On-chain information exhibits that Bitcoin short-term holders have panic bought $2.6 billion value of cash within the crash following the brand new all-time excessive.

Bitcoin Quick-Time period Holders Have Despatched Enormous Quantity In Loss To Exchanges

As analyst James V. Straten defined in a brand new post on X, Bitcoin short-term holders have proven indicators of capitulation throughout the newest drop within the cryptocurrency’s value.

The “short-term holders” (STHs) check with the BTC buyers who purchased their cash throughout the previous 155 days. The STHs make up one of many two essential divisions of the market, the opposite one being the “long-term holders” (LTHs).

Statistically, the longer an investor holds onto their cash, the much less possible they’re to promote at any level. Because of this the STHs, who’re comparatively new palms, typically promote rapidly each time an asset crash or rally happens. The LTHs, however, normally present resilience, solely promoting at particular factors.

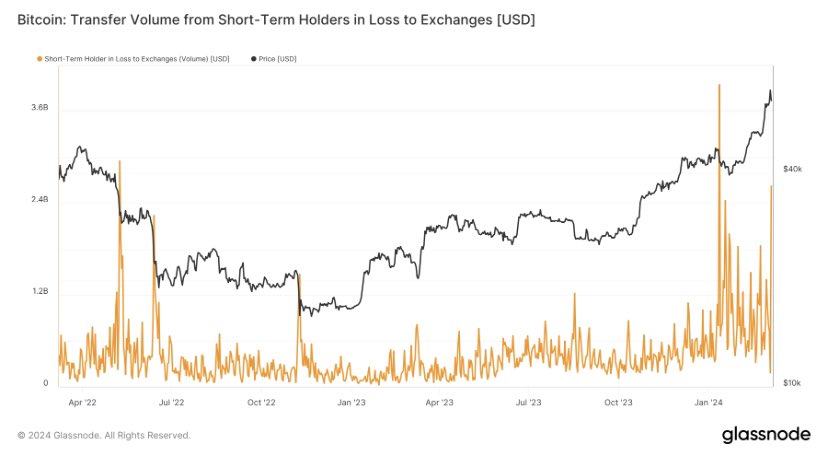

One solution to monitor whether or not both of those teams is promoting is thru the switch quantity they’re sending to exchanges. First, here’s a chart that exhibits the development within the Bitcoin trade influx quantity exactly for the STHs in loss:

The worth of the metric seems to have shot up in current days | Supply: @jvs_btc on X

As displayed within the above graph, the Bitcoin STHs have transferred round $2.6 billion value of cash in loss to exchanges prior to now day, implying that some members of this cohort have capitulated.

This spike is big, nevertheless it’s lower than the loss-taking occasion that came about again throughout the value drawdown that adopted the BTC spot exchange-traded fund (ETF) approval.

These loss sellers could be those that FOMO’d into the rally that took BTC to a brand new all-time excessive past the $69,000 stage, however their conviction wasn’t sturdy sufficient that they have been in a position to maintain previous the sharp crash that BTC noticed shortly after.

The STHs aren’t the one ones who’ve exited the market on this newest value volatility; it could seem that the LTHs have additionally carried out some promoting. The distinction, nonetheless, is that these HODLers have made income.

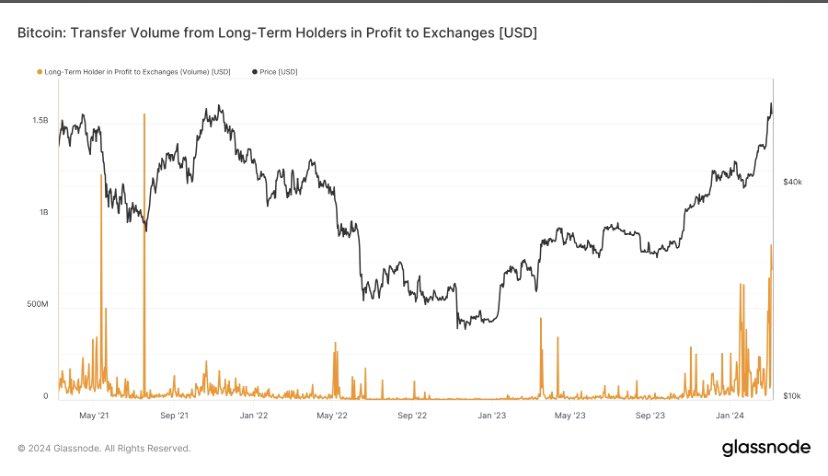

The chart under exhibits how the trade switch quantity for the LTHs in revenue has regarded like just lately.

Seems to be like the worth of the metric has registered a pointy spike just lately | Supply: jvs_btc on X

The graph exhibits that the Bitcoin LTHs have participated of their largest profit-taking occasion since July 2021, transferring tokens value $1.5 billion to exchanges.

Thus, it could seem that this current volatility has shaken up the conviction of even a number of the diamond palms, though these HODLers have a minimum of nonetheless been rewarded with income.

BTC Worth

On the time of writing, Bitcoin is buying and selling across the $65,800 mark, up 8% prior to now week.

BTC has gone by a rollercoaster prior to now couple of days | Supply: BTCUSD on TradingView

Featured picture from 愚木混株 cdd20 on Unsplash.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site fully at your personal danger.

More NFT News

BTC-e crypto change operator pleads responsible to cash laundering within the U.S.

Is the Ethereum Bull Market Again or is One other Dip Under $3K Imminent? (ETH Value Evaluation)

Voxie Ways Launches New Unity Construct