Authored by:

Shannon Kurtas, Product Director, Professional & Institutional Buying and selling

Max Kaplan, Sr. Engineering Director, Core Infrastructure & Knowledge Engineering

Suketu Gandhi, Sr. Engineering Director, Buying and selling Expertise

Steve Hunt, VP Engineering

Almost twelve years in the past, Kraken started its pioneering mission to turn out to be one of many first and most profitable digital asset exchanges. We began buying and selling solely 4 cryptocurrencies, however we now help over 220 property on 67 blockchains, and over 700 markets.

We’ve grown rapidly. Because of our product and engineering groups — together with consultants in blockchain know-how, safety, networking, infrastructure, and buying and selling techniques — we’ve been in a position to sustain with huge demand.

Because the {industry} has matured and developed, so has the dimensions and nature of our consumer base. Whereas we proceed to serve particular person buyers and merchants through our Kraken and Kraken Pro platforms, a rising a part of our order circulation arrives algorithmically through our API from skilled and institutional shoppers. These embody companies, hedge funds, proprietary buying and selling companies, prime brokers, fintechs, in addition to different exchanges counting on Kraken’s deep liquidity.

Our buying and selling techniques have needed to scale to fulfill these elevated calls for, notably for people who closely depend upon pace, stability, and uptime with a purpose to enhance execution prices, handle market danger, and capitalize on buying and selling alternatives. We achieved all of this with out compromising on our primary precedence — security.

As we speak, we’re delighted to focus on a few of our current efforts, successes, and outcomes of that scaling.

The primacy of efficiency

We put important emphasis on instrumenting code to look at and perceive our system efficiency below heavy, real-world circumstances. We additionally make use of aggressive benchmarking to substantiate how we stack up over time. Let’s discover a few of these outcomes.

Velocity and latency

We measure buying and selling pace within the type of latency. Latency is the round-trip delay and we outline it because the time between a buying and selling request (e.g., add order) being despatched by consumer techniques and it being acknowledged by the trade.

In contrast to conventional exchanges, crypto venues are usually much less geographically concentrated and don’t provide full colocation. In lots of circumstances, they’re totally cloud-based.

Latency-sensitive shoppers will deploy code wherever it’s most bodily proximate to the venue. Subsequently, a good comparability consists of measuring latency from the area most related for that particular venue.

Latency will even range between buying and selling requests, even on a persistent connection between a single consumer and the trade. This is because of each variations and variability in internet-based buying and selling, in addition to how the trade is dealing with load. Subsequently, we should talk about latencies by way of percentiles somewhat than single figures. For instance, P25 latency refers back to the 25th-percentile latency. In different phrases, a P25 of 5ms signifies that 25% of all buying and selling requests inside a given sampling timeframe had a latency of 5ms or higher.

