The on-chain analytics agency CryptoQuant has mentioned how the Bitcoin market has modified throughout the previous yr.

Bitcoin Has Been Going By way of Some Adjustments Not too long ago

In a brand new post on X, CryptoQuant has damaged down the modifications that the cryptocurrency’s panorama has noticed not too long ago. The primary can be that the US-based exchanges have been registering withdrawals, whereas the worldwide platforms have seen rising holdings.

The related on-chain indicator right here is the “exchange reserve,” which retains monitor of the whole quantity of Bitcoin saved contained in the wallets of a centralized trade or a bunch of exchanges.

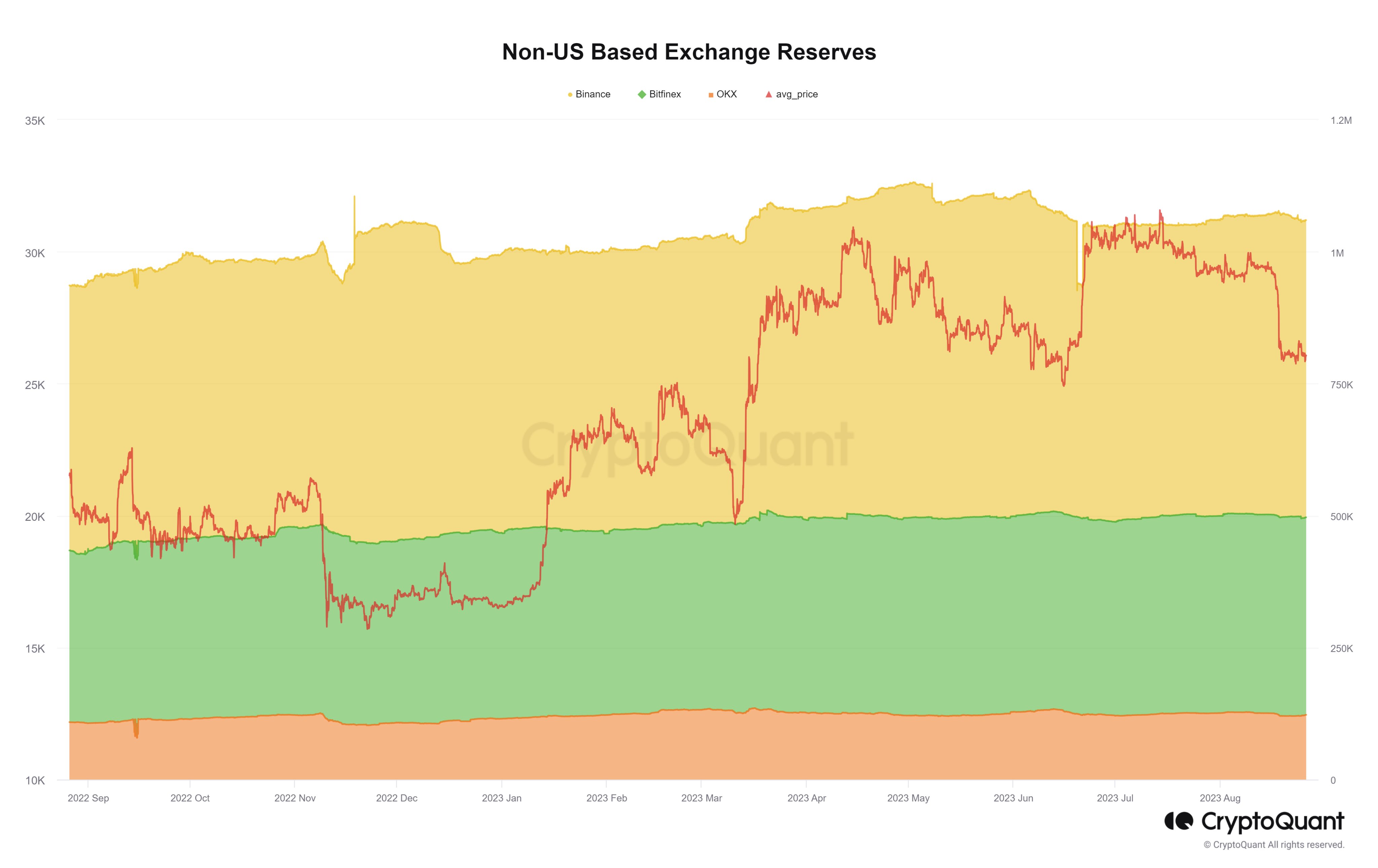

First, here’s a chart that exhibits the development on this metric for the overseas platforms:

Seems to be like the worth of the metric for these platforms is steadily going up | Supply: CryptoQuant on X

The above graph exhibits that the Bitcoin trade reserves for Binance, Bitfinex, and OKX have elevated throughout the previous yr. In complete, the indicator’s worth for these non-US platforms has elevated by 10% on this interval.

