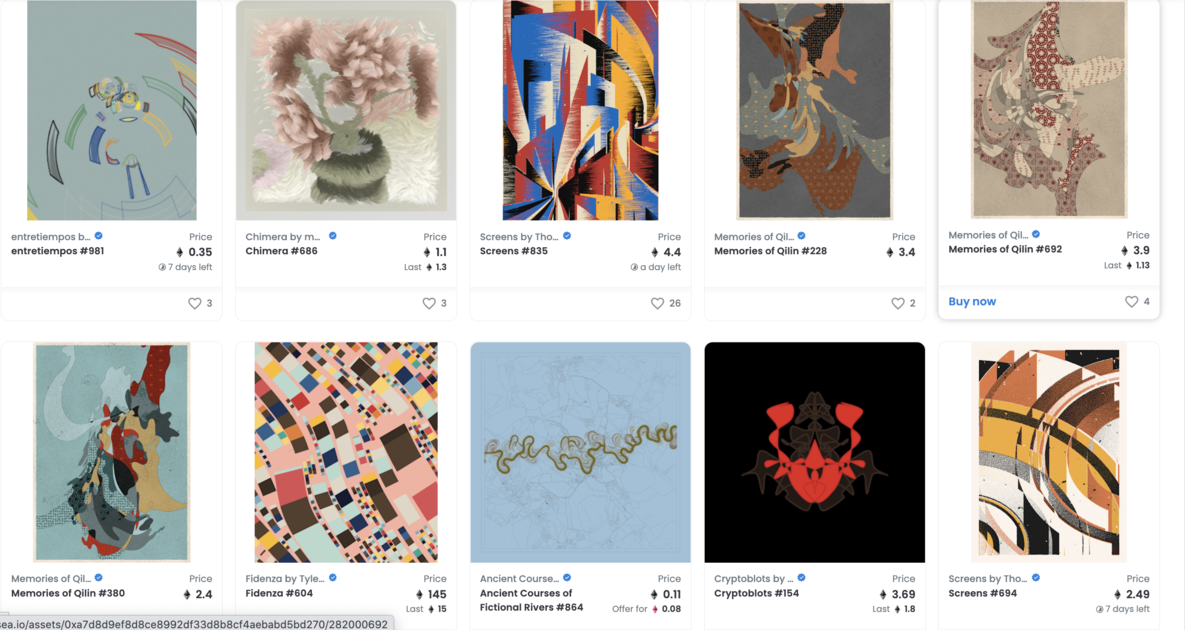

One factor to contemplate when selecting a market is whether or not or not you plan to mint one NFT at a time and place it up for public sale or mint a set or batch of NFTs which can be every individually priced. For the latter, think about just a few of the world’s largest NFT marketplaces. OpenSea is the most well-liked NFT market, with over 1 million lively consumer wallets on the platform. LooksRare and Rarible are two of essentially the most formidable OpenSea opponents.

Should you intend to mint 1/1 NFTs, alternatively, platforms like SuperRare, Foundation, and Zora are your greatest wager.

And do be ready, minting comes with an preliminary value. More often than not, you’ll solely have to pay a gas fee (transaction payment) to mint, however generally marketplaces will tack on additional prices. Equally, ensure you do your due diligence when researching royalty splits. You aren’t assured to have cross-platform royalties whenever you mint on a platform like OpenSea or Rarible. Although there are smart-contract and minting instruments like CXIP that assist sort out this downside and 0xSplits that assist with automated royalty splits to make sure you obtain secondary gross sales royalties irrespective of the place your NFTs are resold.

Step 4A – Mint an NFT

New NFTs are created by way of a course of known as “minting.” That is the process of associating a selected set of information — the NFT — with a selected asset or object. When choosing a singular asset, remember that you should personal the copyright and mental property rights for the merchandise you need to mint. Take care with this course of. Should you create NFTs utilizing belongings you don’t personal, you may simply find yourself in authorized hassle.

As soon as you choose a market and create an account, you possibly can start the minting course of. This course of will probably be barely totally different for every market, however you’ll sometimes have to add the file you plan to affiliate together with your NFT and fund the transaction utilizing ETH or one other cryptocurrency, relying on what blockchain you’re utilizing. It’s additionally attainable to mint a bodily, real-world object, however the course of is extra advanced than what we’ll cowl right here.

As soon as the minting course of is full, you’ll have all of the related info relating to your new NFT, and that NFT will probably be registered to your digital pockets. Now you possibly can preserve it, promote it, or commerce it at your leisure.