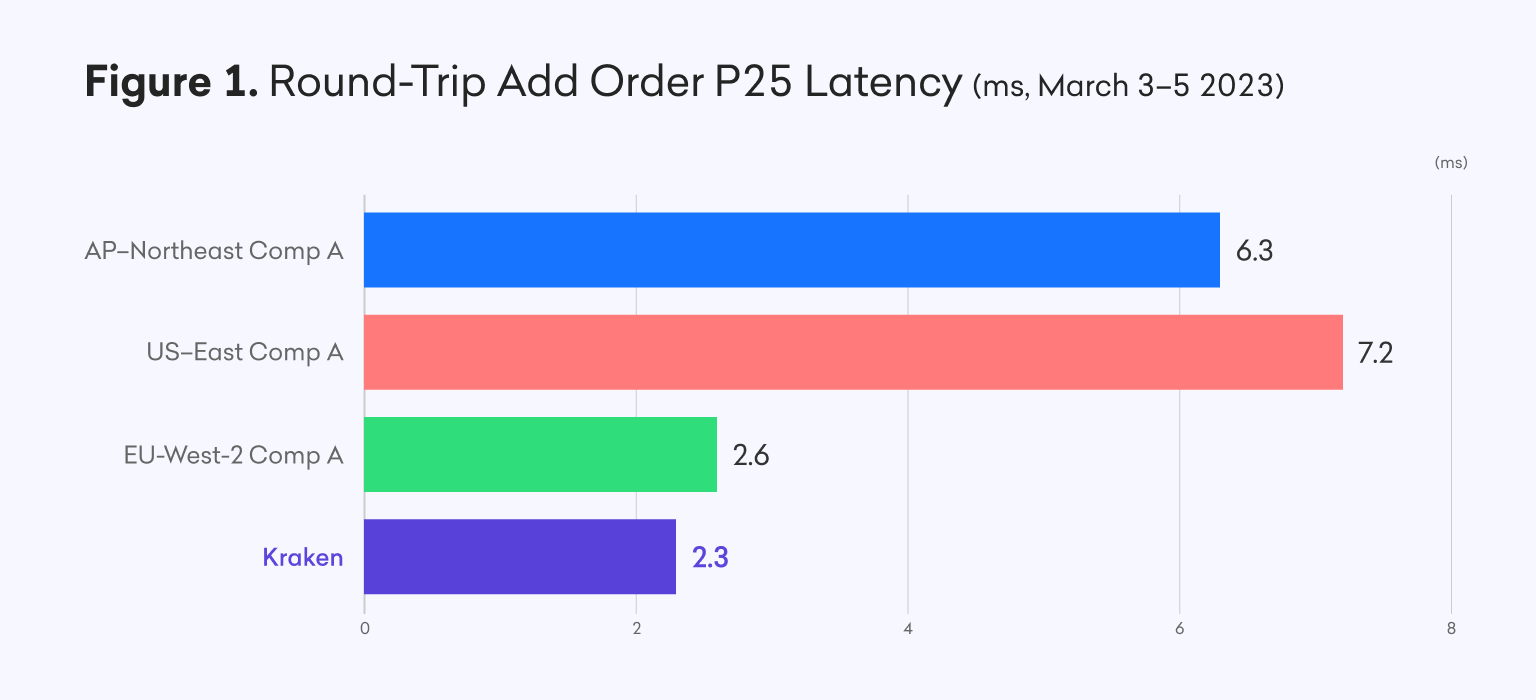

Right here you see Kraken’s finest path P25 latency versus a few of our prime opponents in numerous areas, normalized for location, throughout a baseline measurement final month.

