A refrain of recession calls

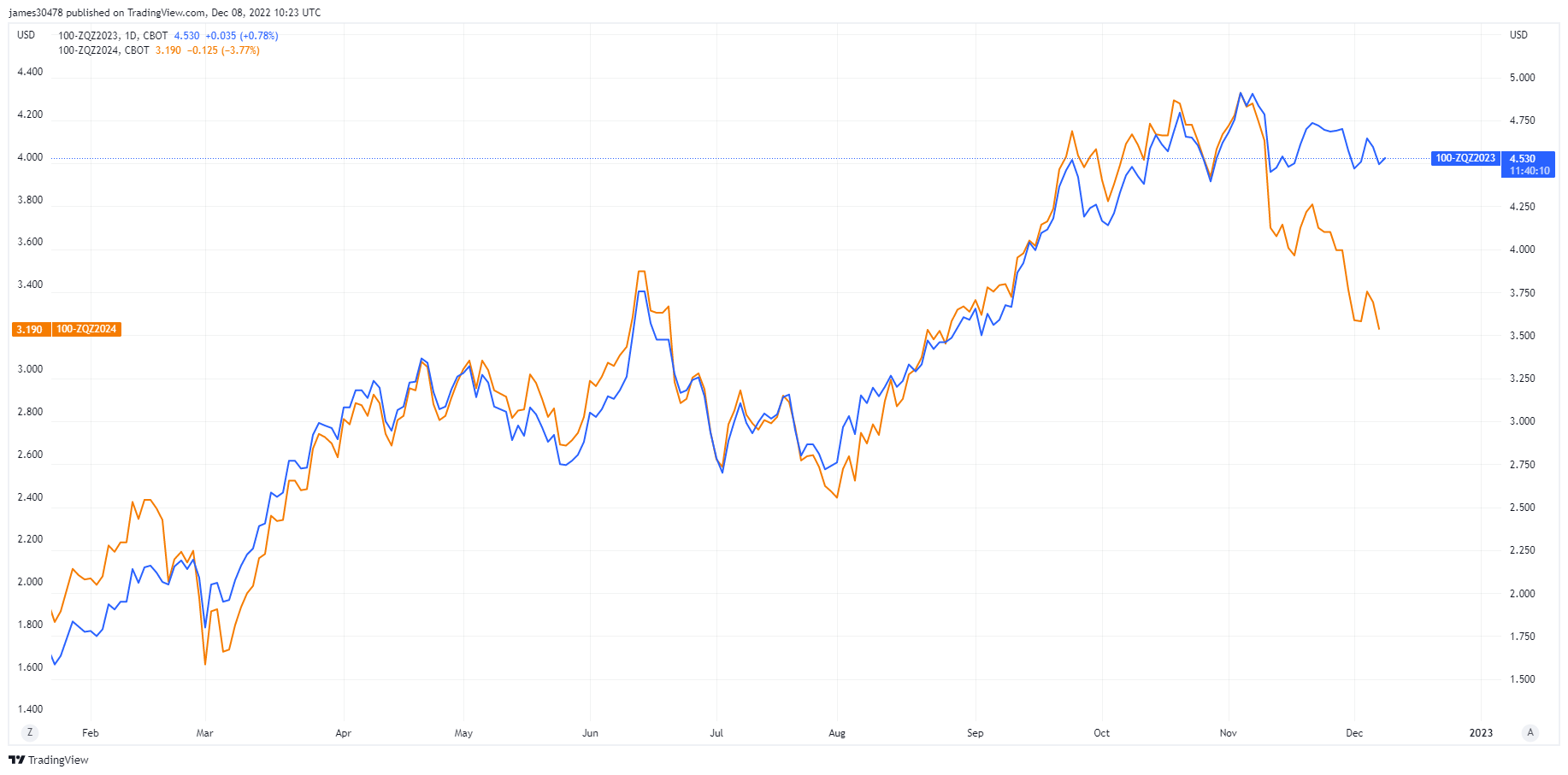

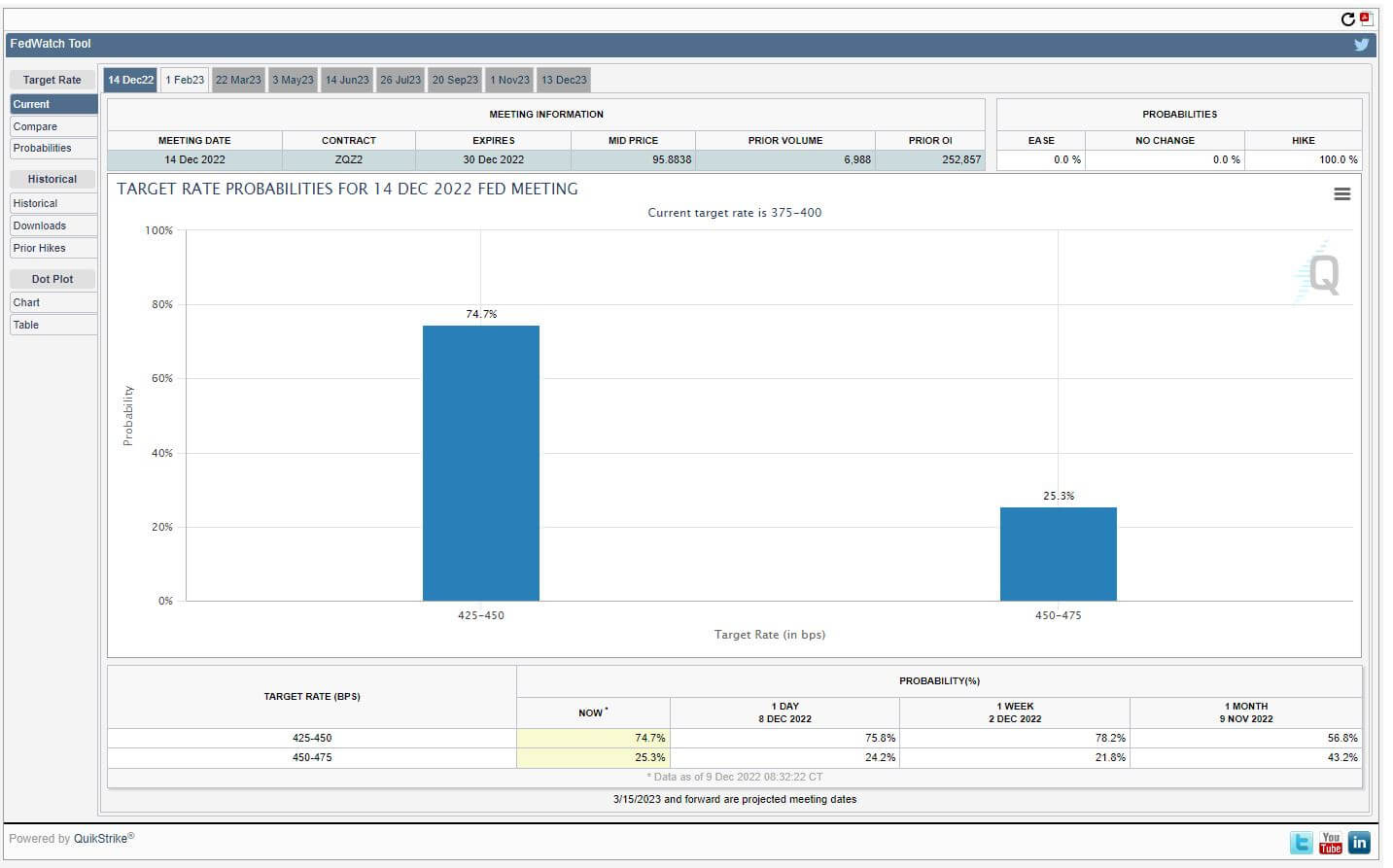

Fed officers have been prohibited from talking forward of subsequent week’s fed funds announcement; buyers have been left pondering on U.S. charge cuts priced in for 2023 and 2024. Whereas December 2023 Fed Funds Fee Futures are priced at 4.5%, December 2024 is presently priced at 3.5%; an aggressive charge minimize occurred this week.