Step 4B – Purchase or promote NFTs

Remember that some NFTs will not be out there on the open market or could solely be bought by way of particular distributors. For instance, CryptoPunks have traditionally been offered by way of the Larva Labs web site relatively than by way of a public market.

When you’ve discovered an NFT that you just’d wish to buy, you will have the chance to purchase it outright. In different circumstances, you’ll have to bid on the NFT of your alternative and wait till the public sale closes. Should you’re the highest bidder after the public sale closes (or if the vendor accepts your bid), the transaction will full and possession of the NFT will switch to your pockets.

At that time, you now personal the NFT and should buy, promote, or show it as you see match.

READ MORE: How to Display NFT Art: A Guide to NFT Displays

Promoting your NFT follows the same course of as outlined above. You’ll have to arrange the public sale on {the marketplace} of your alternative. Take the time to grasp all of the charges and totally different sorts of public sale strategies out there to you earlier than initiating the sale. As soon as the public sale is full, the NFT will probably be robotically transferred out of your possession and the proceeds from the transaction will probably be transferred to you.

The environmental affect of NFTs

After all, the NFT increase isn’t with out its downsides. Among the many most frequent criticisms pertains to the vitality wants for working blockchains that use proof-of-work consensus programs to validate transactions. Earlier than the Ethereum merge to proof-of-stake consensus, a validation mechanism with vitality wants which can be orders of magnitude decrease, Ethereum’s vitality consumption rivaled that of total nations when paired with the Bitcoin blockchain.

Nonetheless, because the merge, Ethereum’s vitality wants have fallen by a staggering 99.5 %. Prior to now, many argued that NFTs contributed to blockchain’s general carbon footprint as a result of they promoted using the expertise.

Sadly, most of the arguments critics used to denigrate proof-of-work blockchain have been largely based mostly on misinformation. Many appeared in articles that claimed to calculate the quantity of vitality wanted to conduct a single NFT transaction, however these claims omitted the truth that proof-of-work consensus mechanisms mine blocks, not transactions, and lots of transactions can match inside a single block. It’s additionally not straightforward to calculate how a lot vitality a single NFT transaction makes use of.

Even when this weren’t the case, it’s essential to maintain perspective in thoughts when commenting on a expertise’s vitality wants. Quite a few different applied sciences have obscene vitality necessities. In truth, YouTube and Ethereum used to have roughly the same carbon footprint. That’s not an excuse relating to blockchains and the carbon footprint they depart behind, nevertheless it’s essential to grasp the difficulty in its correct context. No expertise’s existence is as environmentally pleasant as its absence, and deciding which applied sciences we deem priceless sufficient to proceed to make use of is an ongoing dialog.

What’s extra, some blockchains are already shifting to unravel the blockchain vitality downside. For instance, Solana makes use of a singular mixture of proof-of-history (PoH), and several other chains use a model of proof-of-stake mechanisms to considerably handle their vitality use. The Liquid Proof-of-Stake (LPoS) mechanism employed by Tezos, for instance, makes use of roughly two million times less energy than Ethereum did pre-merge.

There are many legitimate criticisms to contemplate relating to blockchain expertise, however maybe a greater query to ask is whether or not or not publications protecting the NFT area will do a greater job of analyzing the information earlier than maligning it.

READ MORE: NFTs and the Environment: Why the Anger Is Unjustified

NFT utilization and possession rights

NFTs have a nuanced relationship with the belongings tied to them. Whereas an NFT is designed to characterize the unique asset on the blockchain, the NFT itself is seen as a separate entity from any content material it comprises. All through this text, we’ve usually in contrast NFTs to buying and selling playing cards, and that analogy holds true right here as effectively.

Say you personal a classic baseball card or a preferred buying and selling card from a collectible card recreation, like Magic: The Gathering. You personal a illustration of the unique work — however you don’t personal the unique work itself. The copyright for the paintings, design, and branding of the cardboard you possess are wholly owned by the cardboard’s producer.

In the identical method, whereas NFTs characterize an merchandise on the blockchain, possession of an NFT doesn’t switch the mental property or utilization rights of that authentic work to you.

For instance, let’s say you purchase an NFT that comprises the very first digital copy of Harry Potter and Sorcerer’s Stone. You personal the NFT. However that doesn’t imply you’ve got the best to promote Harry Potter merchandise, make Harry Potter films, or give others permission to make use of the Harry Potter IP for business functions.