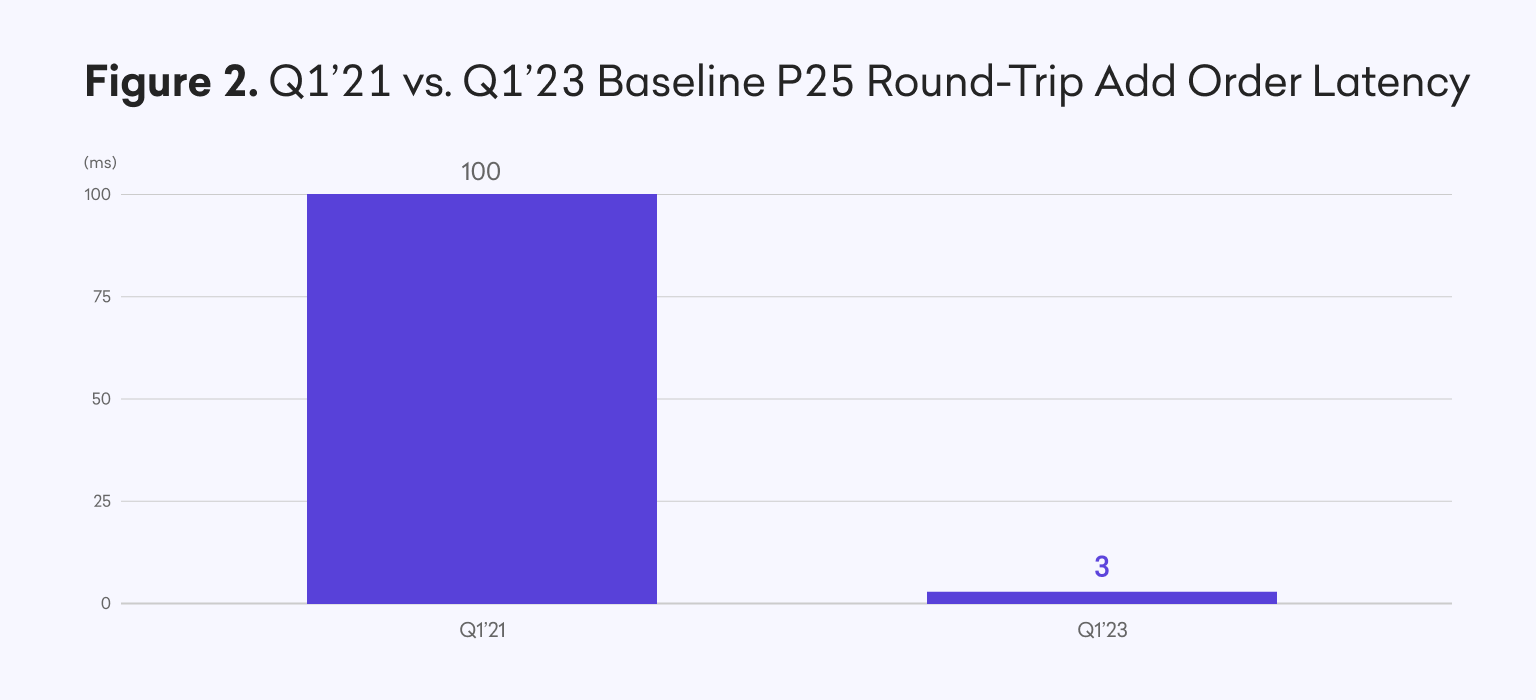

Our baseline round-trip latency of about 2.5ms represents over a 97% enchancment vs. Q1 2021.

Stability

As talked about earlier than, real-world efficiency below heavy load is as necessary, if no more necessary, than finest case efficiency and absolute latency figures.

Enhancing execution value, lowering slippage, and managing market danger relies on minimizing the variability of latency between every buying and selling request. We name this variability jitter, and we measure the distinction between totally different latency percentile figures for a similar sampling timeframe.