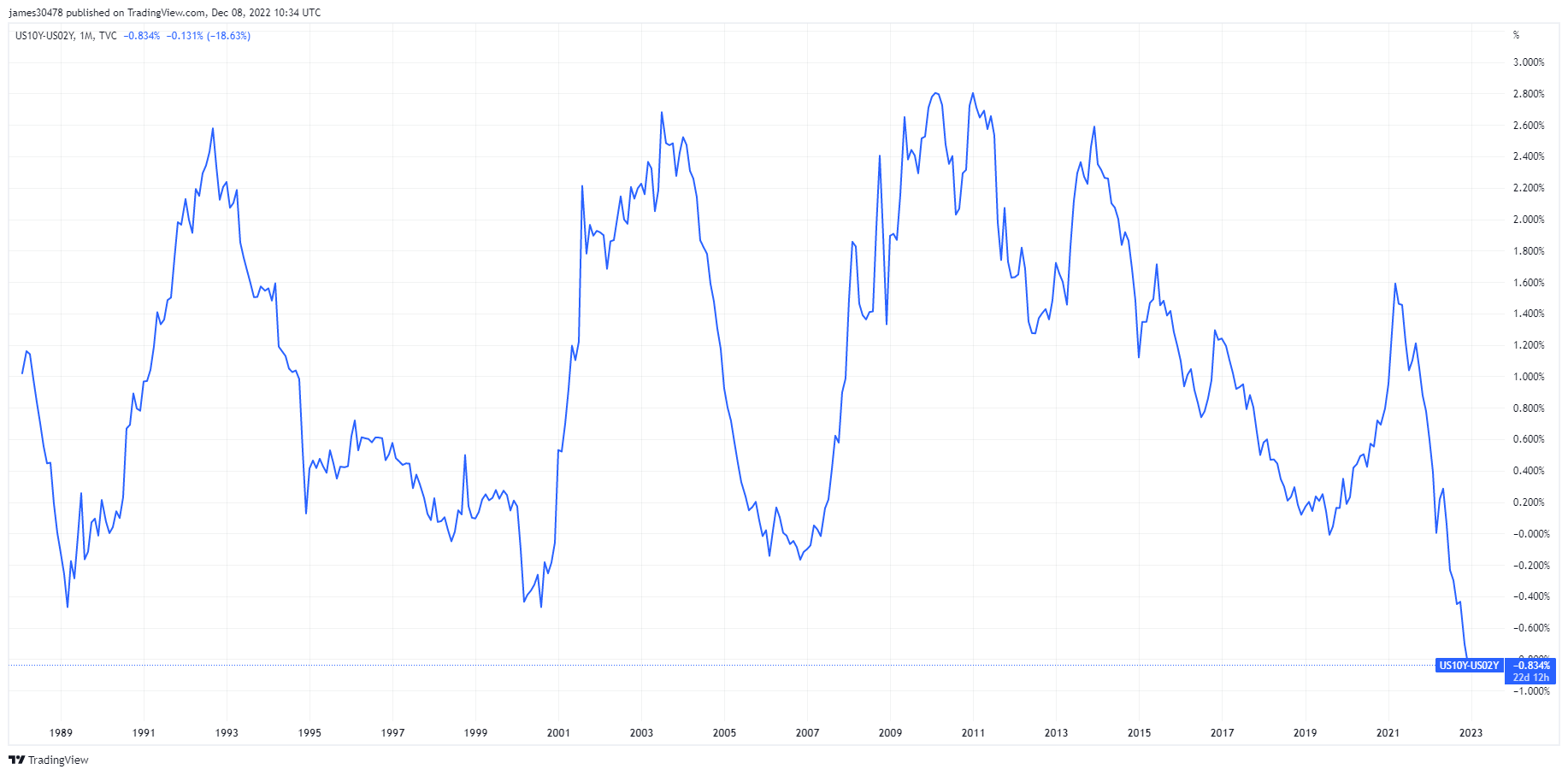

Jerome Powell and the Fed’s principal goal is to regulate inflation and tighten fiscal circumstances; nevertheless, for the reason that center of October, monetary circumstances have eased as bond yields declined, credit score spreads tightened and inverted to multi-decade ranges whereas equities have rallied. The unfold between the ten and two-year yield closed to a brand new extensive of -84bps.

Dec. 9 noticed worse-than-expected PPI information, with the true check for the treasury market will comply with subsequent week’s CPI report. Relying on the CPI outcomes, the Fed funds charge hike may change, which presently sees a 75% chance of a 50bps charge hike taking the fed funds charge to 4.25-4.50%.