This improve would naturally recommend that these exchanges have seen web deposits within the final yr. Nonetheless, the trade reserve for the US-based platforms paints a unique image.

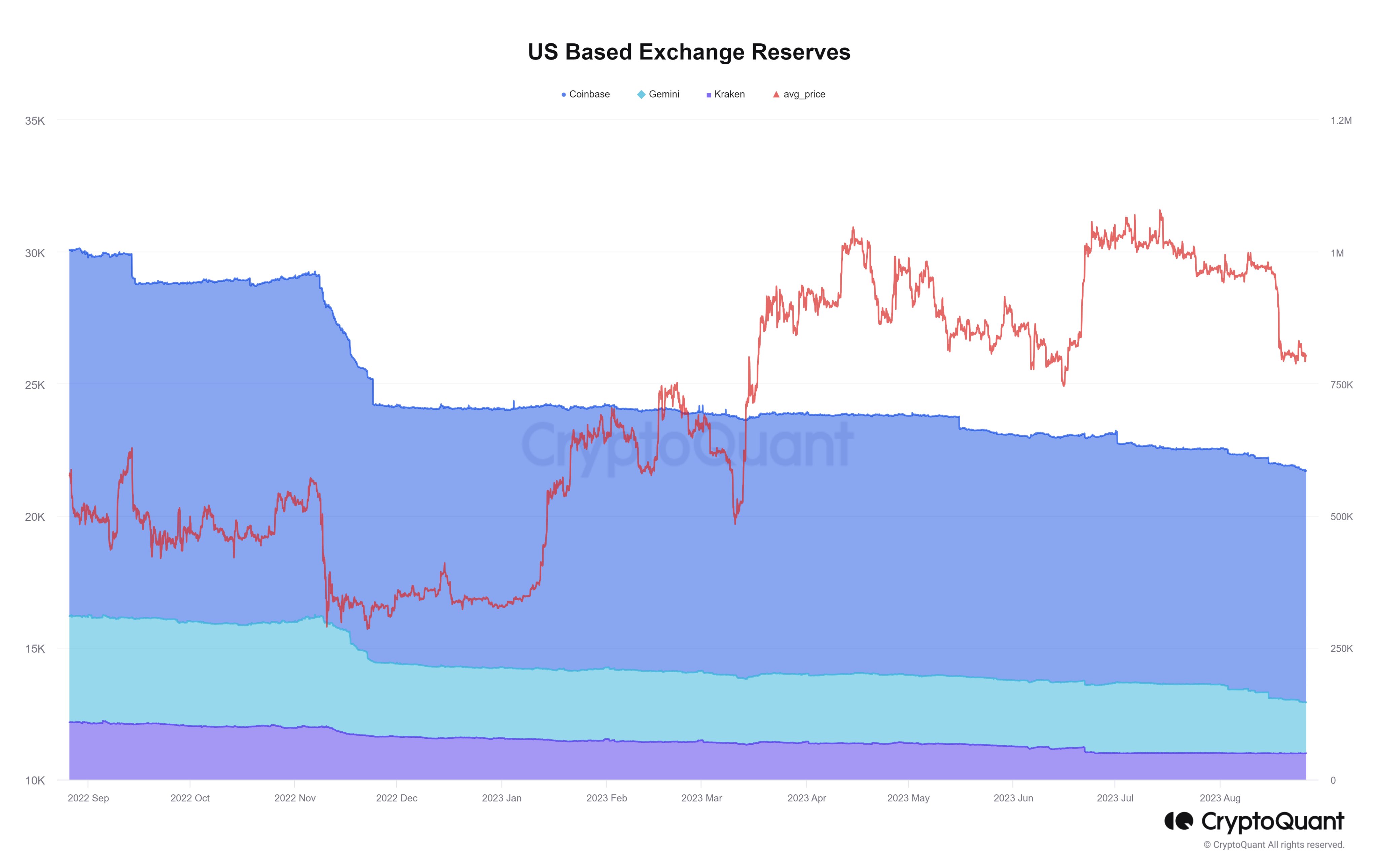

These platforms have seen a falling worth of the indicator | Supply: CryptoQuant on X

Whereas the overseas exchanges have seen deposits, the platforms primarily based within the US, comparable to Coinbase, Gemini, and Kraken, have noticed declining reserves throughout the previous yr.

