That is an opinion editorial by Shane Neagle, the editor-in-chief of “The Tokenist.”

Time and time once more, we see the mainstream media taking advantage of Bitcoin’s perceived exploit: vitality consumption. For the Bitcoin community, this path has turn into all too acquainted.

Simply have a look at what occurred in Could 2021, when Elon Musk successfully “broke” bitcoin’s value as Tesla announced it could not settle for BTC as cost, citing environmental issues. The worth of a single bitcoin dropped by nearly $8,000 within the two hours following the announcement. There are numerous related instances as nicely.

However the takeaway is that this: It’s very clear that the notion of Bitcoin’s fundamentals goes far past the safety of the community, the soundness of the code and the asset’s restricted provide. Bitcoin’s vitality consumption performs a task, too. So huge of a task, that it considerably impacts not simply the worth of bitcoin, however its regulatory framework as nicely. For higher or for worse, this actually can’t be argued.

However what if Bitcoin’s vitality consumption was truly a superb factor? What if Bitcoin functioned as a “retailer of vitality” that gives a superior various to any financial system we’ve ever seen?

Thankfully, the idea of an energy-backed forex isn’t as radical or novel as folks might imagine — it has been round for greater than a century. However the vital circumstances (i.e., the expertise) didn’t but exist to facilitate such a game-changing improvement for civilization.

That expertise now exists, nevertheless, and it’s known as Bitcoin. Let me clarify.

Cash And ‘Life Vitality’

The evolution of human civilization largely facilities upon the decision of 1 key query: How can we appraise the true worth of products and companies?

Extra particularly, how can we assess such worth in probably the most uniform and easy method attainable?

Think about the period of ancient barter systems, when a uniform system of fiat forex had but to be conceived. Exchanging crops or livestock for companies was commonplace. Nonetheless, this method was fraught with inefficiencies, because it was closely reliant on the mutual coincidence of desires. Think about a fisherman trying to commerce his fish — however just for salt which he wanted to protect his future catch from spoiling. Any particular person trying to commerce for fish, should now have exactly what the fisherman needed: salt.

In such a situation, it’s straightforward to see how the precept of provide and demand is skewed.

Figuring out an equitable alternate for distinctive, non-fungible gadgets poses a particular problem. How can we be certain that each events are duly rewarded for the vitality they’ve invested — their “life vitality” — in producing the services or products they’re promoting?

This idea of “life vitality” refers back to the time, effort and inventive vitality that people pour into their work. Each human has a finite time span that they convert into tangible, productive output — a measurable type of vitality.

However on this system of bartering, life vitality isn’t appropriately accounted for. Relatively, exterior components closely affect the worth of a services or products — steadily to the detriment of the life vitality dedicated to its manufacturing.

Ideally, we’d like a system that permits for the buildup and storage of this expenditure of vitality — which we are able to consult with as “surplus vitality” — and its related worth.

The benefits right here go far past the person who expended such vitality. The metaphorical lifeblood of any economic system is this idea of “surplus vitality.” If this movement is impeded or clots, it results in a much less vibrant, stagnant economic system. If it’s correctly saved and fluid, it could actually result in innovation and breakthroughs which profit the society at massive.

If we do not set up correct mechanisms, capturing and storing surplus vitality or worth turns into unattainable.

Therefore, it turns into important to measure this vitality output in probably the most streamlined method attainable, to make sure honest compensation for — and skill to capitalize on — the vitality expended. On this respect, a major landmark in civilization’s journey was the evolution from bartering to commodity cash, ultimately resulting in using transportable, interchangeable and standardized steel cash.

A Historic Devaluation Of Life Vitality

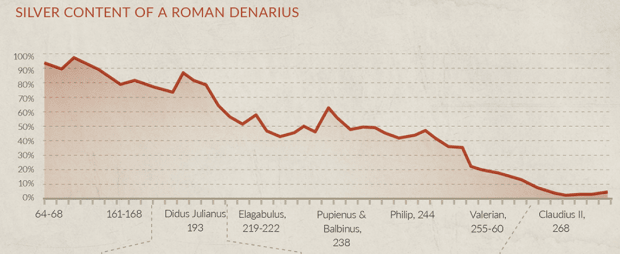

The Roman Empire constructed itself on financial effectivity by minimizing cash friction. Its blood was the denarius currency, molded out of the restricted provide of treasured metals. The restricted nature of the denarius allowed for it to function a retailer of worth.