Bitcoin mining issue and hash charge proceed on

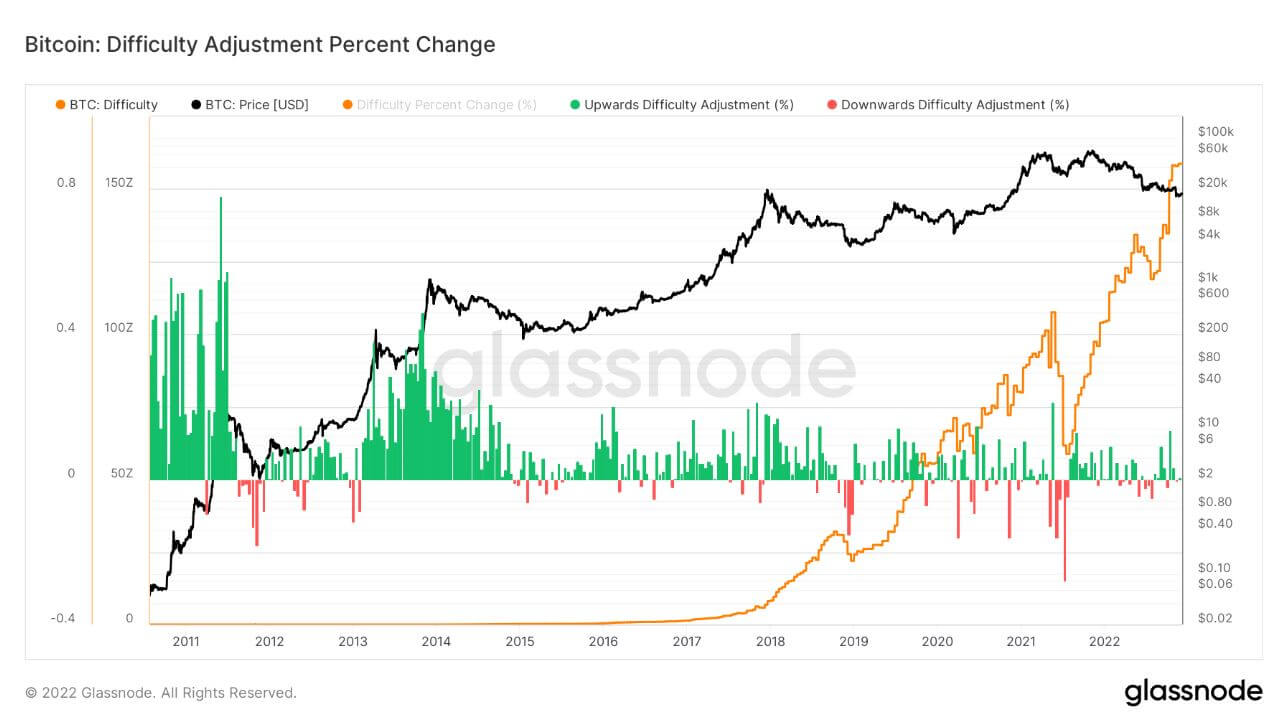

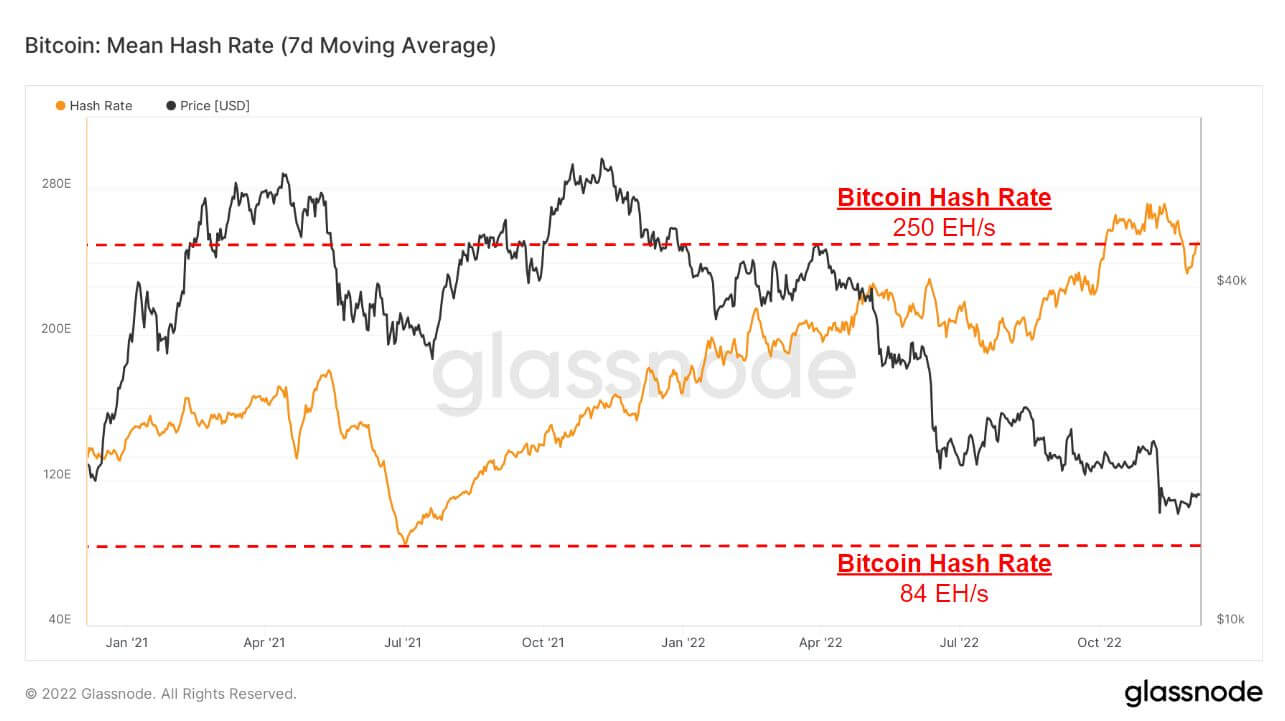

Bitcoin issue adjusted 7.32% on the morning of Dec. 6, the largest unfavorable adjustment since July 2021 which noticed over a 20% adjustment as a consequence of China banning Bitcoin final summer time on account of miners being unplugged and the hash charge tumbling to 84EH/s.

A drop in mining issue will see a reduction on miner faces nevertheless, this reduction may very well be short-lived as hash charge is already beginning to tick again as much as ranges round 250EH/s.

For the reason that China ban final summer time, mining issue and hash charge are each up a complete of 3x which reveals the long run safety of Bitcoin has by no means been stronger.