Usually, the reserves of those platforms have dropped by at the least 30%, which is a really important worth. The other tendencies being adopted by the 2 teams of exchanges may suggest a migration of cash between them, with traders more and more preferring the non-US platforms.

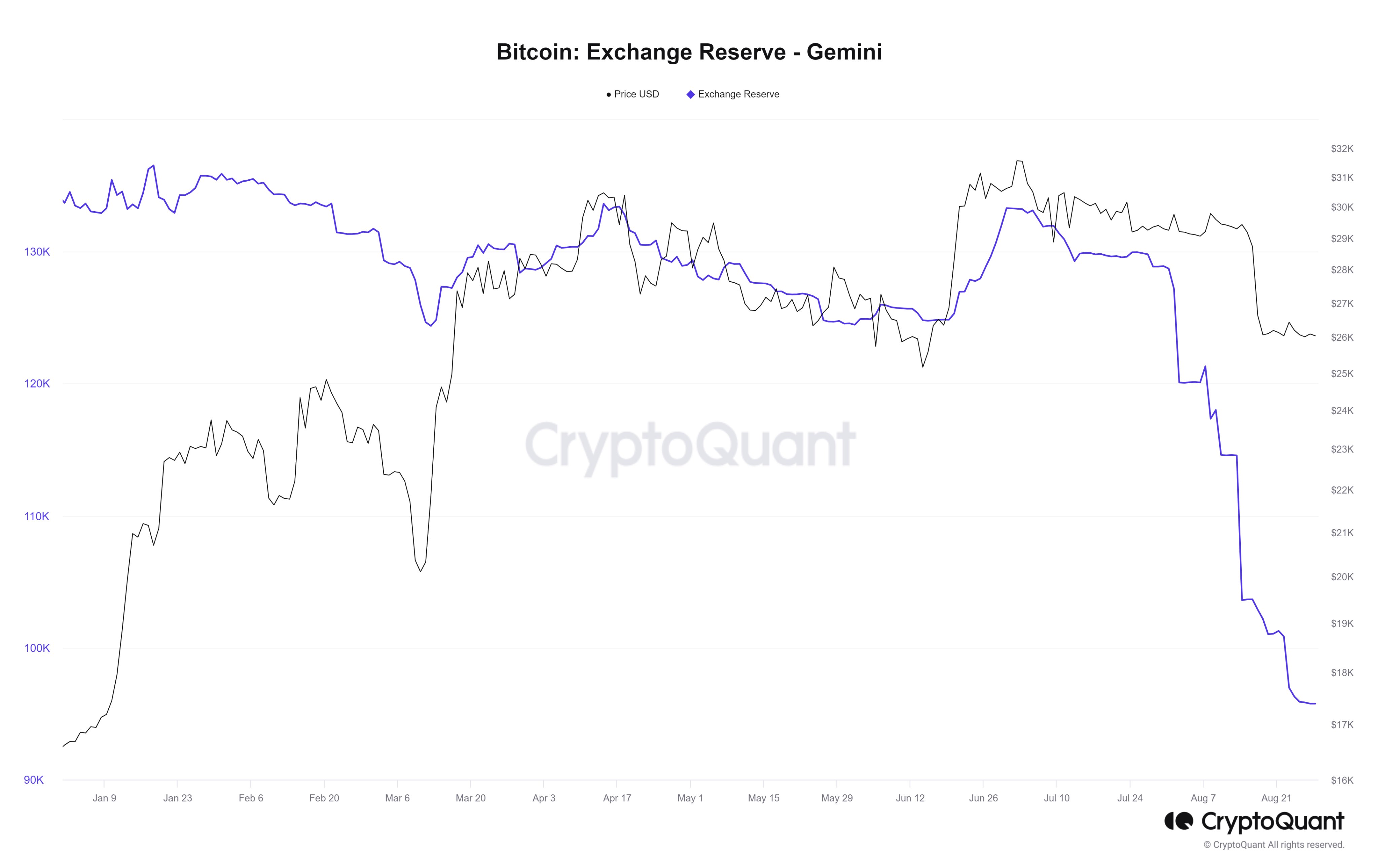

The second change within the BTC market is that institutional traders have began displaying an accumulation conduct. “Contemplating the quantity withdrawn and the deposit and withdrawal data of the wallets, establishments are constantly shopping for Bitcoin,” explains the analytics agency.

CryptoQuant notes that in August alone, Gemini has seen an enormous withdrawal of greater than 20,000 BTC, which is usually a signal that institutional traders are shopping for.