Sadly, NFT possession and utilization rights are sometimes conflated, which has given rise to some patrons buying NFTs with the mistaken understanding that an NFT successfully offers them the rights to broaden upon (and capitalized from) well-established IPs.

After all, there are some exceptions to those arduous and quick guidelines. Bored Ape Yacht Membership has stated publicly that every one BAYC NFT homeowners have full business rights to that Ape. It may be monetized nonetheless the NFT proprietor sees match to take action. Some initiatives like CrypToadz and Nouns have taken this even additional by releasing their IP to the general public area underneath Creative Commons (referred to as CC0). However they need to be considered because the exception, not the rule.

Copyrighted content material

Utilizing self-minting platforms like OpenSea, it’s attainable for any consumer to mint a brand new NFT utilizing copyrighted content material that they don’t personal. That is harmful for the minter, patrons, and the unique artist for just a few causes:

- By profiting off of illegitimate content material, sellers and patrons open themselves as much as authorized motion by the respectable copyright holders.

- Respectable NFTs issued by the copyright holder could also be devalued by illegitimate NFTs of the identical work.

- Patrons could not know that the content material they’ve bought is illegitimate or that they’ve put themselves in authorized jeopardy with an illegitimate commerce.

Considerations round legitimacy are one of many causes that verified NFT initiatives and accounts are preferable. To remain secure on NFT marketplaces, all the time search for verified projects on platforms, and solely observe hyperlinks from official (and verified) consumer accounts on social media.

Within the case of gross sales that happen by way of official web sites, like with Art Blocks or NBA Top Shot, patrons can act with confidence figuring out that their NFT comes from a respectable supply.

NFT scams defined

NFTs are nonetheless a brand new phenomenon. Because of this, the market is susceptible to scams that may benefit from unsuspecting collectors. Listed here are just a few scams and issues with the NFT market that it is best to be careful for.

FURTHER READING: How to Identify and Avoid NFT Scams

Rug pulls

Though massive generative initiatives are most well-liked by collectors, there’s not all the time security in numbers, and no NFT undertaking is fully with out threat. In truth, many initiatives have fallen aside on account of rug pull scams. A rug pull happens when the undertaking creators take the funding cash for the undertaking and disappear. By absconding with the entire cash, the staff leaves collectors with a worthless asset.

Notably, these sorts of rug pulls usually aren’t unlawful. Are they unethical? Positive. But when a undertaking guarantees to donate funds after which chooses to maintain the cash, there isn’t a lot that anybody can do. In uncommon cases, a rug pull may count as fraud, however this usually isn’t the case.

Rug pulls also can occur when NFT builders take away the flexibility for traders to promote their tokens. These sorts of rug pulls are unlawful, and also you might be able to recoup your cash. Nonetheless, it’s going to in all probability value you a prolonged court docket battle. Moreover, many NFT creators don’t use their authorized names, so it could be tough (and even inconceivable) to trace them down.

FURTHER READING: What Are Rug Pulls? Are They a Crime?

Wash buying and selling

As with shares and different collectibles, market manipulation can occur throughout NFT auctions.

Working collectively, a gaggle of potential patrons can drive up the value of an NFT by artificially inflating the bid value till an unsuspecting purchaser joins the fray. After the sale, the asset deflates in worth, leaving the client with a worthless NFT. One of the crucial frequent methods of doing this with NFTs is with wash buying and selling. Wash buying and selling happens when a consumer controls either side of an NFT commerce, promoting the NFT from one pockets and buying it from one other.

When many transactions like this are executed, the commerce quantity rises. Because of this, it appears to be like just like the underlying asset is very wanted. This has the impact of accelerating the worth (the value) of the NFT in query. In truth, some NFT wash traders have executed hundreds of transactions by way of self-controlled wallets to attempt to enhance demand.

FURTHER READING: What is a “wash trade” in NFTs?

Phishing scams

Whether or not by way of faux commercials, NFT giveaways, or another type of coercion, scammers will generally ask on your non-public pockets keys and/or different delicate info like your seed phrase.

Relying on what info they get entry to, the scammer can then entry your pockets and take away any cryptocurrency or NFTs saved inside or signal transactions with out your consent. As a result of blockchain is decentralized and sometimes nameless (i.e. there’s no regulatory authority and people don’t have submit proof of identification to make use of it) there’s usually no option to get well your belongings if this occurs.