Bitcoin falls under the worldwide electrical price

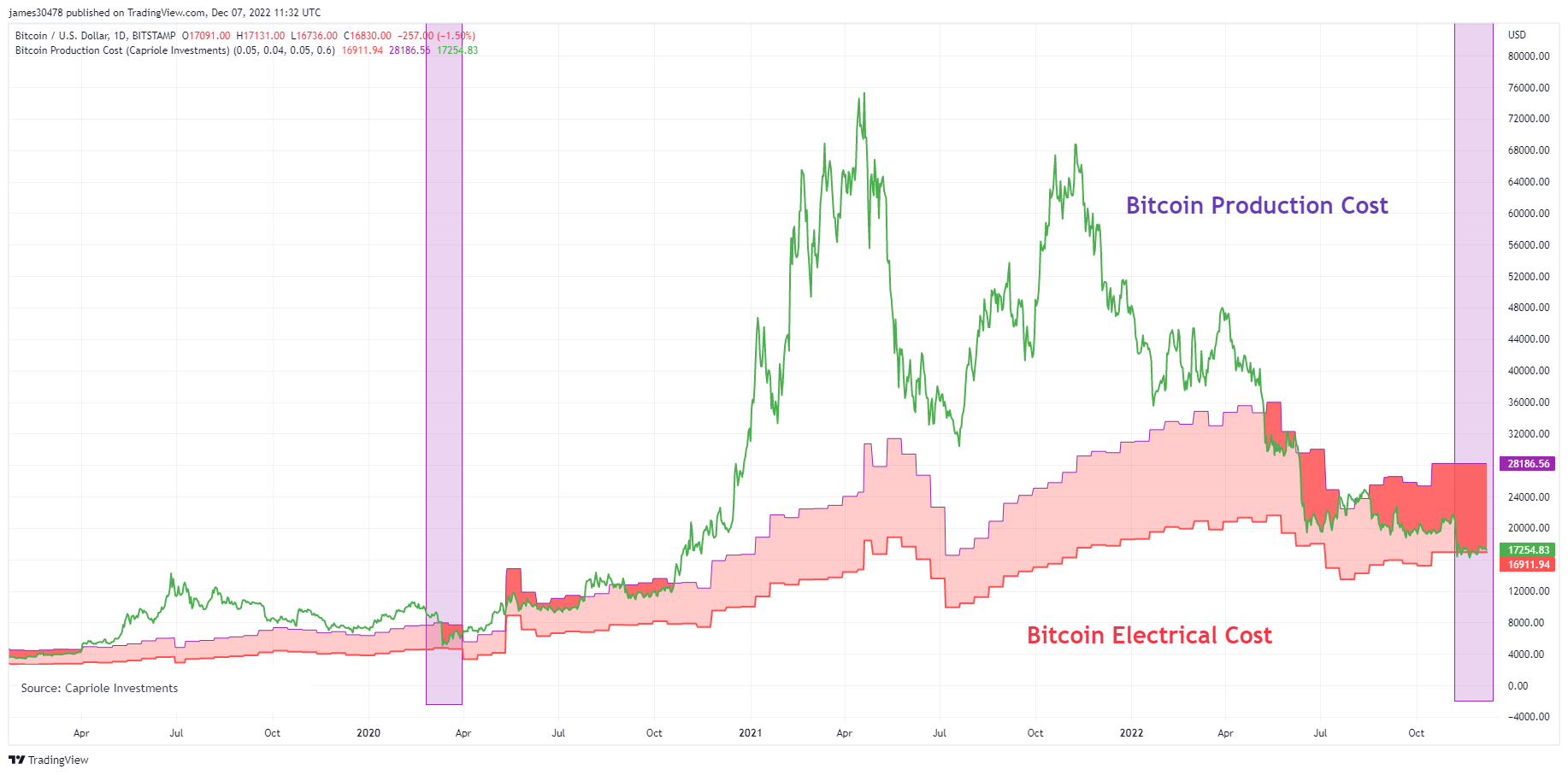

A mannequin created by Charles Edwards (Capriole Investments) on Bitcoin electrical and manufacturing price mannequin to determine how a lot it prices to provide one Bitcoin.

This mannequin has supplied an incredible ground for the worth of Bitcoin throughout bear markets, and solely 4 intervals in Bitcoins historical past has the worth gone under the worldwide Bitcoin electrical price.

The newest time the Bitcoin price fell via the mannequin was covid, and now in the course of the FTX collapse, the worth was under the worldwide Bitcoin electrical price for almost all of November, roughly $16.9K, and has fallen again beneath it once more.

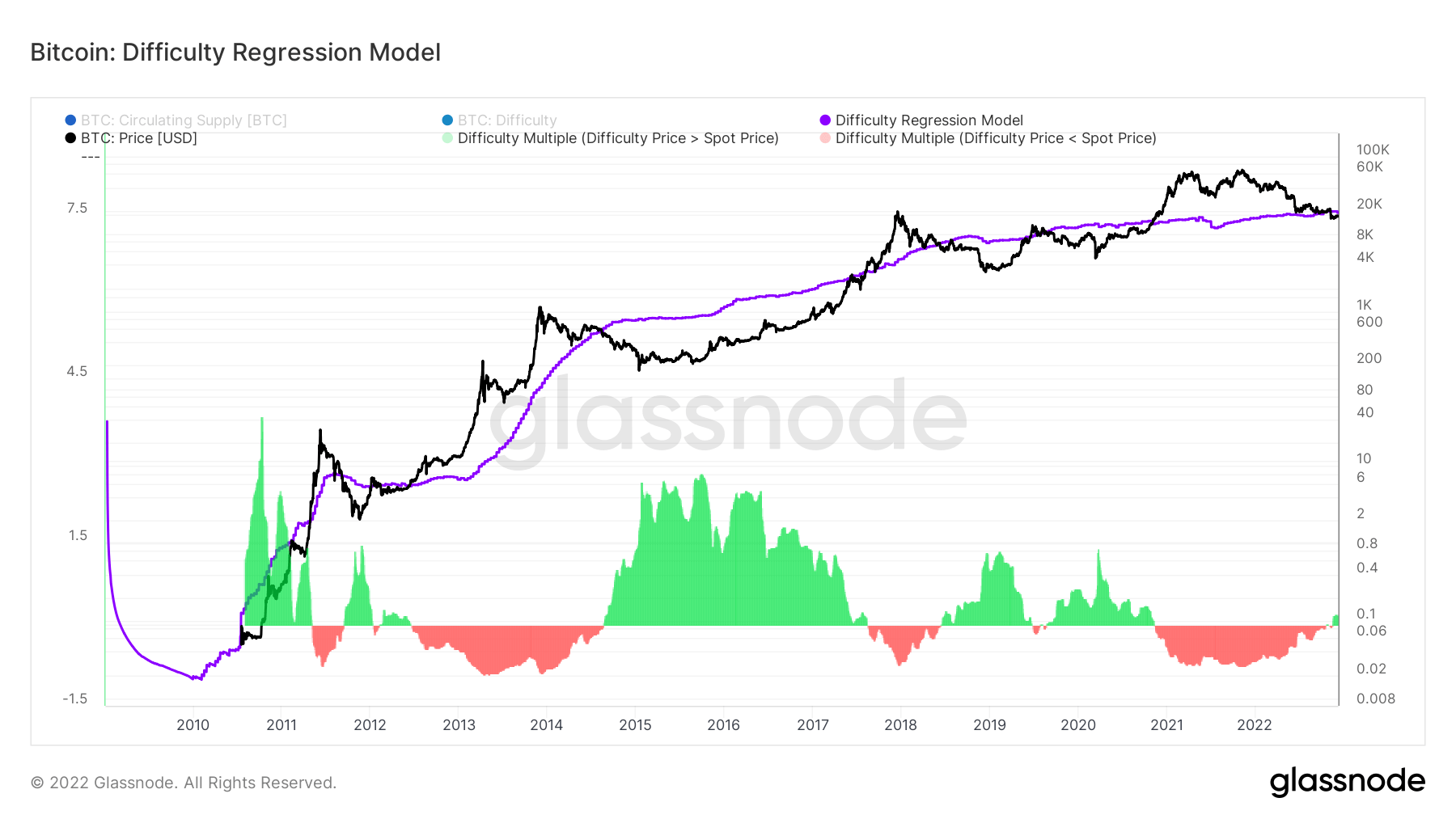

An analogous mannequin coined by Hans Hague modeled the thought of the issue regression mannequin. By making a log-log regression mannequin by issue and market cap, this mannequin works out the all-in price for producing one bitcoin.

The price of producing one Bitcoin is presently $18,872, greater than the present Bitcoin worth. The Bitcoin worth fell under the regression mannequin in the course of the FTX collapse on Nov. 15 and for the primary time for the reason that 2019-20 bear market — a deep worth zone for Bitcoin.