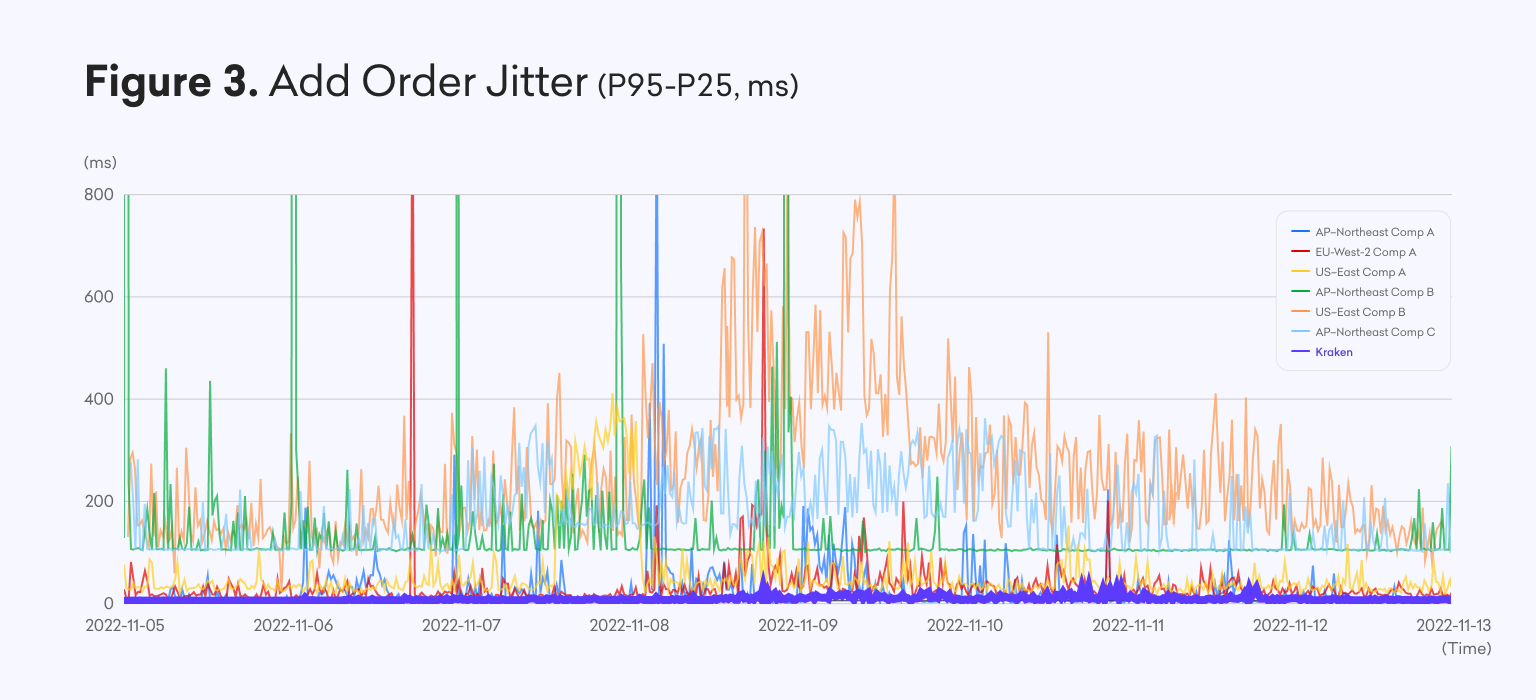

By measuring jitter with P25 and P95 latencies, we are able to seize a big vary of efficiency and noticed conduct over time. For instance, we measured how our jitter stacked up with a broader set of prime opponents through the week of 5-12 November 2022, a time when market volatility was acute because of the misery and supreme shutdown of FTX.

Right here you may see how our buying and selling infrastructure behaved exceptionally nicely, regardless of the dramatically elevated volatility and cargo. At no level through the week did this jitter exceed 30ms. In the meantime, for a lot of different exchanges, it frequently reached a number of hundred milliseconds, or requests timed out totally as indicated by the vertical spikes.

Throughput

Throughput displays the variety of profitable buying and selling requests (add order, cancel order, edit order, and so on.) dealt with by an trade in a given period of time.

Just like latency, we talk about throughput in both theoretical or noticed phrases.

Noticed throughput is extra related because it displays many interrelated components together with price limits. We set these limits to stop DDoS assaults and hold site visitors comfortably inside theoretical limits. Measurement of the consumer base, basic market demand, order circulation (which is impacted closely by worth volatility and buying and selling exercise elsewhere), and efficiency below load (since past a sure stage of service degradation, shoppers would begin throttling their very own requests) all have an effect on these limits.