A considerable amount of BTC has been withdrawn from Gemini | Supply: CryptoQuant on X

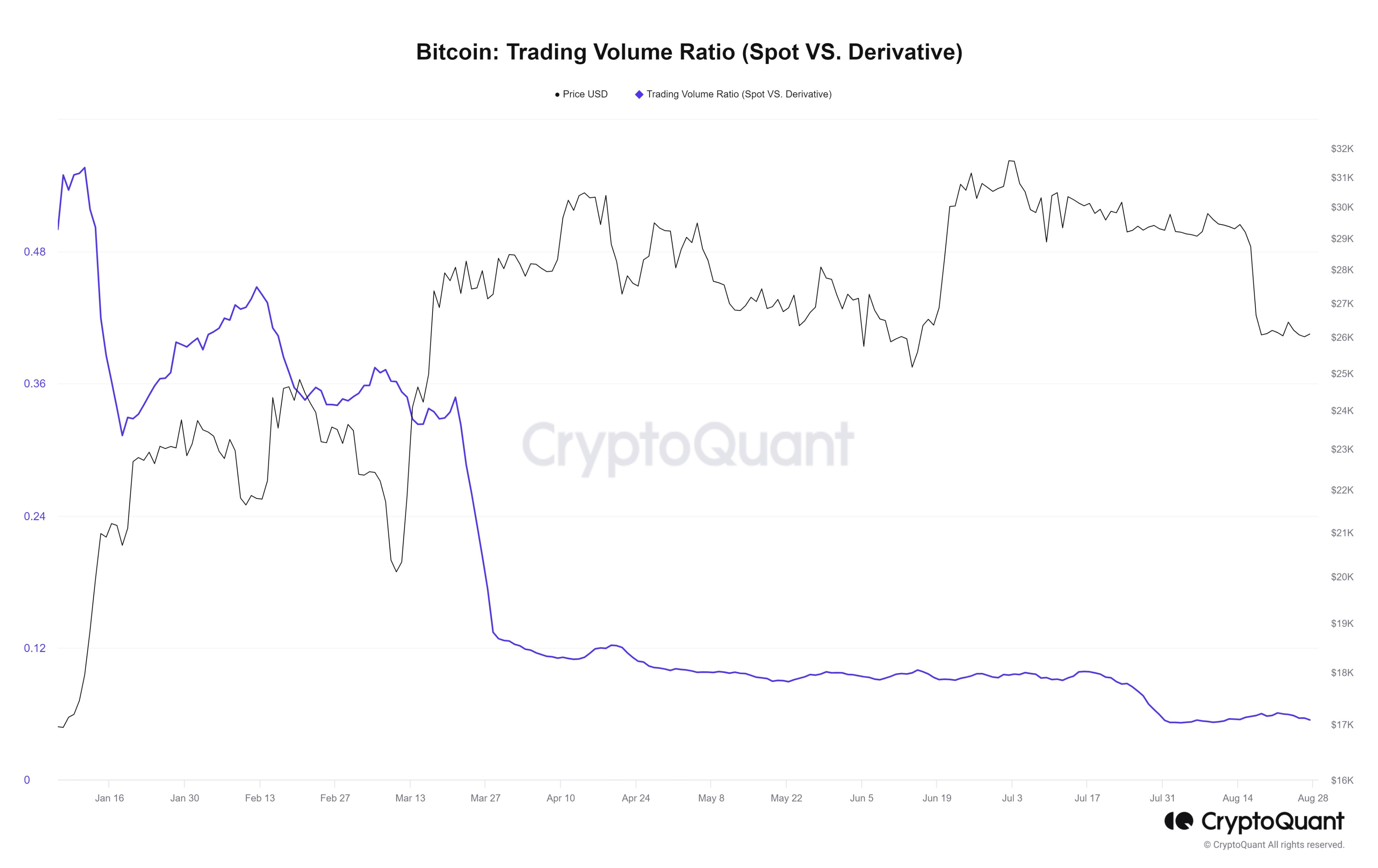

Lastly, there’s a change in how market members have been wanting on the futures sector not too long ago, as they’ve elevated their publicity to by-product merchandise.

The ratio of the buying and selling quantity of the asset between spot and by-product platforms has dropped to fairly low values not too long ago, an indication that exercise on the by-product exchanges is overwhelmingly greater than on the spot ones.