Bear market accumulation

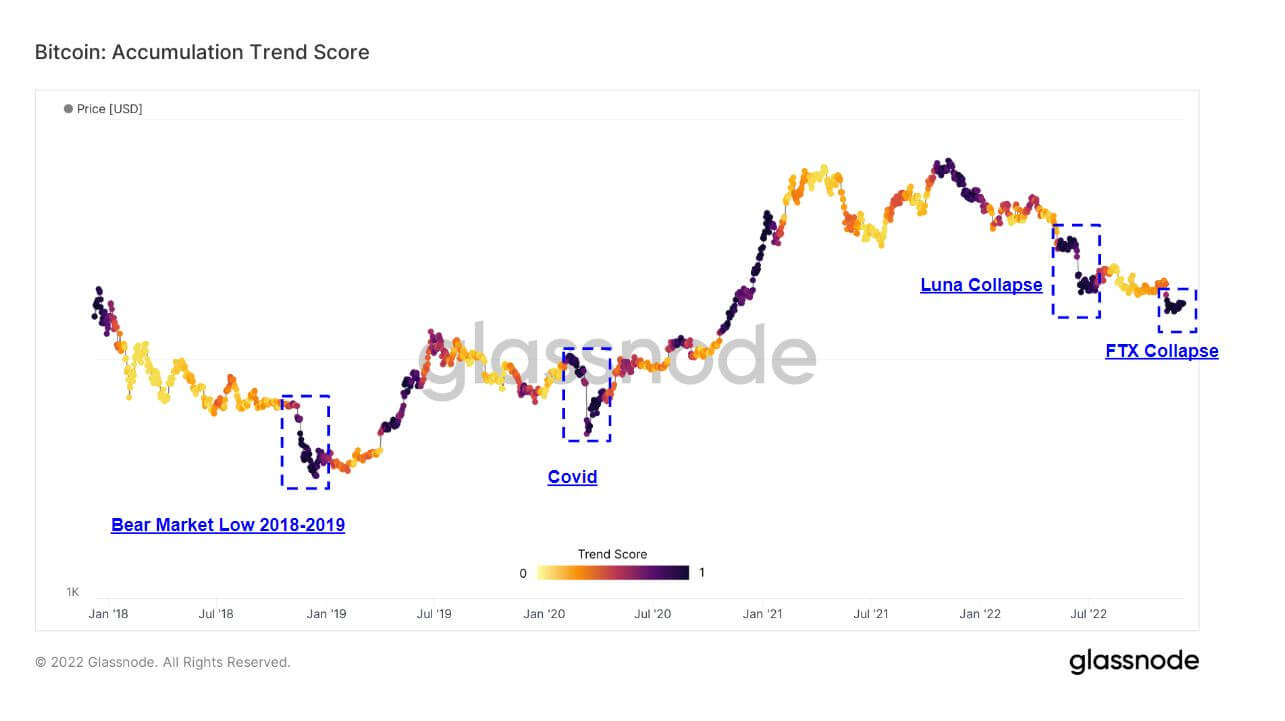

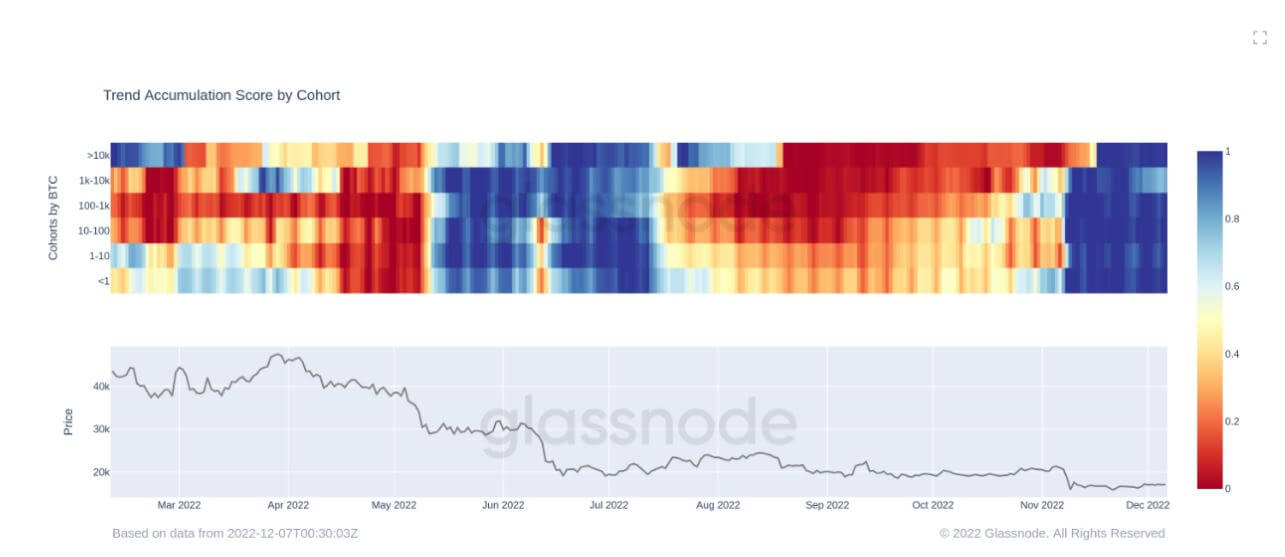

The Accumulation Development Rating is an indicator that displays the relative dimension of entities which are actively accumulating cash on-chain when it comes to their BTC holdings. The size of the Accumulation Development Rating represents each the dimensions of the entity’s stability (their participation rating) and the quantity of latest cash they’ve acquired/bought over the past month (their stability change rating).

An Accumulation Development Rating of nearer to 1 signifies that, on combination, bigger entities (or a giant a part of the community) are accumulating, and a price nearer to Zero signifies they’re distributing or not accumulating. This supplies perception into the stability dimension of market contributors and their accumulation habits over the past month.

Highlighted under are the situations {that a} Bitcoin capitulation has occurred whereas Bitcoin buyers are accumulating, the FTX collapse that despatched Bitcoin right down to $15.5k, has seen the identical quantity of accumulation that emerged in the course of the Luna collapse, covid and the underside of the 2018 bear market.

The buildup development rating by cohort has the breakdown by every cohort to point out the degrees of accumulation and distribution all through 2022, presently in a big interval of accumulation from all cohorts for over a month which has by no means occurred in 2022. Buyers see the worth.

Futures open curiosity, leverage and volatility decreased

Because of the macro local weather and common sentiment, many dangers have been taken off the market, evident in Bitcoin derivatives.