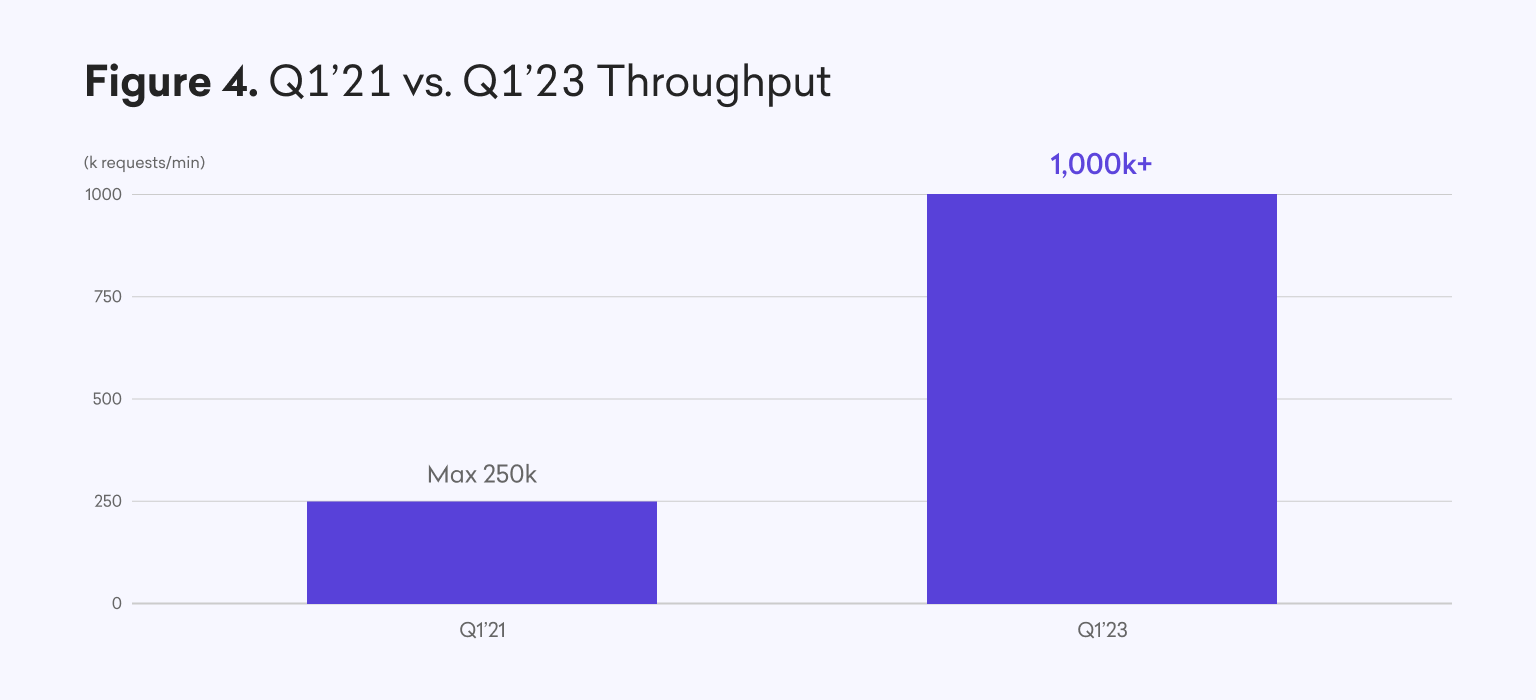

Right here we’ve illustrated the over 4x enchancment in our most noticed throughput between Q1 2021 and Q1 2023. This transformation is a transfer from 250okay requests/min to over 1mm requests/min, and there may be important headroom left between this stage and our dramatically improved theoretical most throughput.

Uptime

This yr, we made efforts to attenuate downtime because of deliberate upkeep, scale back the frequency and impression of unscheduled downtime, and enhance the speed of characteristic updates and efficiency enhancements with out negatively impacting uptime.

These modifications included each technical and operational enhancements, comparable to an more and more mature and huge operational resilience group which operates 24/7.