Similar to password phishing emails, these scams are available all stripes, and they are often very arduous to identify in case you aren’t on the lookout for them. As a reminder: By no means share your seed phrase or non-public keys with anybody or they’ll be capable of entry your funds, and solely observe hyperlinks from official web sites and accounts.

Generally, even that’s not safe…

Taxes and NFTs

Tax obligations will range by nation, however because of the buying and selling worth for many NFTs, buying a big sum of cash on this method will likely be considered capital gains. Should you’re an NFT creator — which means you’ve minted and offered your personal NFTs — that earnings will possible be construed as some type of enterprise earnings, and also you’ll want to say it when submitting your tax returns.

The specifics will range based mostly on the legalities inside your area, however NFTs are usually not a tax-free funding. Watch out in case you plan to deal with them as such.

FURTHER READING: 6 Critical Things to Know About NFTs and Taxes

However what about crypto philanthropy? We’ve seen a pointy rise in “intentional charitable donations” made by way of NFTs lately. The geopolitical crisis in Ukraine stands as a perfect example of how NFTs can be utilized to positively affect communities in want.

In truth, greater than 1,300 nonprofits accepted crypto-based donations in 2021, that are thought-about tax-deductible within the U.S., amongst different nations. That means that taxpayers can get a tax-deductible write-off for donations they made in crypto or NFTs. However once more, it will range from nation to nation.