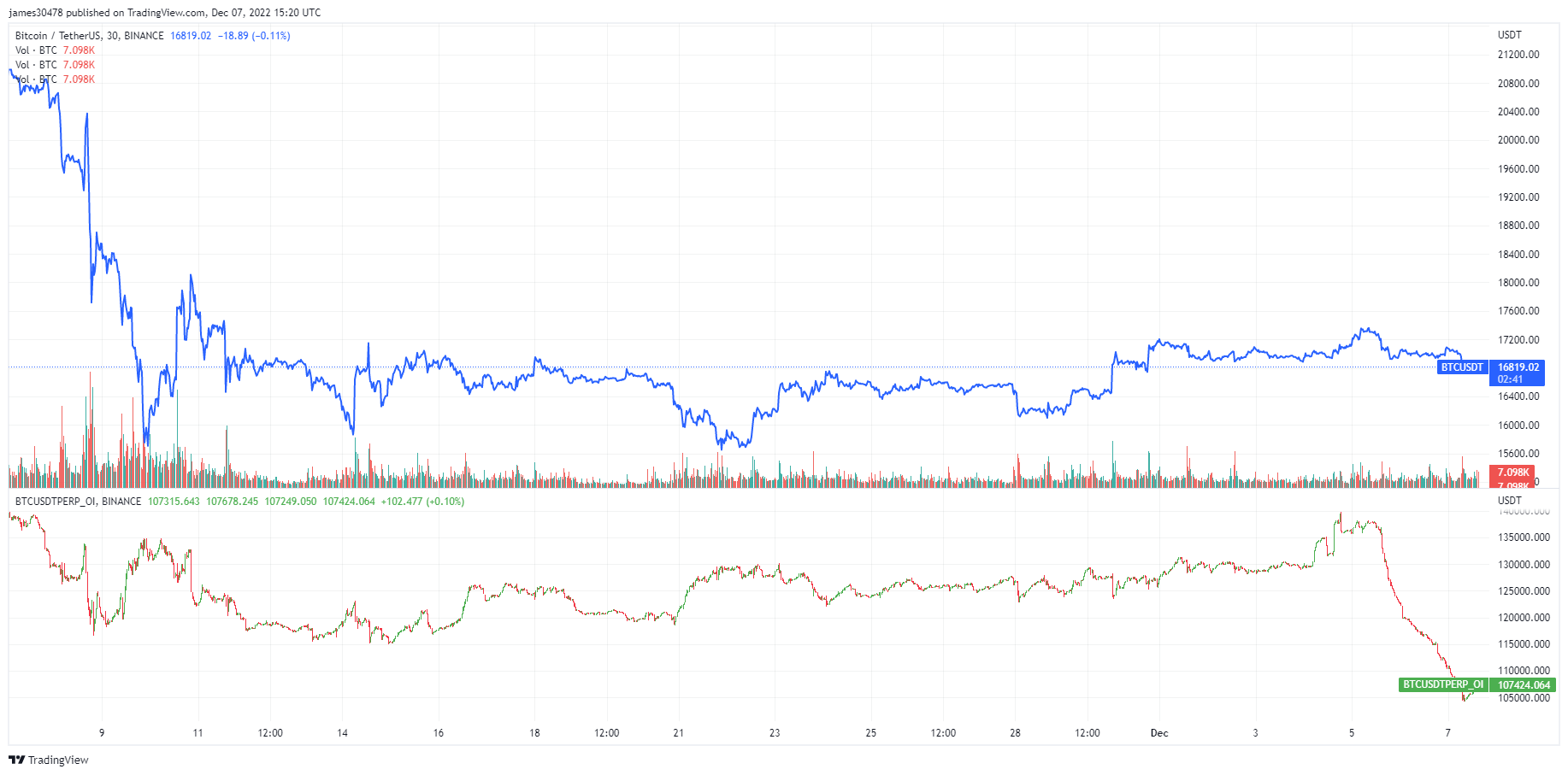

Bitcoin open curiosity on Binance is now again to July ranges. Futures’ open curiosity is the whole funds allotted in open futures contracts. Over 35Okay BTC have been unwound from Dec. 5, the equal of $595m; that is roughly a 30% OI lower.

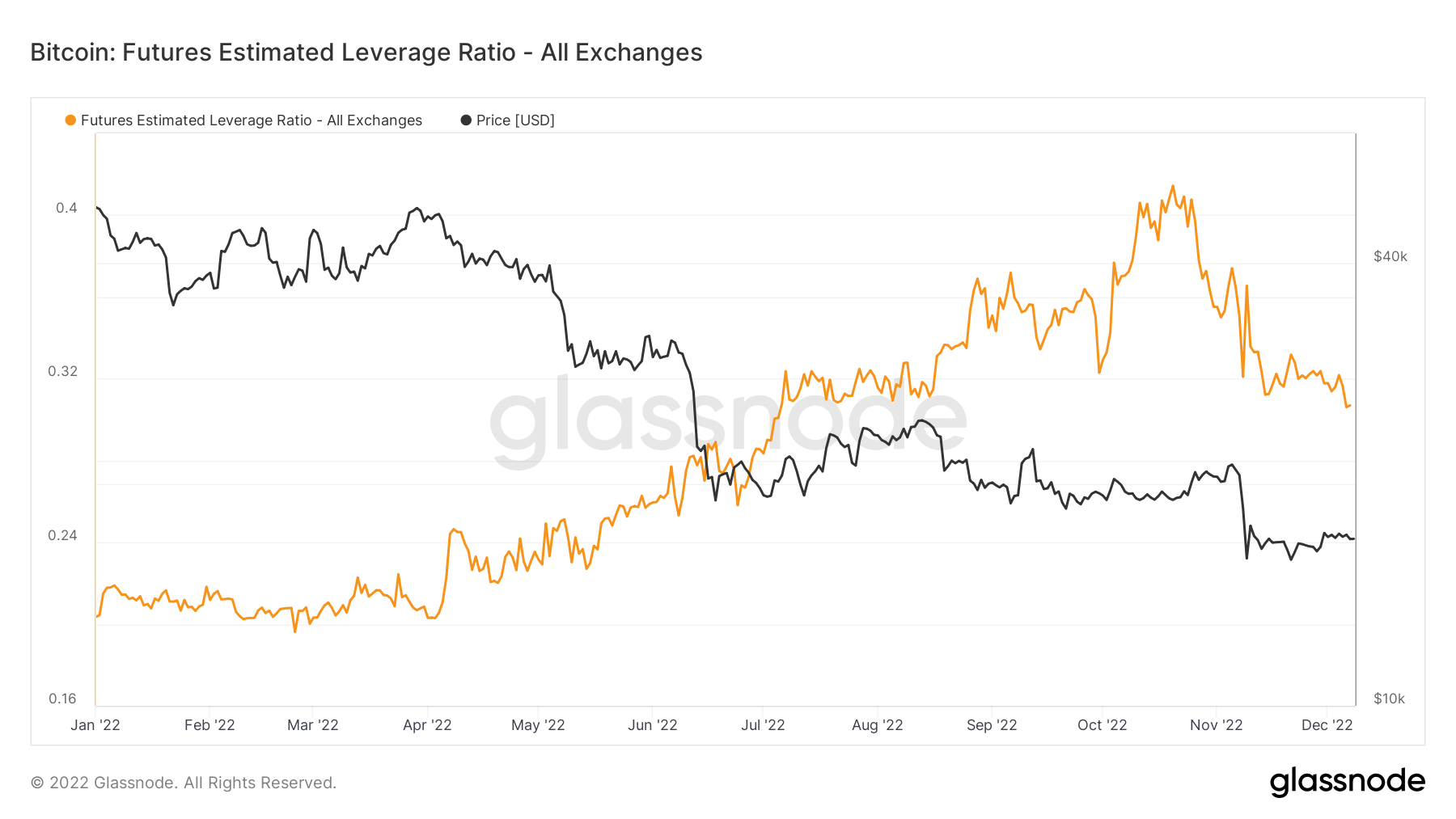

The much less leverage within the system, the higher; this may be quantified by the Futures Estimated Leverage Ratio (ELR). The ELR is outlined because the ratio of the open curiosity in futures contracts and the stability of the corresponding trade. The ELR has been diminished from its peak of 0.41 to 0.3; nevertheless, at the start of 2022, it was at a stage of 0.2, and nonetheless, plenty of leverage is constructed within the ecosystem.