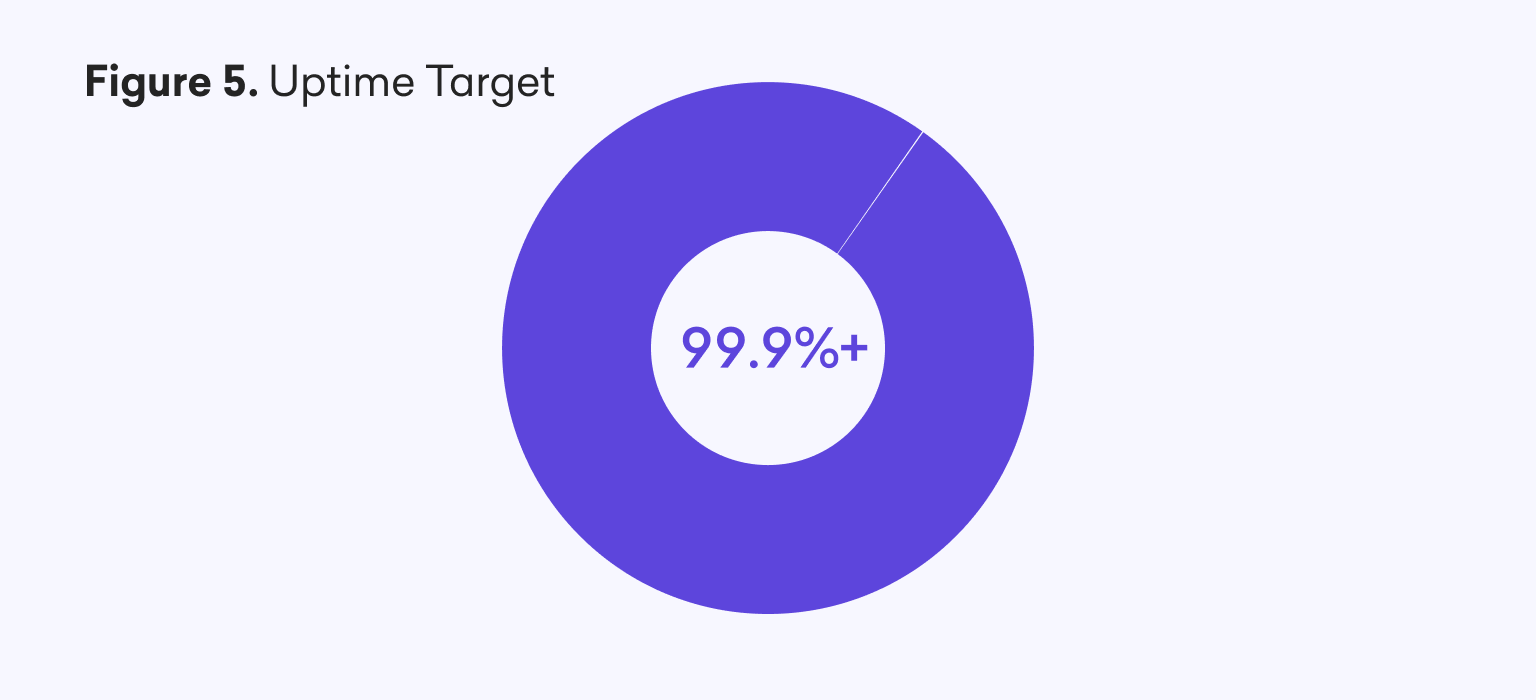

Whereas uptime for our worst month in 2021 was near 99%, these enhancements have allowed us to set more and more aggressive error budgets and a buying and selling uptime goal of 99.9+%.