FURTHER READING: NFTs and Charity: What to Know About Deductions and Tax Hurdles

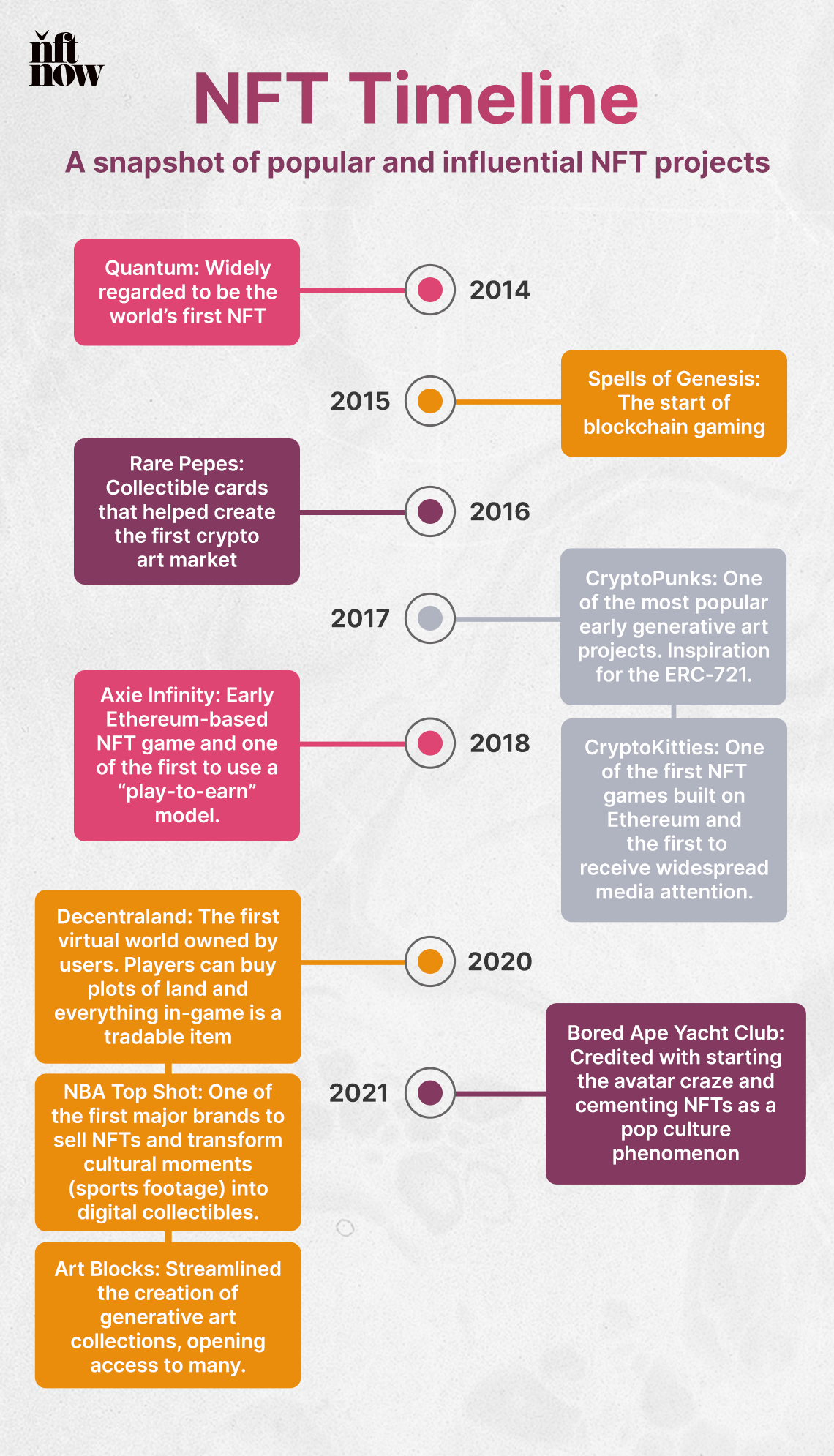

A quick historical past of NFTs

Most individuals first heard of NFTs in 2021. Nonetheless, the tokens really obtained their begin almost a decade earlier. “Quantum” was the first NFT ever created. It was minted by Kevin McCoy on Namecoin in 2014. Over the subsequent two years, a number of different NFTs have been launched on pre-Ethereum blockchains. Nonetheless, these initiatives failed to succeed in widespread recognition and remained largely unknown.

NFTs solely began to achieve mainstream momentum in 2017, when the primary NFT collections have been launched on the Ethereum blockchain. Though it wasn’t the primary NFT undertaking on Ethereum, CryptoPunks stands as of the most well-liked of those early collections and helped really kickoff the crypto artwork motion.

The following 4 years have been crammed with a bevy of area of interest undertaking launches throughout a variety of blockchains. Then 2021 rolled round, and issues actually took off.

READ MORE: Top 10 Historical NFTs Everyone Should Know

Two catalysts helped begin the 2021 bull run. The primary was the COVID-19 pandemic. It induced people worldwide to grow to be extra digitally native, and platforms like Twitter and Clubhouse shortly grew to become Web2 bastions for Web3’s most excited builders. The second is Beeple, who grew to become the primary creator to promote an NFT with a serious public sale home. Christie’s public sale for Beeple’s “Everydays — The First 5000 Days” closed for $69 million, and NFTs might not be ignored.

As mainstream adoption elevated, so did the gross sales volumes and value factors. This led to an explosion of curiosity from firms and types trying to launch their very own NFT initiatives. Early adopters embody manufacturers like Coca-Cola, Taco Bell, Hot Wheels, and Adidas.

What’s subsequent? It’s actually arduous to say. Given how younger NFTs are for the time being, the place NFTs stand now could be prone to look vastly totally different inside a brief time frame.

READ MORE: NFT Timeline: The Beginnings and History of NFTs

A timeline of progressive and standard NFTs

On this part, we’ll cowl among the most notable NFT initiatives thus far. However be warned — this record is much from exhaustive. So make sure to check out our resources on historical NFTs for a extra in-depth blast from the previous.

Quantum (2014)

As famous, the world’s first NFT was minted by Kevin McCoy on Namecoin in 2014. It’s known as “Quantum,” and it was offered in 2021 via Sotheby’s for $1.47 million. There was a subsequent lawsuit on account of possession disputes, and one other get together with the Twitter deal with @EarlyNFT registered because the proprietor of the NFT forward of McCoy’s 2021 sale. The contents of the 2014 blockchain entry appear to point that the Twitter consumer could, the truth is, be the rightful proprietor — not McCoy.

Nonetheless, on condition that NFTs are largely unregulated, it stays to be seen precisely how it will play out from a authorized perspective.

FURTHER READING: Quantum: The Story Behind the First NFT and Its Controversial Sale

Spells of Genesis (March 2015)

Spells of Genesis was created in 2015 by EverdreamSoft on high of Bitcoin. It’s the very first blockchain buying and selling card recreation. As such, it helped usher in a new era of gaming — one through which gamers have true possession of their digital belongings. Every card comprises a chunk of artwork representing a historic second in blockchain historical past. Gamers gather, commerce, and mix playing cards to create a robust deck. As soon as that is carried out, they’ll problem varied opponents.