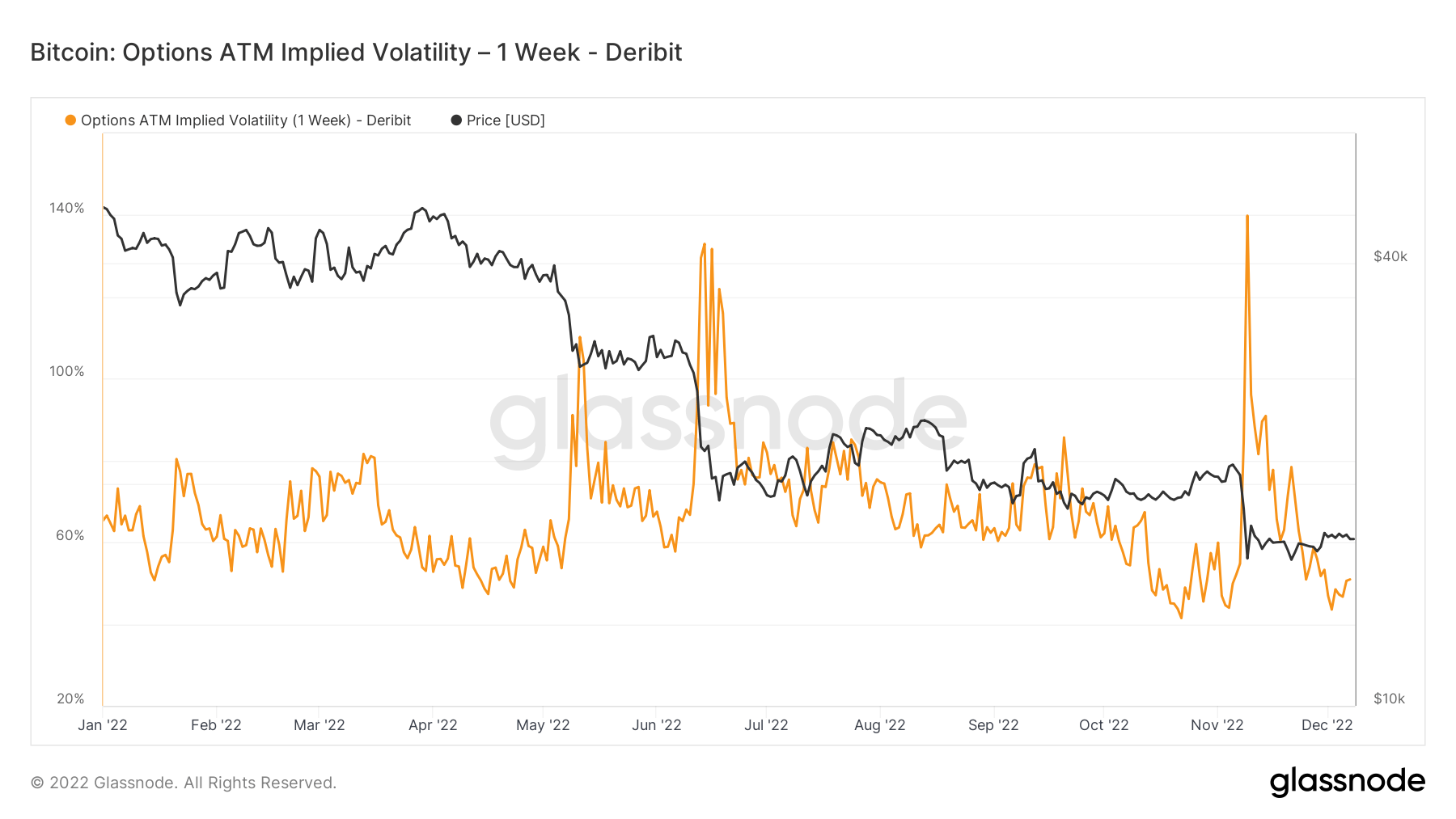

Implied Volatility is the market’s expectation of volatility. Given the worth of an possibility, we are able to resolve for the anticipated volatility of the underlying asset. Formally, implied volatility (IV) is the one commonplace deviation vary of the anticipated motion of an asset’s worth over a 12 months.

Viewing At-The-Cash (ATM) IV over time offers a normalized view of volatility expectations which can typically rise and fall with realized volatility and market sentiment. This metric reveals the ATM implied volatility for choices contracts that expire one week from at the moment.

Equally to the Luna collapse again in June, the Bitcoin implied volatility had come again down following the FTX implosion, year-to-date lows.