Efforts

Blue/inexperienced and rolling deployments

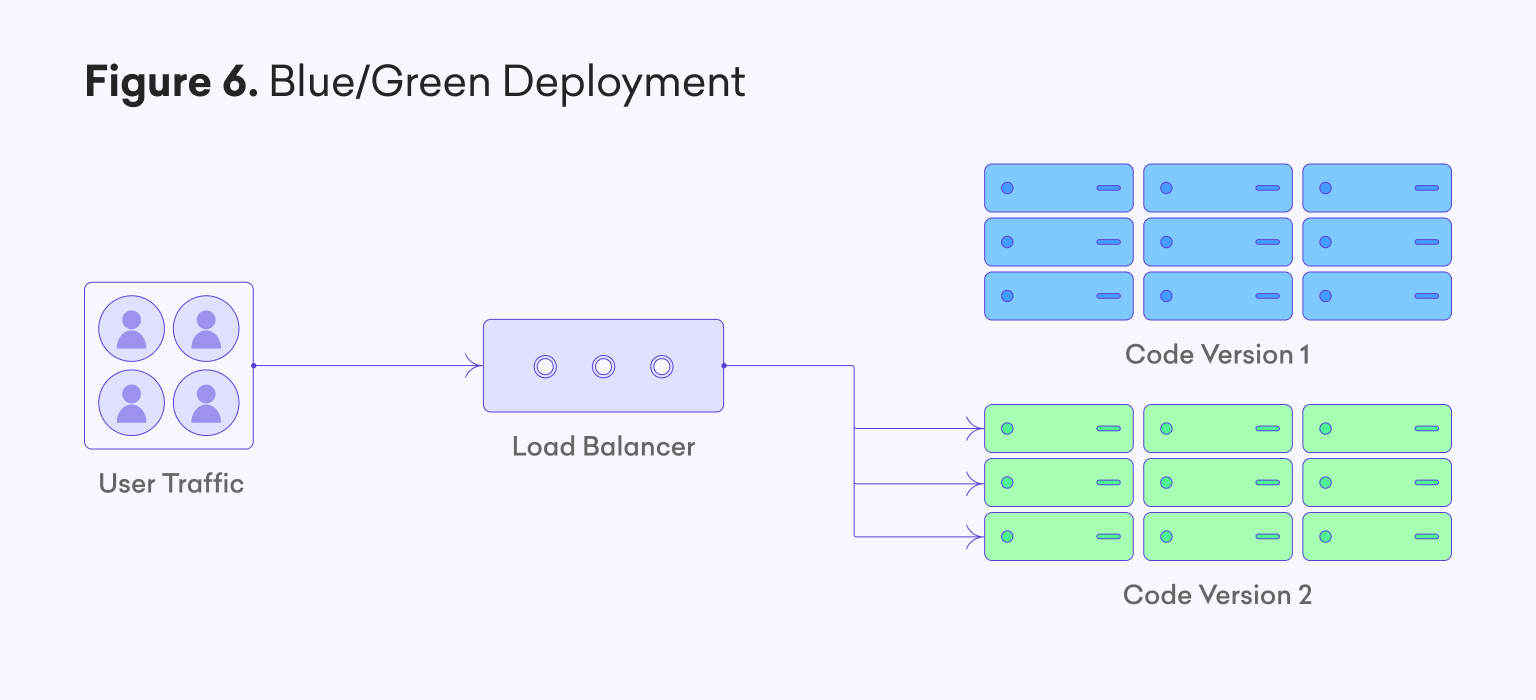

We’ve made growing use of a blue/green deployment strategy throughout our API gateways and plenty of inside companies. You’ll be able to see a really simplified illustration of that is highlighted in Determine 6. By working a number of fully-fledged code stacks in parallel, we are able to deploy options with out disturbing the primary stack which is at present receiving consumer site visitors. Afterward, site visitors will be re-routed to the brand new stack, resulting in a zero-impact deployment, or a really fast rollback process ought to something go unsuitable. Moreover, for our many companies which function a number of situations for functions of load balancing, updates to those situations occur on a rolling foundation somewhat than all-or-none. These approaches now permit us to conduct zero-impact, and extra frequent updates, to the overwhelming majority of our tech stack.

Infrastructure as Code

Kraken closely leverages Infrastructure as Code (IaC) with Terraform and Nomad, largely to ensure consistency of all code deployments in addition to repeatability. We automate our Terraform repositories with steady integration and steady supply so we are able to roll modifications out rapidly and reliably. For the previous two years, we now have deployed new infrastructure utilizing IaC and almost all of our infrastructure right now makes use of this sample. This transfer was a serious milestone and we leverage IaC for each cloud-based and on-premise functions.

Connectivity and networking

We leverage non-public connectivity between AWS and our on-premise information facilities. This connectivity permits Kraken to ensure we now have the bottom potential latency, highest potential safety, and redundant paths to ensure we are able to attain out to AWS always. Current networking and routing enhancements have enabled a big a part of the baseline round-trip buying and selling latency discount highlighted above.

Instrumentation and telemetry

Fantastic-grained and correct logging, metrics, and request tracing have allowed us to rapidly establish, diagnose, and resolve any sudden bottlenecks and efficiency points in real-time. Past this telemetry and our personal aggressive monitoring, we’ve additionally not too long ago up to date our API latency and uptime metrics on status.kraken.com with exterior monitor deployments to, typically, extra precisely replicate these numbers as skilled by shoppers.

Optimized API deployments

At any given second, our APIs and buying and selling stack help tens of hundreds of connections buying and selling algorithmically via our Websockets or REST APIs. A whole bunch of hundreds extra connections come from our UI platforms, together with our new high-performance Kraken Pro platform. Whereas these platforms reap most of the identical core buying and selling infrastructure advantages described on this submit, the workloads are basically totally different and have totally different necessities. Bespoke API deployments to help our UI platforms, with particular information feeds, compression, throttling, aggregation, and so on have allowed us to additional enhance pace and scale back wasted bandwidth, and due to this fact enhance total consumer capability.