Rare Pepe (September 2016)

The Rare Pepe Wallet was created by developer Joe Looney. It’s a web-based, encrypted pockets that runs on Counterparty, and lets customers commerce and destroy their Rare Pepes. Out of the almost 1,800 playing cards issued throughout 36 sequence, the Collection 1, Card 1 is the rarest and most precious. It pays homage to Satoshi Nakamoto, the individual or group that created Bitcoin. It’s known as the Nakamoto Card, and holding one (there are solely 300 whole) is the one option to acquire entry into the 300 Membership.

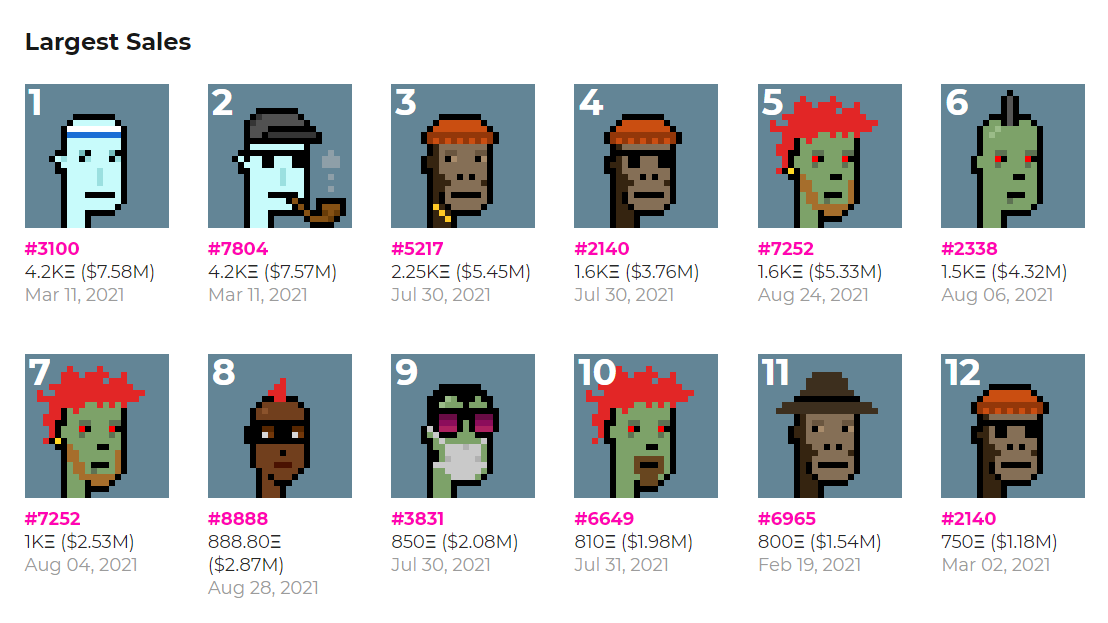

CryptoPunks (June 2017)

CryptoPunks first hit the market in 2017, launched by product studio Larva Labs, and it immediately impressed the present crop of standard generative PFP initiatives, like Bored Ape Yacht Membership. On this respect, it’s one of the most influential NFT projects of all time. Every Punk is algorithmically generated and completely distinctive, with some traits rarer than others. The Punks themselves sometimes go for a whole lot of hundreds, with some trades simply climbing into the hundreds of thousands.

FURTHER READING: A Guide to CryptoPunks NFTs

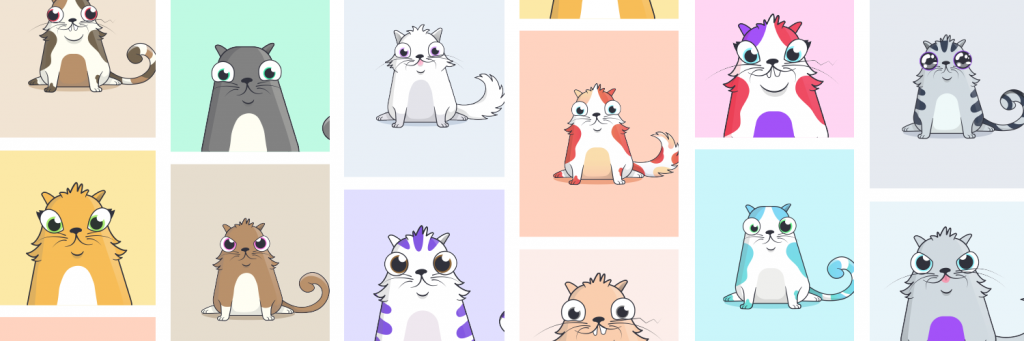

CryptoKitties (November 2017)

