Chainlink has shot up over 12% to interrupt $18 throughout the previous day. A retest of the on-chain resistance wall at $20 might be subsequent.

Chainlink Has Outperformed Market With Its 12% Rally

The previous 24 hours have been inexperienced for a lot of the cryptocurrency sector, however the optimistic returns have been small for a lot of the market, with Bitcoin, the biggest digital asset, solely seeing income of 1%.

Chainlink, nonetheless, has separated from the gang throughout this era, rallying round 12%. The chart beneath reveals how the coin has carried out over the previous couple of days.

The value of the coin appears to have noticed a pointy climb over the previous day | Supply: LINKUSD on TradingView

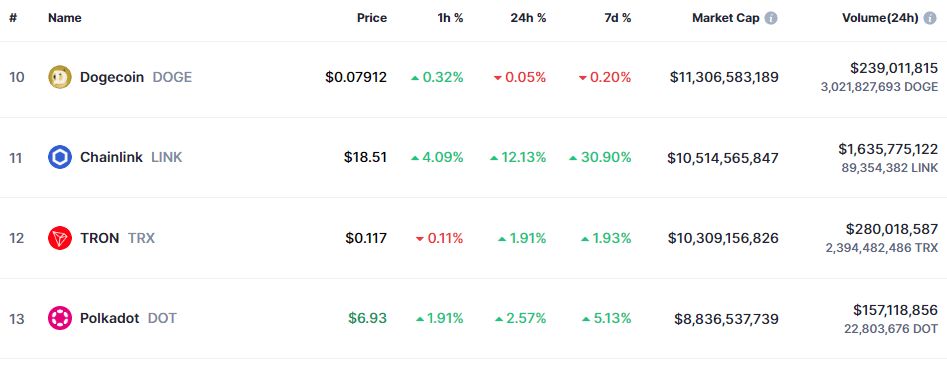

With this newest surge, Chainlink has surpassed the $18 degree for the primary time in nearly two years. With income of about 30% over the previous week, LINK is by far the best-performing asset among the many high 60 cryptocurrencies by market cap.

Talking of the market cap listing, LINK has now flipped Tron (TRX) to change into the 11th largest asset within the sector following this latest robust efficiency. The desk beneath reveals the place LINK stands amongst its friends within the sector proper now.

The market cap of the coin seems to be round $10.four billion in the meanwhile | Supply: CoinMarketCap

Dogecoin (DOGE) is the subsequent coin above Chainlink now, and if the asset can proceed its run, it ought to be capable of flip the meme coin. Whereas there’s nonetheless some hole between their market caps, it isn’t too large.

Whether or not the coin can additional this rally or not, maybe on-chain information might present some hints.

LINK Has Subsequent Main On-Chain Resistance Wall Round $20

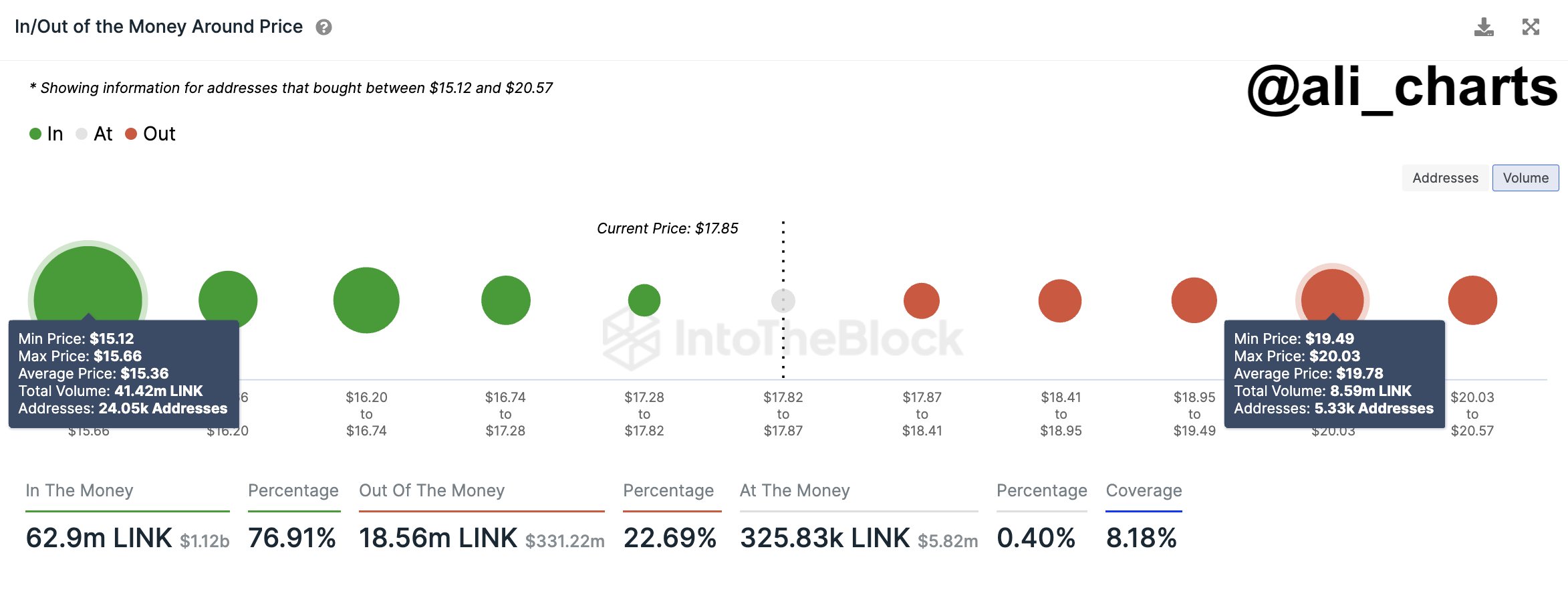

As defined by analyst Ali in a brand new post on X, LINK has important on-chain resistance at $20. In on-chain evaluation, the power of a help/resistance degree lies within the quantity of BTC that the traders purchased at it.

Under is a chart that reveals the distribution of holder cost basis throughout the varied LINK value ranges close to the present value of the cryptocurrency.

Seems like there's some resistance developing forward for the coin | Supply: @ali_charts on X

When the analyst shared the chart, LINK was buying and selling round $17.85, and the ranges till the $19.49 to $20.03 one weren’t too dense with traders. Chainlink has mowed by way of a few of these weaker value ranges since then, and the asset could proceed to take action till it strikes the resistance wall round $20.

In whole, 5,330 addresses purchased 8.59 million LINK inside this vary. Typically, traders change into extra delicate when the worth retests their value foundation, so they might be susceptible to creating some strikes. For traders in loss like these inside this vary, such a retest can imply an exit alternative, as they could be determined to get their a reimbursement.

This impact turns into extra pronounced as traders share their value foundation inside the identical vary, so ranges with dense value foundation distribution could be a supply of main resistance for the spot value.

Featured picture from Shutterstock.com, charts from TradingView.com, IntoTheBlock.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site solely at your individual threat.

More NFT News

Saylor predicts SEC will designate Ethereum as a safety and deny spot ETF purposes this summer time

Time to Purchase SHIB? Fashionable Analyst Bets on a 300% Shiba Inu Worth Rally

Bitcoin Milestone Forward? Analyst Forecasts New Peak This Month