Core code enhancements

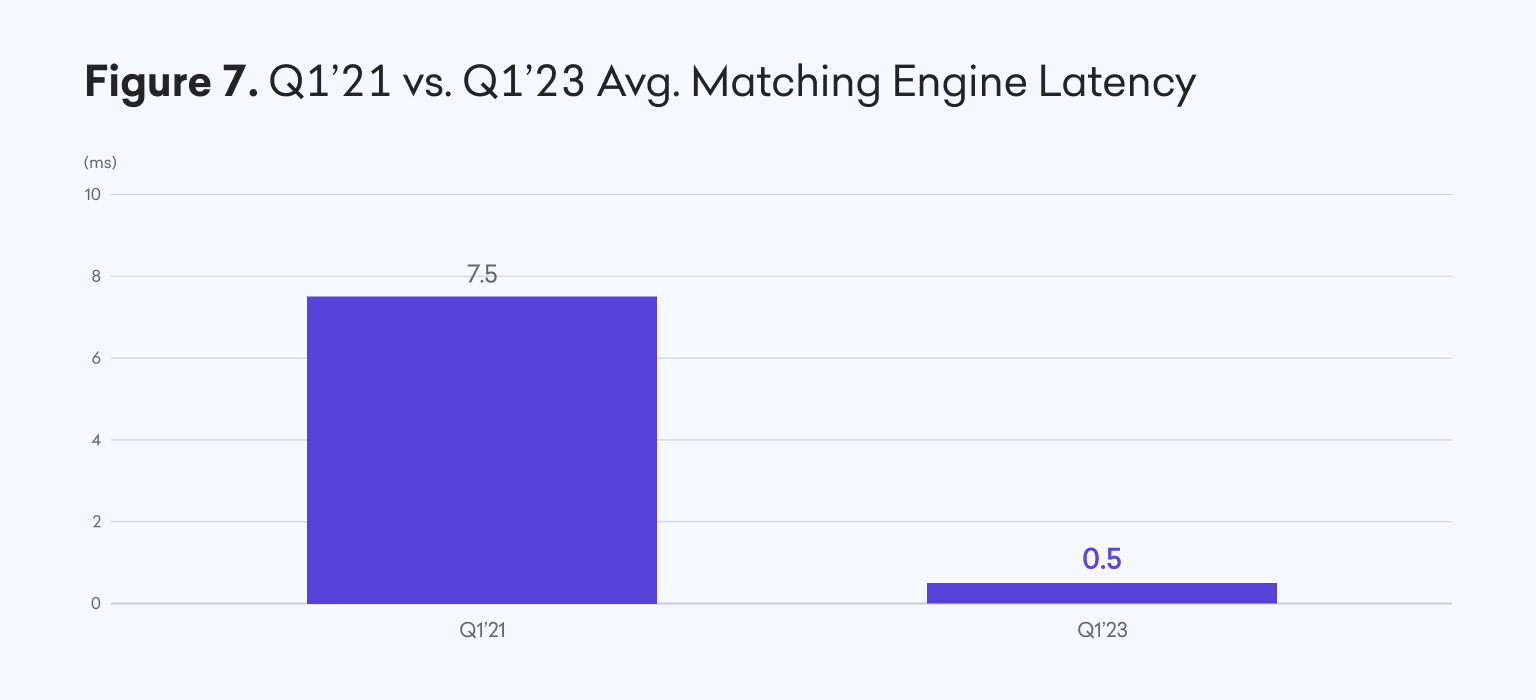

We’ve made a variety of additional, dramatic enhancements throughout the stack via re-engineering core companies in Rust and C++. These modifications make elevated use of asynchronous messaging and information persistence the place potential and assist us construct strong efficiency profiling into extra of our CI/CD pipelines. In addition they lets us make use of finest identified strategies for static and dynamic code evaluation. A number of of those enhancements have culminated within the matching engine’s common latency dropping from milliseconds to microseconds. This a greater than 90% enchancment vs two years prior, whereas supporting over 4x the throughput.

What’s subsequent?

Native FIX API

We’ll additionally quickly be launching our native FIX API for spot market information and buying and selling. FIX, which stands for Monetary Info Change, is a robust and complete however versatile industry-standard API that many establishments use for buying and selling equities, FX, and stuck revenue at a large scale. It’s a trusted and battle-tested protocol, with broad third social gathering software program and open supply help, making it simpler and faster for establishments to combine with Kraken and start buying and selling.

Kraken’s native FIX API additionally comes with architectural nuances and advantages relative to our Websockets and REST APIs, together with session-based cancel-on-disconnect, assured in-order message supply, session restoration, and replay. Our FIX API is at present in beta testing — reach out should you’d like to assist kick the tires!

Zero-downtime matching engine deployments

We’ve made important inroads on the frequency of zero-impact deployments of API gateways and varied backend companies (authentication, audit, telemetry, and so on.). Materials updates to our matching engine, although, nonetheless require scheduling upkeep and temporary downtime, which we feature out roughly biweekly.

Nonetheless, our group underwent a big effort to re-engineer a few of our inside messaging techniques with multicast know-how, making use of Aeron, an especially performant and strong suite of instruments for fault-tolerant excessive availability techniques. The results of this will likely be zero-downtime deliberate deployments throughout the buying and selling stack, accessible later in 2023.

Need assistance? Attain out

Please attain out to our account administration and institutional gross sales groups utilizing the e-mail tackle [email protected] to be taught extra about any of those updates, to debate easy methods to optimize your buying and selling connectivity, or to beta take a look at forthcoming options like our FIX API.

Focused on serving to to scale Kraken for the following decade of progress? Try our careers page.

Want extra proof? Hold an eye fixed out and subscribe to updates on status.kraken.com for any deliberate upkeep, service data and latency and uptime statistics.

More NFT News

Saylor predicts SEC will designate Ethereum as a safety and deny spot ETF purposes this summer time

Wanderers Closed Beta Begins Might third

Time to Purchase SHIB? Fashionable Analyst Bets on a 300% Shiba Inu Worth Rally