Concurrently, the denarius’ portability as a retailer of worth allowed it to unfold throughout each nook of the empire, simply transported and traded by varied retailers. Consequently, the financial circulatory system overflowed with energy. Because the friction inside the alternate of products and companies was minimized, new specialised labor markets might kind, which elevated productiveness and innovation.

In financial phrases, all was good. The Roman civilization achieved a commodity forex which facilitated financial enlargement. Such a standardized forex, transportable and restricted because it was, saved and effectively captured Roman vitality into productiveness and financial development.

Till it did not, by decree.

As every Roman emperor desired to expend extra vitality than the forex allowed, they began to erode the denarri’s retailer of worth.

The denarius remained transportable and fungible, but it started to falter in its capability to precisely characterize folks’s life vitality outputs. The silver content material of every denarius turned smaller and smaller, eroding the forex’s capability to keep up worth and, finally, buying energy.

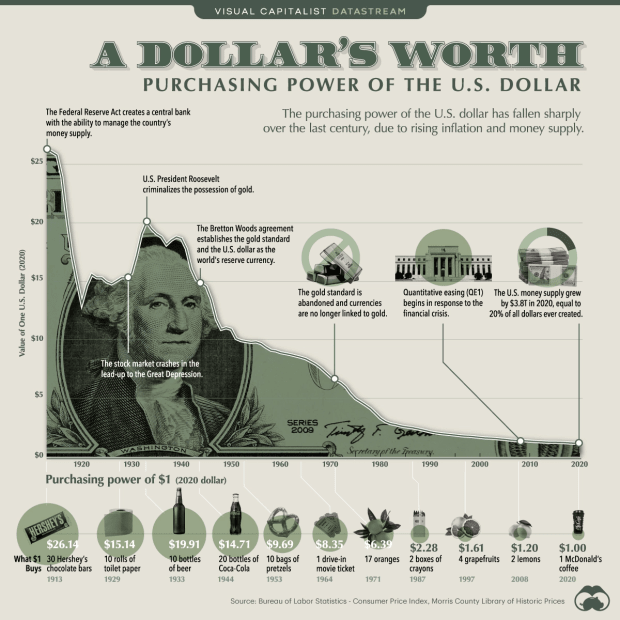

Immediately, we perceive this as inflation. With every forex debasement cycle, folks misplaced confidence that their life’s vitality output was correctly measured, fairly similar to what’s happening today:

The USA is in a peculiar historic place through which it can export domestic inflation due to the standing of the greenback as the worldwide reserve forex (GRC). Due to this fact, wages can continue to grow at an inflationary tempo. However, as debt ceilings have become debt ladders, nobody is aware of for positive for the way lengthy this can be sustainable.

And it’s positively not sustainable in lots of different international locations with double- and even triple-digit inflation charges.

Cash: What Wants To Be Fastened?

So, what patterns can we observe from our financial historical past?

First, to correctly measure life’s vitality outputs, the gauge must be fungible and standardized, facilitating a possible calculation of the worth of nonfungible items and companies. Second, the gauge must concurrently retailer worth and be transportable.

These baseline parts present folks with a instrument to precisely remodel their restricted time and vitality — life vitality — right into a productive, well-compensated vitality output.

After we have a look at all fashionable fiat currencies, their shops of worth relaxation on shaky grounds. The issue is, central banks have changed emperors — however their decrees aren’t any much less disruptive.

At a basic stage, the alternate of funds between employers and workers is the alternate of vitality. However neither employers nor workers management this compensatory vitality’s present(cy). That vitality’s present is offered by forex — and it’s fully managed by central banks.

Thus, it’s central banks that uniquely possess the authority to switch that vitality present over time, echoing the follow of historical Roman emperors.

The most important affect on a forex’s retailer of worth is its provide and issuance schedule. Central banks and Roman emperors alike have had a bent to seriously change obtainable provide, negatively impacting this attribute.

In flip, this negatively impacts folks’s capability to capitalize on their expended vitality.

Vitality Forex As New Milestone Know-how

From bartering and commodities, to steel cash and fiat paper forex, historical past’s financial experiments have delivered actionable conclusions.

Alongside portability, sustaining the integrity of the forex’s retailer of worth is of the utmost significance. For this to be achievable, it should not depend on arbitrary decrees.

And that is exactly the revolution Satoshi Nakamoto introduced along with his Bitcoin white paper. The belief have to be faraway from the centralized entities which have full management over financial programs — and the power for people to capitalize on their expended vitality by labor: “an digital cost system primarily based on cryptographic proof as a substitute of belief,” as Nakamoto put it.