The ratio's worth has been on the decline this yr | Supply: CryptoQuant

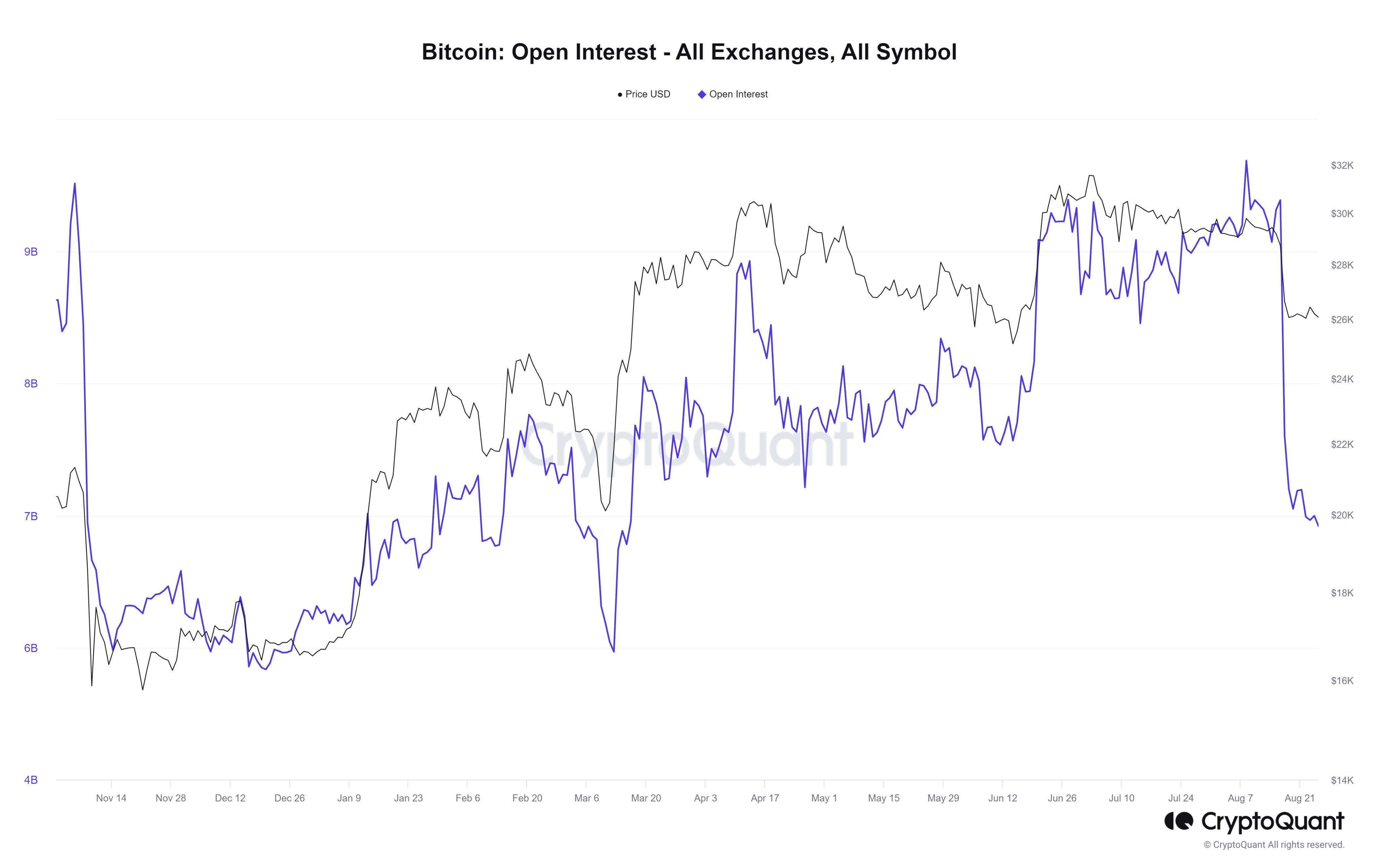

The open interest, a measure of the variety of positions open on the by-product market, additionally showcases this alteration, because the metric’s worth hit very excessive only in the near past.

The open curiosity was at highest values since November only in the near past | Supply: CryptoQuant on X

The chart exhibits that whereas the open curiosity was at highs only a whereas in the past, it has since noticed a plummet. The rationale behind this plunge was the newest Bitcoin crash, which resulted in a cascade of liquidations available in the market.

BTC Worth

Bitcoin is buying and selling across the $25,900 stage, unchanged from one week in the past, displaying how stagnant the cryptocurrency has been not too long ago.

BTC stays locked in sideways motion | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, CryptoQuant.com

More NFT News

Solana’s Totally Baked New Meme Coin Slothana ($SLOTH) Soars 107% In 24 Hours To Hit New ATH After Burn Mechanism Announcement

Transfer Over Bitcoin, Robert Kiyosaki Advocates For Ethereum Funding

Bitcoin May Crash Under $55,000, Prime Analyst Sounds The Alarm