Fast Take

The latest surge in Bitcoin holdings amongst short-term holders (STHs), outlined as traders who’ve held Bitcoin for lower than 155 days, factors to a noticeable enhance. Since December, STHs have beefed up their Bitcoin portfolios by approximately 450,000 BTC. Nonetheless, opposite to typical market habits, mushy indicators like Google trends counsel that we’re not close to market euphoria regardless of the aggressive accumulation from STHs.

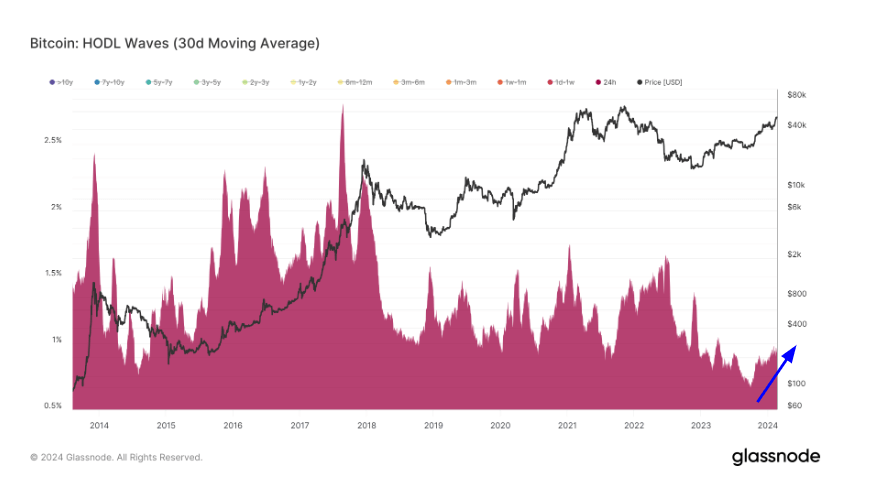

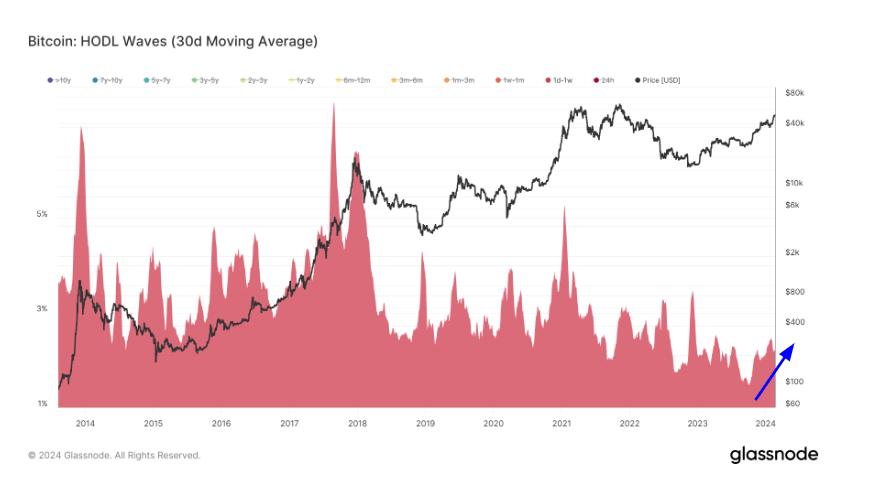

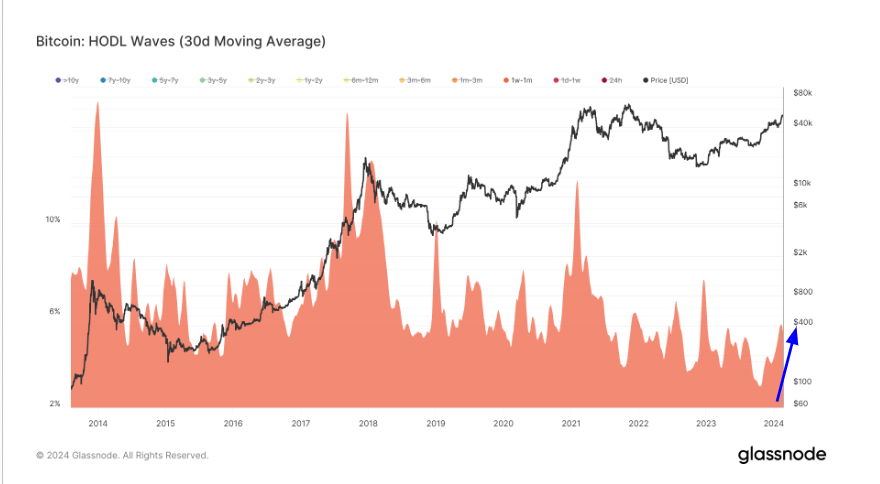

This intriguing sample is additional illuminated by analyzing HODL waves, a metric representing totally different age bands of lively provide. HODL waves for the extraordinarily short-term hypothesis bands – 24 hours, someday to 1 week, and one week to at least one month – had been at an all-time low in October 2023, simply as Bitcoin launched into its journey from $25,000 to $53,000.

Though these cohorts have grown considerably, they nonetheless characterize extraordinarily low percentages in comparison with historic knowledge. This factors to a definite lack of maximum short-term hypothesis.

Moreover, these cohorts sometimes wield a a lot bigger share provide on the peak of bull markets when hypothesis is highest. This specific knowledge suggests there may be substantial room for progress on this cycle.

The put up Analysis of HODL waves reveals a speculative market at play appeared first on CryptoSlate.

More NFT News

Saylor predicts SEC will designate Ethereum as a safety and deny spot ETF purposes this summer time

Time to Purchase SHIB? Fashionable Analyst Bets on a 300% Shiba Inu Worth Rally

Bitcoin Milestone Forward? Analyst Forecasts New Peak This Month