CryptoKitties was created by Canadian studio Dapper Labs and launched in 2017. CryptoKitties is a collectible recreation the place gamers buy, breed, and commerce digital cats. Every cat is assigned 12 distinctive traits, together with fur patterns, accent colours, eye form, and extra. Every cat is 100% distinctive, however breeding them isn’t free: You’ll have to spend ETH on the platform to commerce and breed your cats. As one of the first blockchain games constructed on Ethereum, it acquired widespread media consideration and impressed ERC-721, an open commonplace that describes the right way to construct NFTs on Ethereum digital machine (EVM) appropriate blockchains.

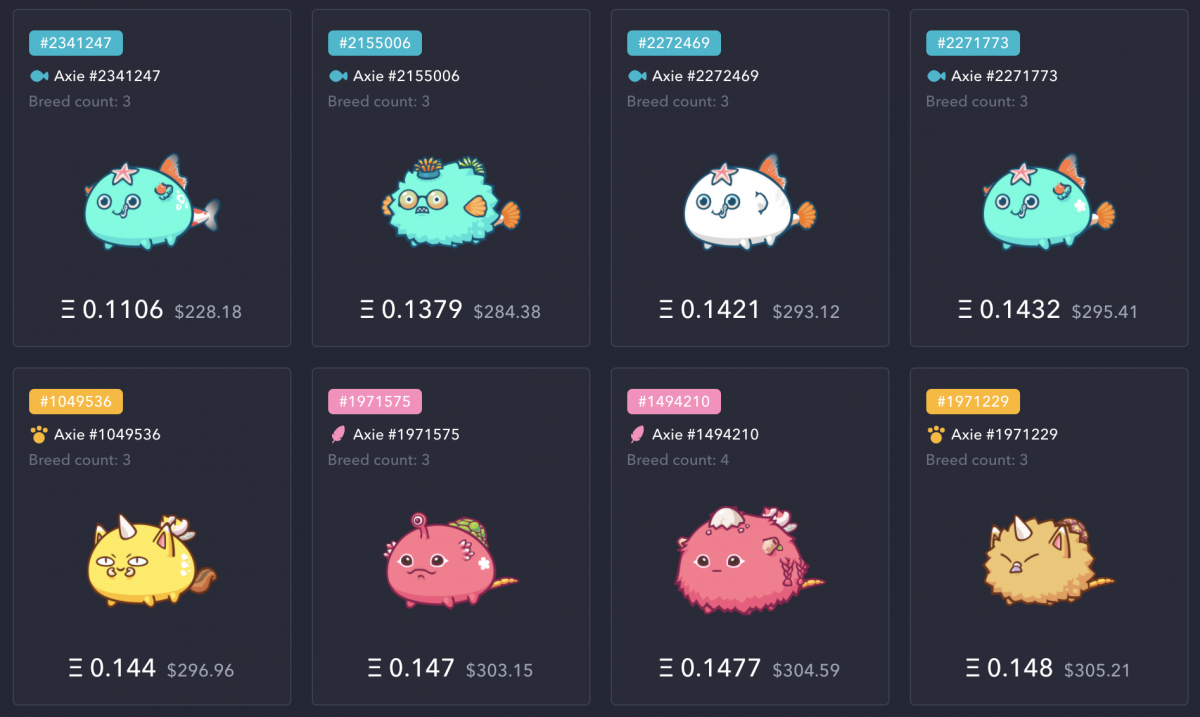

Axie Infinity (March 2018)

One of many first blockchain video games, Axie Infinity is an online video game based mostly on NFTs and Ethereum. First launched in 2018, Axie makes use of a “play-to-earn” mannequin, which means that customers can earn in-game cryptocurrency by enjoying. Created by Vietnamese studio Sky Mavis, the sport lets gamers gather creatures known as Axies to battle, construct, and obtain victory throughout the recreation. The platform additionally incorporates a market the place people can promote recreation objects and Axies to different gamers. In essence, it permits Axie customers to extend their general market worth by partaking with the sport.

FURTHER READING: The Dawn of P2E Giants? An Inside Look at Axie Infinity

Decentraland (February 2020)

Decentraland is a browser-based recreation the place users can buy and sell virtual plots of land and in-game objects. It was created by Argentinians Ari Meilich and Esteban Ordano, who started engaged on the undertaking in 2015. It went reside in 2020, and it’s at the moment run by the nonprofit Decentraland Basis. Every thing in-game is a sellable merchandise together with avatar wearables, estates, and the land on which these estates sit. Notably, it additionally stands as the primary digital world owned by customers, and is taken into account an early mannequin for the metaverse.