Large stablecoin provide ready on the sidelines may set off a bull run

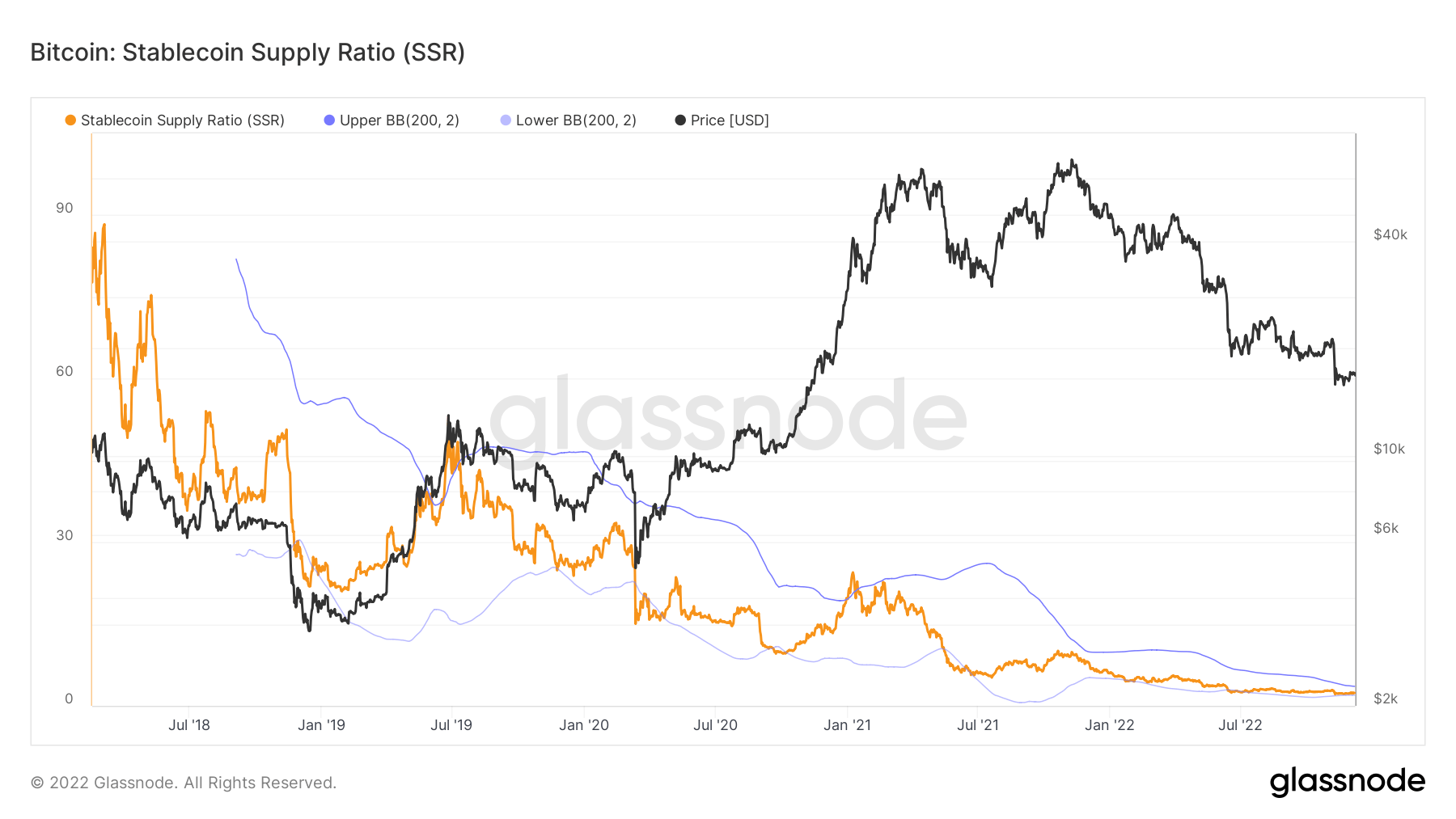

The Stablecoin Provide Ratio (SSR) is the ratio between Bitcoin provide and the availability of stablecoins denoted in BTC, or: Bitcoin Market cap / Stablecoin Market cap. We use the next stablecoins for the availability: USDT, TUSD, USDC, USDP, GUSD, DAI, SAI, and BUSD.

When the SSR is low, the present stablecoin provide has extra “shopping for energy” to buy BTC. It’s a proxy for the availability/demand mechanics between BTC and USD.

The ratio presently stands at 2.34, the bottom it has been since 2018, whereas the SSR was at a ratio of 6 in January 2022. The ratio developments decrease because the rise of stablecoin buying energy continues.

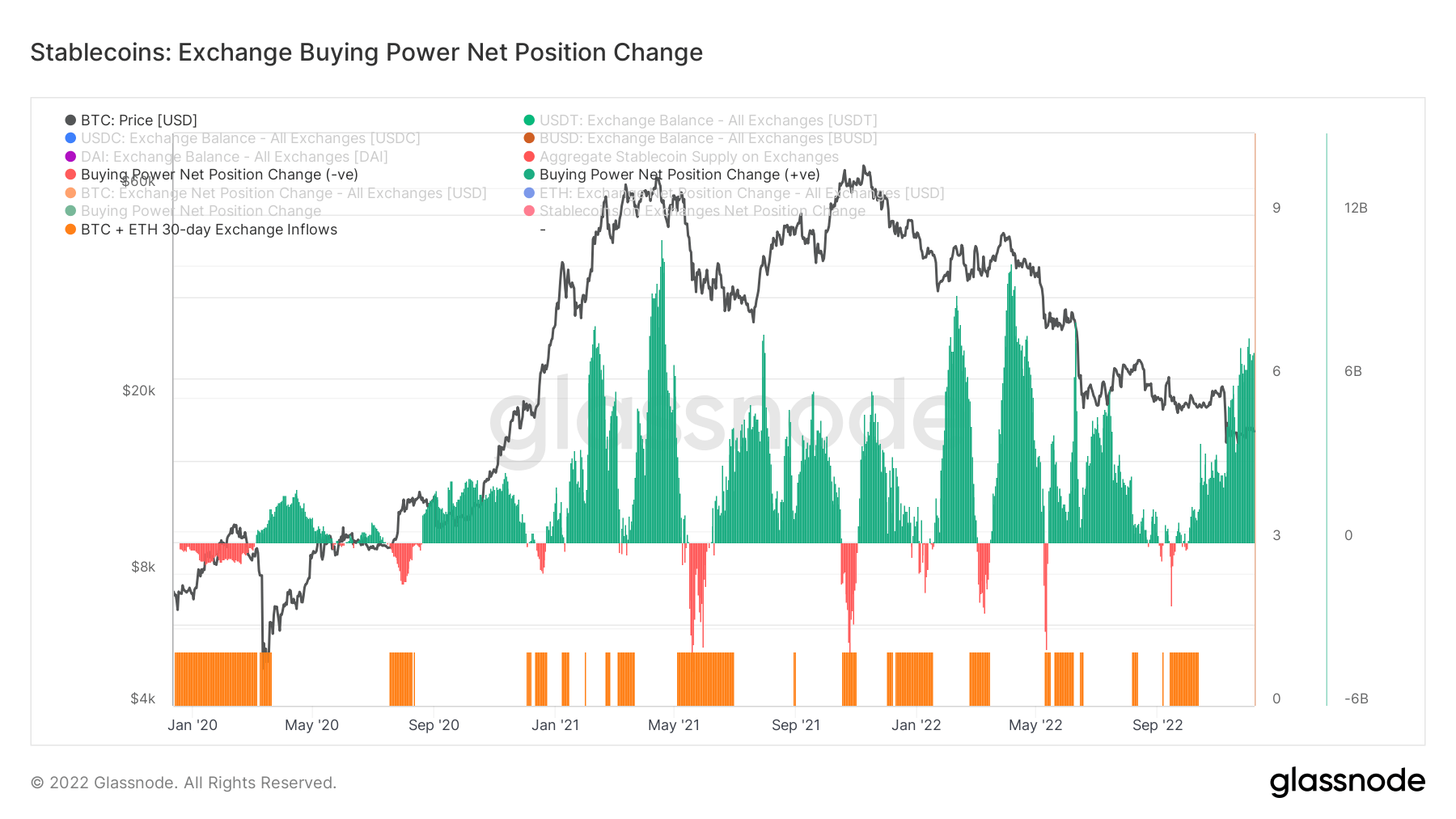

Whereas the trade shopping for energy web place change helps this, this chart reveals the 30-day stablecoin shopping for shift energy on exchanges. It considers the 30-day change in main stablecoin provides on exchanges (USDT, USDC, BUSD, and DAI) and subtracts the USD-denominated 30-day change in BTC and ETH flows.

Optimistic values point out a extra important or growing USD quantity of stablecoins flowing into exchanges relative to BTC + ETH over the past 30 days. It usually suggests extra stablecoin-denominated shopping for energy obtainable on exchanges relative to the 2 main property.

For the previous two years, stablecoin shopping for energy has solely elevated by over seven billion of shopping for energy for stablecoins, trending to highs final seen for the reason that starting of the 12 months.

More NFT News

Prime 10 Ideas and Methods to Put money into US Shares from India

Marathon Digital doubles hash fee goal to 50 EH/s

BitcoinOS Posts “Sport-Altering” Whitepaper To Get Rollups On Bitcoin