The query then shifts to: How can we safe that new part of belief?

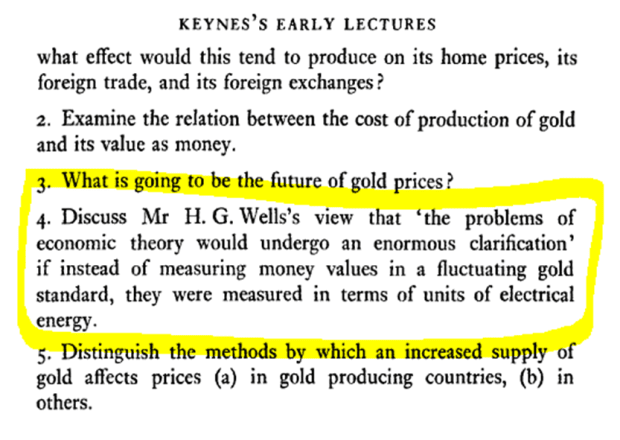

Previous intellectuals have argued for backing cash with items of vitality. Specifically, in John Maynard Keynes’ lectures of 1912 to 1913, which offered the mental framework for a method of measuring cash “when it comes to items {of electrical} vitality.”

Ever forward of the occasions, American industrialist titan Henry Ford truly proposed an vitality forex quickly after, in 1921. Ford’s “items of energy,” generated from the world’s largest energy plant, had been to unravel the problem of “the worldwide banking group to which we’ve got grown so accustomed that we expect there isn’t any different fascinating customary.”

Bitcoin: An Vitality-Secured System Of Vitality Transference

Within the case of Bitcoin, that new part of belief is secured by vitality.

Bitcoin isn’t solely transportable however digitally transportable, complementing our digital period. It’s not merely scarce, however its shortage is outlined in an energy-agnostic method. This hyperlinks again to Ford’s dream of an energy-backed forex, however with a basic distinction. Ford’s envisioned vitality forex, tied to the world’s largest energy plant, would have been inclined to vulnerabilities related to centralization. In distinction, Bitcoin leverages vitality from any supply obtainable.

The decentralized nature of computing energy creates a resilient and sturdy system. It’s by this vitality itself that the Bitcoin community secures this new part of belief — cryptographic proof.

On this mild, it’s no coincidence that Michael Saylor paints the imaginative and prescient of Bitcoin as the answer to the issue of how one can retailer vitality over time and throughout house.

Returning to one of many first factors talked about, the place Bitcoin’s notion goes past its personal fundamentals, two questions stay: How sturdy ought to Bitcoin be to exterior components? Are there any authentic threats on the market?

Simply have a look at new expertise which is creating at breakneck speeds. Synthetic intelligence (AI) is anticipated to closely affect the finance world — from long-term investing and portfolio administration to shorter-term options trading. But with the event and mass integration of AI, actuality and phantasm will turn into intertwined. Separating the 2 will turn into an arduous process.

How will such vital improvements affect Bitcoin?

Bitcoin is poised to endure such technological revolutions. The immutable nature of the blockchain permits for a level of verifiability which the event of AI will create a larger want for. But much more importantly, Bitcoin advocates see how Bitcoin represents one thing of a vocation, somewhat than an asset merely for hypothesis and revenue. Any such “bigger than life” help will solely assist Bitcoin to endure life-changing improvements, political regime adjustments or every other existential “risk” that will come up sooner or later.

But there stays an ongoing absence of the right framework in terms of Bitcoin’s vitality consumption, as I’ve tried to articulate right here.

Based on a current ballot, for instance, 76% of investors need BTC to be extra “environmentally pleasant” — which misses the mark in terms of the connection between Bitcoin’s vitality use (or, in different phrases, its technique of securing the community) and our capability to successfully capitalize on the life vitality we commit.

With its distinctive capability to retailer and switch vitality, the Bitcoin community fixes this dilemma.

Not solely is the community secured by vitality, but it surely has the potential to successfully allow people to correctly capitalize on using their life vitality. This implies Bitcoin has already ventured into the unprecedented territory of an vitality forex — not only for the good thing about the person, however of society at massive.

Historical past is right here and the journey has simply begun.

It is a visitor submit by Shane Neagle. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

More NFT News

High Trending Cryptos on Solana Chain At present – Jiji, Buna, Popcat

Will They Mine Or Maul It?

It is Time To Swap Your {Dollars} For Bitcoin