FURTHER READING: Decentraland: The Ultimate Game for Your Virtual Land Hustle

NBA Top Shot (October 2020)

One of many extra standard NFT collections available on the market is NBA Top Shot. It permits customers to buy NFTs created utilizing video clips of their favourite gamers and key basketball moments. The clips are reduce and numbered in a sequence, and a number of copies are minted to create various ranges of rarity. In 2021 alone, the digital platform had greater than 1.1 million registered customers who traded some $800 million in NFTs, bringing new ranges of mainstream consciousness. Notably, NBA High Shot is likely one of the most reasonably priced NFTs for beginning collectors, with most promoting for effectively underneath $100 upon launch and purchasable by way of commonplace fiat currencies.

FURTHER READING: NBA Top Shot: The Ultimate Guide

Art Blocks (November 2020)

Art Blocks launched in 2020 and dramatically streamlined the creation of generative artwork. It makes use of generative scripts to create distinctive works of computer-generated artwork. Merely choose a undertaking that you just like, after which mint an NFT from that assortment. Your outcome will probably be randomly generated on demand, so that you received’t know precisely what your NFT will appear to be till you make the acquisition.

FURTHER READING: Art Blocks: Snowfro, Tyler Hobbs, and More on the Rise of Generative NFT Art

Bored Ape Yacht Club (April 2021)

A wildly standard PFP NFT, Bored Ape Yacht Club has acquired huge essential acclaim since its founding. Created by product studio Yuga Labs, the gathering options 10,000 distinctive NFTs, and NFT holders have full commercialization rights to the Ape that they personal. Most Ape gross sales go for a whole lot of hundreds of {dollars}, which is why they’re essentially the most distinguished and worthwhile examples of the medium. Bored Ape additionally performed a serious position in kicking off the avatar craze (utilizing NFTs as profile photos). In some ways, it’s immediately answerable for cementing NFTs as a popular culture phenomenon.

FURTHER READING: A Guide to Bored Ape Yacht Club

Different fascinating NFTs

Sometimes, you’ll additionally discover different odd NFTs floating round within the metaverse. These will not be connected to any explicit undertaking, however their cultural significance or quirkiness makes them price noting. For instance…

In all probability, we’ll proceed to see extra quirky and progressive NFT makes use of, as manufacturers and unbiased creators push the boundaries of the collectibles market even additional within the years to come back.

READ MORE: Unique and Weird Ways People Are Using NFTs

Are NFTs best for you?

To date, we’ve given you all the pieces it’s worthwhile to higher perceive NFTs, how they function out there, the advantages and dangers, and the right way to get began with them. However are NFTs best for you?

It’s a tough query to reply. In the long run, it actually simply comes all the way down to your private choice and why you need to become involved within the first place. However right here’s what we are able to inform you:

- NFTs are excellent for hobbyist collectors who need to help a content material creator, be a part of a neighborhood, or personal a bit piece of one thing they’re keen about.

- As an funding alternative, NFTs are extremely risky and the market is speculative. As with artwork and different uncommon objects, some NFTs have gained immense worth over time whereas others have misplaced immense worth.

- The worth of neighborhood for NFTs can’t be understated. From Bored Ape Yacht Membership and CryptoPunks to purchasing NFTs out of your favourite model or artist, NFTs could be a gateway to a distinct neighborhood and life-style.

- Regardless of the explosive recognition we’ve seen prior to now few years, NFTs are nonetheless of their early phases, and it’s by no means too late to get began. You undoubtedly didn’t miss the boat.

Should you do resolve to get into the NFT ecosystem, we hope you benefit from the experience – we all know that we actually have.

FURTHER READING: Should You Buy an NFT? Should Anyone?

Editor’s be aware: This text has been up to date to mirror adjustments within the tremendously lowered carbon footprint of crypto and NFTs because the Ethereum Merge.

More NFT News

Moonfrost Launches Closed Alpha Launch 3, Begins July 29

A North Korean Hacker Tricked a US Safety Vendor Into Hiring Him—and Instantly Tried to Hack Them

Vehicles Are Now Rolling Computer systems, So How Lengthy Will They Get Updates? Automakers Can’t Say